GBP/USD Forecast: Pound Sterling awaits a sustained move above 1.2300

- GBP/USD remains capped by 1.2300 after mixed UK employment data.

- Attention now turns toward the US inflation data for a fresh directional move.

- Pound Sterling buyers take a breather amid cautious optimism.

GBP/USD is holding a three-day recovery in the European session on Tuesday after finding a positive impetus from the mixed UK employment data. The UK ILO Unemployment Rate held steady at 4.2% in the quarter to September. Additional details showed that the number of people claiming jobless benefits climbed by 17.8K in September when compared to the previous jump of 20.4K. Average Earnings excluding Bonus rose 7.7% 3M YoY in September, as against a 7.8% increase registered in August. Markets had expected an increase of 7.7%.

However, the further upside in the GBP/USD pair appears capped, as Pound Sterling traders turn cautious and refrain from placing fresh bets on the pair ahead of the all-important US Consumer Price Index (CPI) data due later in the day. Wednesday’s UK inflation data also holds the key for the pair, as it could significantly impact the Bank of England’s (BoE) interest rate outlook, spiking up the volatility around the Pound Sterling.

Ahead of that, if the US CPI data support Fed Chair Jerome Powell’s latest hawkish rhetoric, the US Dollar could find fresh demand at the expense of the British Pound. On the other hand, softer-than-expected US CPI figures will reinforce expectations of no interest rate hike by the Fed next month. At the moment, markets are pricing just a 14% chance of a December Fed rate hike.

Previewing the US CPI inflation data, FXStreet’s Senior Analyst – Yohay Elam noted, “it would take nasty upside surprises of 0.2% or more to trigger a market rethink. And if the data surprises to the downside, the party on Wall Street would continue, while the US Dollar would suffer another blow. In case data comes out as expected, the drop in headline inflation will likely trigger an immediate positive impact on equities and put pressure on the US Dollar – even if Core CPI remains stubbornly elevated.”

Meanwhile, the pair could take cues from risk sentiment, which is seeing a slight improvement, reflective of a 0.12% gain in the US S&P 500 futures.

GBP/USD Technical Analysis

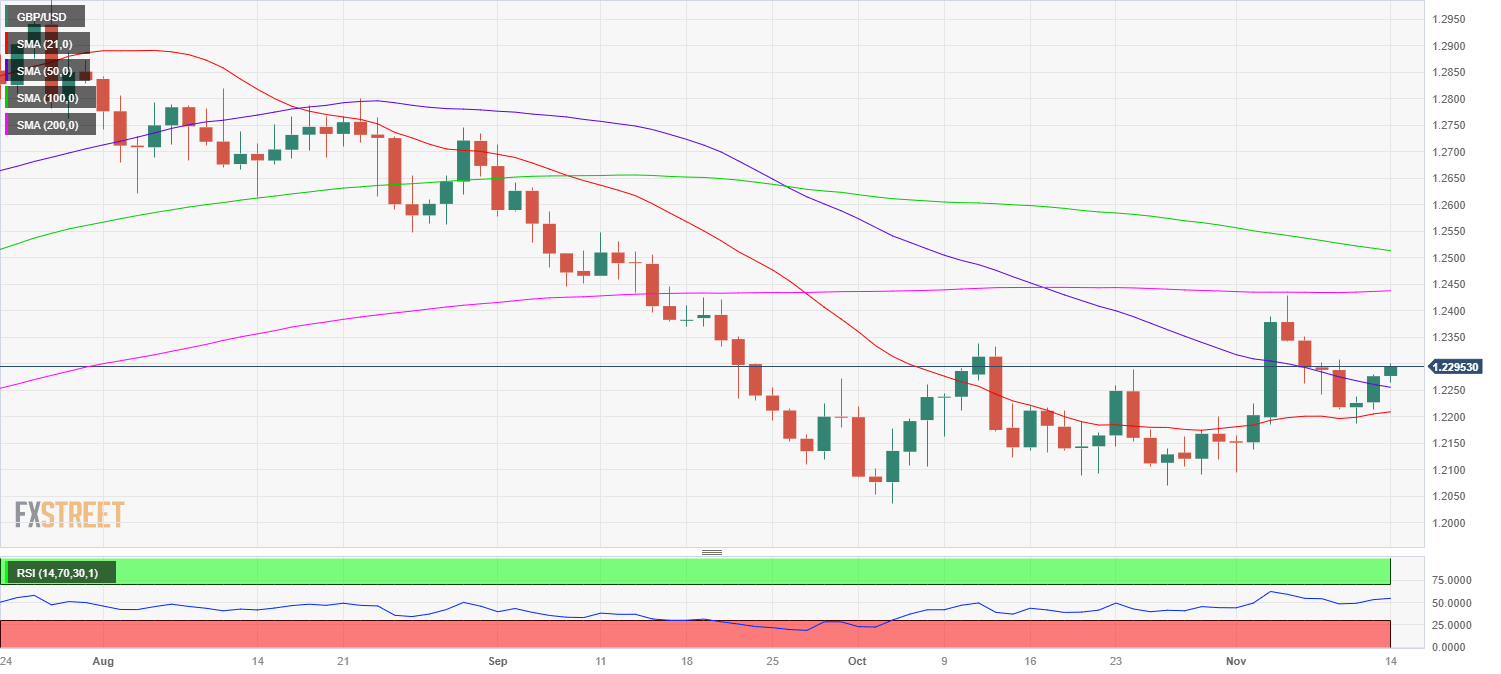

The GBP/USD pair has been struggling to find a strong foothold above the 1.2300 round level on a daily closing basis. If that materializes, the pair is likely to extend the recovery toward the 1.2350 psychological level.

The 14-day Relative Strength Index (RSI) is pointing north above the midline, justifying the ongoing upbeat momentum in the pair. The next topside barrier is envisioned at the 200-day Simple Moving Average (SMA) at 1.2437.

However, if the upswing falters, the immediate support is seen at the 50-day SMA at 1.2255, below which the 21-day SMA at 1.2205 could test bullish commitments. Further declines could challenge the 1.2100 demand area.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.