GBP/USD Forecast: Pound finally reacts to risk appetite

GBP/USD Current price: 1.3832

- The American dollar fell amid resurgent demand for high-yielding assets.

- The UK macroeconomic calendar has nothing to offer until next Tuesday.

- GBP/USD has turned bullish in the near-term, with an immediate resistance at 1.3845.

The British Pound was the most benefited from risk-appetite, recovering from an intraday low of 1.3715 on Friday to hit a weekly high of 1.3842, closing it a handful of pips below the level. The impressive U-turn had no particular catalyst but speculative interest moving away from the greenback and jumping into high-yielding assets. The fact that the pair settled above the 1.3800 threshold opens the door for another leg north this week.

Meanwhile, the coronavirus vaccine rollout continues in the kingdom, with the number of new daily contagions averaging 2,000 in the past week. The number of new deaths, however, has decreased sharply, down to 34 per day, according to the latest reports. The path to normal continues in the kingdom, providing it with an economic advantage. The UK macroeconomic calendar has nothing to offer until next Tuesday when the country will publish employment-related data.

GBP/USD short-term technical outlook

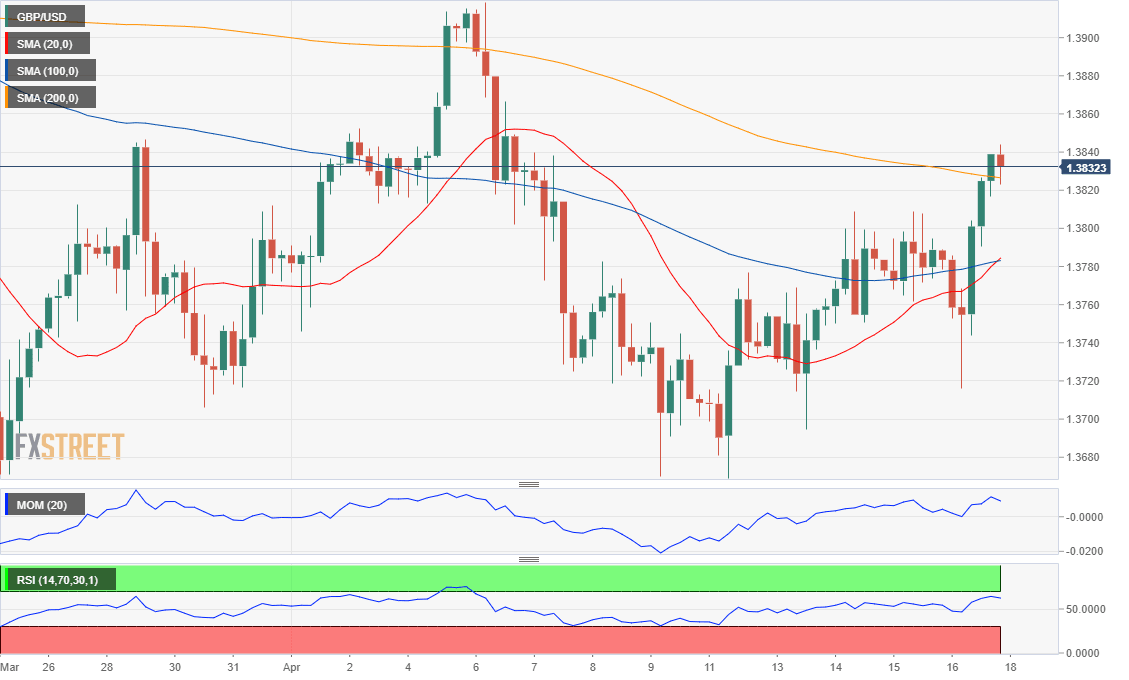

The GBP/USD pair has turned bullish according to the daily chart, rising sharply after meeting buyers around a mildly bullish 100 SMA and settling well above the 20 SMA. Technical indicators have picked up after testing their midlines, maintaining their positive slopes although within familiar levels. In the 4-hour chart, the bullish potential is stronger, as the Momentum indicator heads north almost vertical, while the RSI advances around 63. Also, the pair closed above its 200 SMA, although it would need to extend its advance to confirm the bullish breakout.

Support levels: 1.3805 1.3760 1.3715

Resistance levels: 1.3845 1.3890 1.3930

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.