GBP/USD Forecast: Pound fluctuates between key technical levels

- GBP/USD has been struggling to make a decisive move in either direction.

- ONS reported a decline in UK Retail Sales in February.

- British pound needs to flip 1.3200 into support to extend recovery.

GBP/USD has been moving sideways in a relatively tight channel in the second half of the week. The pair needs to break out of the 1.3160-1.3200 range to determine its next short-term direction.

The data published by the UK's Office for National Statistics showed on Friday that Retail Sales in the UK declined by 0.3% on a monthly basis in February after rising by 1.9% in January. This print missed the market expectation for an increase of 0.6% by a wide margin and made it difficult for the British pound to continue to gather strength.

In the meantime, Thursday's data revealed that the Manufacturing PMI in the UK declined to 55.5 in early March from 58 in February. Although this reading pointed to an ongoing expansion in the business activity, the survey's findings showed that rising price pressures and ongoing supply chain problems were expected to weigh heavily on growth in the coming months.

Later in the day, February Pending Home Sales will be the only data featured in the US economic docket ahead of the weekend. Market participants will pay close attention to comments from New York Fed President John Williams and Fed Governor Christopher Waller as well.

Following the Fed's decision to hike its policy rate by 25 basis points (bps) earlier in the month, FOMC policymakers adopted a hawkish tone and opened the door for double-dose rate hikes in upcoming meetings.

According to the CME Group FedWatch Tool, markets are pricing in a 70% chance of a 50 bps hike in May. In case US T-bond yields continue to push higher on increasing odds for a 50 bps hike, the dollar should be able to hold its ground against its major rivals.

GBP/USD Technical Analysis

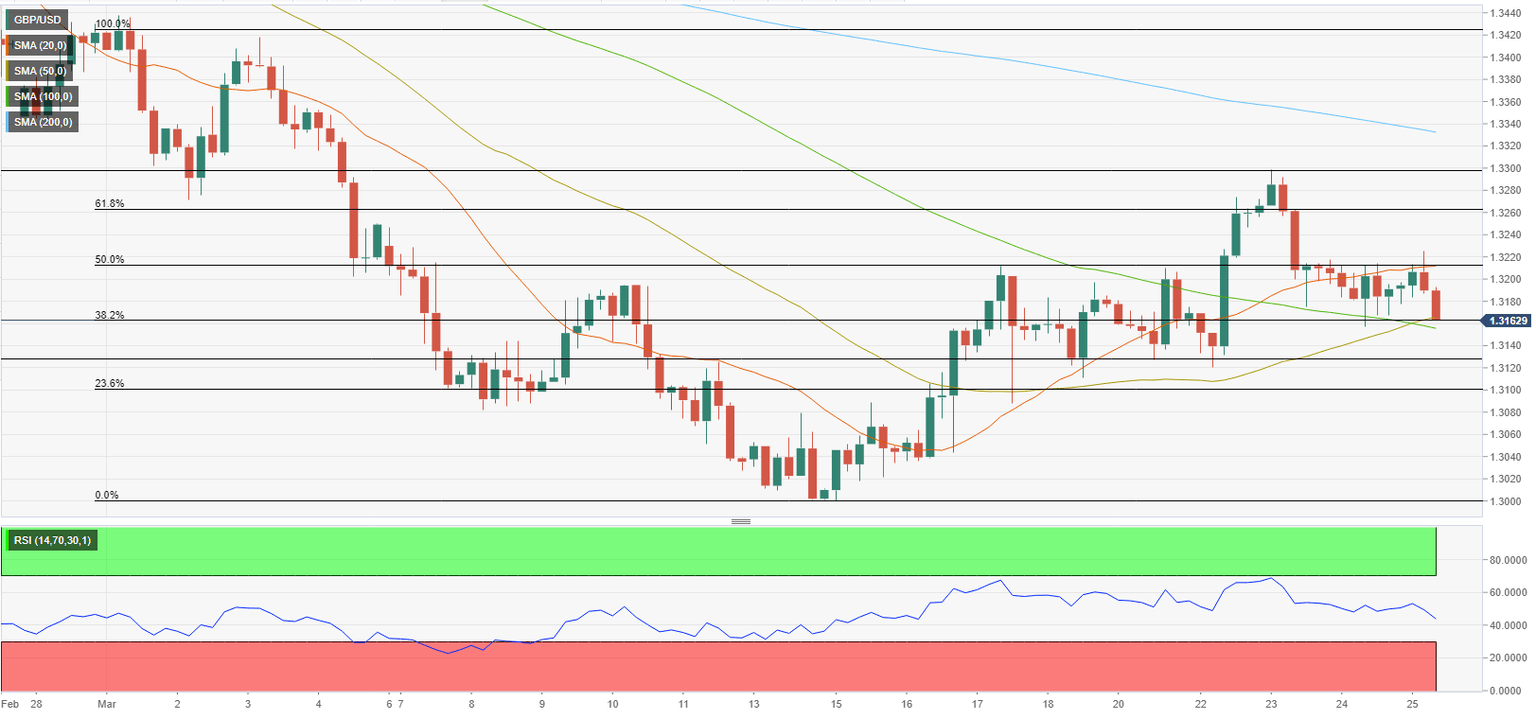

The 50-period and the 100-period SMAs on the four-hour chart seem to have formed strong support at 1.3160. The Fibonacci 38.2% retracement of the latest downtrend reinforces that level as well. In case sellers drag the pair below that support, the next bearish targets could be seen at 1.3130 (static level) and 1.3100 (psychological level, Fibonacci 23.6% retracement).

On the upside, GBP/USD could extend its rebound toward 1.3260 (Fibonacci 61.8% retracement) if buyers manage to flip 1.3200 (psychological level, Fibonacci 50% retracement, 20-period SMA) into support.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.