GBP/USD Forecast: Pound Sterling awaits NFP data to determine next direction

- GBP/USD posted small gains on Thursday but remained below 1.2600.

- November jobs report from the US could drive the USD's valuation.

- Pound Sterling needs to stabilize above 1.2600 to stretch higher.

GBP/USD closed in positive territory on Thursday but failed to attract additional buyers early Friday. The pair was last seen fluctuating below 1.2600, with market focus shifting to November labor market data from the US.

Improving risk mood caused the US Dollar (USD) to lose interest on Thursday and helped GBP/USD register small daily gains. Early Friday, US stock index futures trade mixed, suggesting that investors stay cautious.

Pound Sterling price this week

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this week. Pound Sterling was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 1.02% | 1.08% | 0.73% | 1.11% | -1.48% | 0.95% | 0.89% | |

| EUR | -1.05% | 0.07% | -0.29% | 0.10% | -2.58% | -0.06% | -0.13% | |

| GBP | -1.12% | -0.05% | -0.35% | 0.03% | -2.59% | -0.13% | -0.19% | |

| CAD | -0.74% | 0.29% | 0.36% | 0.39% | -2.25% | 0.24% | 0.16% | |

| AUD | -1.13% | -0.10% | -0.03% | -0.39% | -2.68% | -0.15% | -0.23% | |

| JPY | 1.46% | 2.51% | 2.72% | 2.22% | 2.62% | 2.48% | 2.37% | |

| NZD | -0.97% | 0.07% | 0.13% | -0.22% | 0.16% | -2.49% | -0.06% | |

| CHF | -0.90% | 0.14% | 0.19% | -0.16% | 0.22% | -2.43% | 0.06% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

The US Bureau of Labor Statistics' monthly jobs report is forecast to show an increase of 180,000 in Nonfarm Payrolls (NFP) in November. Earlier this week, employment-related figures from the US pointed to loosening conditions in the labor market. A disappointing NFP print below 150,000 could reaffirm the cooldown in the job market and weigh on the USD with the immediate reaction.

On the other hand, a strong NFP reading above 200,000 could go against market expectations for a Federal Reserve policy shift as early as March and help the USD hold its ground ahead of the weekend. According to the CME Group FedWatch Tool, markets are currently pricing in a nearly 60% probability that the Fed will lower the policy rate by 25 basis points in March.

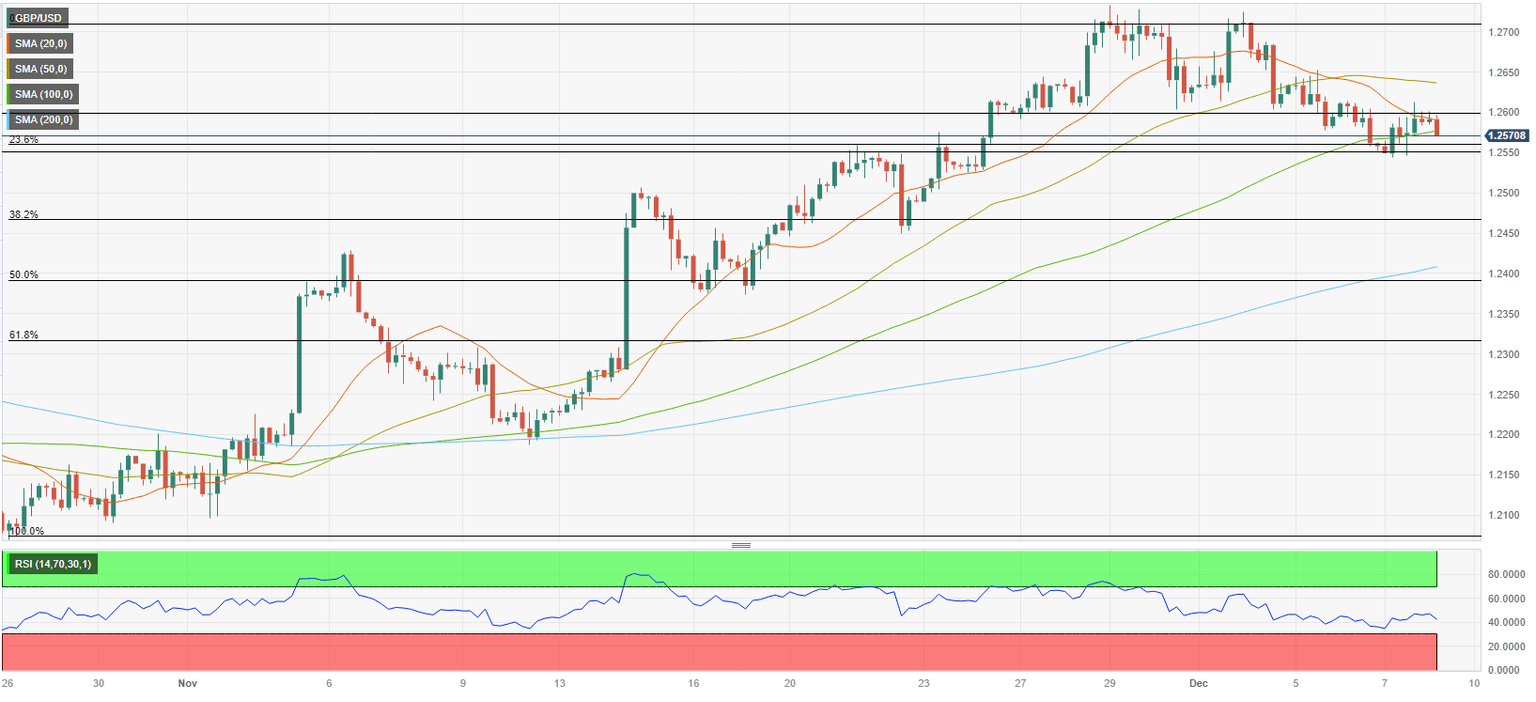

GBP/USD Technical Analysis

GBP/USD could face immediate support at 1.2550-1.2560 (static level, Fibonacci 23.6% retracement of the latest uptrend). A 4-hour close below that level could bring in technical sellers and open the door for an extended slide toward 1.2500 (psychological level, static level) and 1.2470 (Fibonacci 38.2% retracement).

On the upside, 1.2600 (psychological level, static level) aligns as interim resistance before 1.2640 (50-period Simple Moving Average (SMA) on the 4-hour chart) and 1.2700 (static level, psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.