GBP/USD Current Price: 1.3141

- Weekend polls continued to show a comfortable 10-point Conservatives’ lead.

- Chances of a hung Parliament are still present amid a large number of undecided voters.

- GBP/USD technically bullish, holding near May’s monthly high, the immediate resistance.

The GBP/USD pair retained most of its latest gains, ignoring US data as the focus remains on the UK elections and Brexit. The pair fell on Friday to 1.3100, bouncing from the level amid prevalent hopes that UK PM Johnson will get support enough to pass its Brexit deal through the new Parliament.

Sunday polls show that, ahead of December 12 election, Conservatives’ lead remains unchanged on average at 10 points. The YouGov survey, the one that gets more attention, showed Tories at 43% and Labour at 33%. Johnson’s majority, however, is still at doubt amid a large number of undecided voters. A hung Parliament will be chaotic for the UK and Johnson and lead to a Pound collapse. The UK macroeconomic calendar, meanwhile, has nothing relevant to offer this Monday.

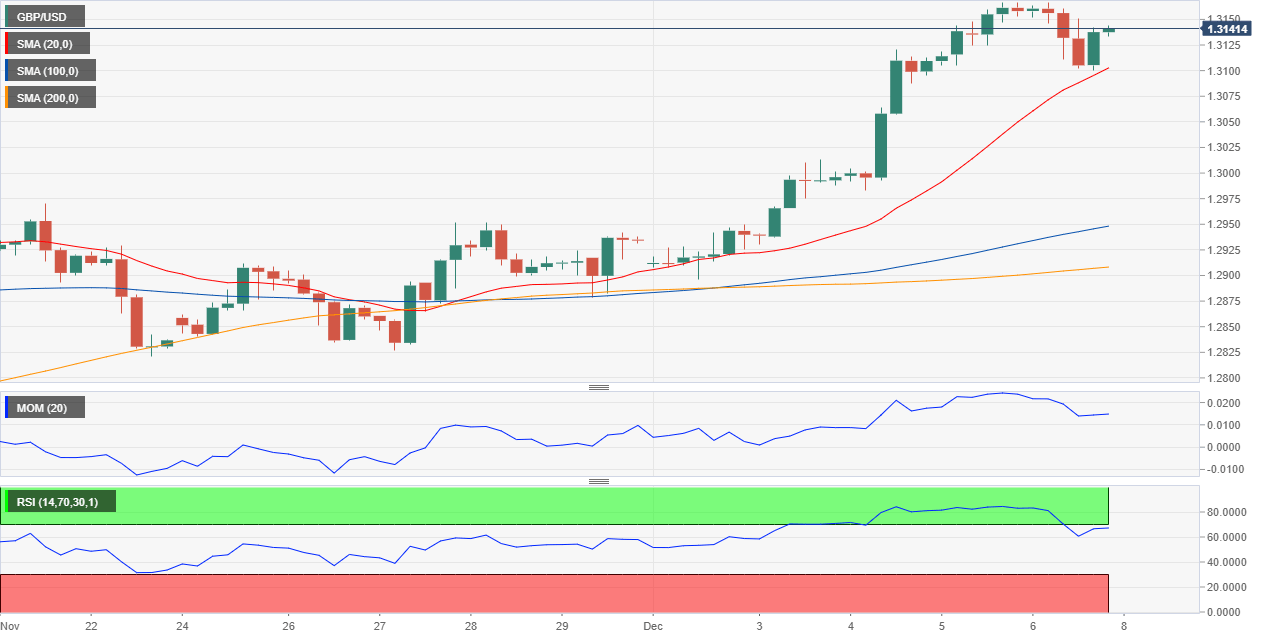

GBP/USD short-term technical outlook

The GBP/USD pair is bullish, trading not far from its May monthly high at 1.3176, a critical resistance level. In the daily chart, the pair is developing far above its moving averages, with the 20 DMA maintaining its bullish slope but the larger ones heading nowhere. Technical indicators have lost their strength upward, but remain well into positive ground. In the shorter term, and according to the 4-hour chart, technical readings continue favoring an extension upward, as the intraday slide was contained by buyers aligned around a firmly bullish 20 SMA, while technical indicators eased amid the pair holding within familiar levels, with the RSI steady at 70.

Support levels: 1.3120 1.3085 1.3040

Resistance levels: 1.3175 1.3220 1.3260

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD eases below 1.0900 amid cautious mood

EUR/USD has erased gains to trade on the back foot below 1.0900 early Tuesday. The pair treads water amid a cautious market mood, as traders weigh the US political updates and China slowdown worries. The US Dollar remains subdued, in the absence of top-tier economic data.

GBP/USD drops toward 1.2900 as US Dollar looks to stabilize

GBP/USD is dropping toward 1.2900, lacking firm direction in European trading on Tuesday. The US Dollar looks to stabilize after the early decline, weighing on the pair. Traders await mid-tier US housing data for fresh trading impetus.

Gold price struggles to gain ground amid mixed fundamental cues

A combination of factors drag the Gold price lower to nearly a one-week low on Tuesday. Bets that the Fed will cut rates in September could lend support and help limit losses.

Bitcoin price struggles around $67,000 as US Government transfers, Mt. Gox funds movement weigh

Bitcoin (BTC) struggles around the $67,000 mark and declines by 1.7% at the time of writing on Tuesday at around $66,350. Bitcoin spot ETFs saw significant inflows of $530.20 million on Monday.

Big tech rebound ahead of earnings, Oil slips

/stock-market-graph-gm532464153-55981218_XtraSmall.jpg)

Tesla and Google are due to report earnings today after the bell, and their results could shift the wind in either direction. Despite almost doubling its stock price between April and July, Tesla sees appetite for its cars and its market share under pressure.