GBP/USD Forecast: Pound bulls to take action above 1.3200

- GBP/USD has regained its traction on improving market mood early Tuesday.

- US Dollar Index turned south after rising toward 99.00.

- US stock index futures are up, reflecting an improving market mood.

GBP/USD has turned north following a decline toward 1.3100 earlier in the day. The positive shift witnessed in market mood seems to be helping the British pound hold its ground against the greenback in the early European session. The pair is closing in on key 1.3200 resistance and additional gains could be witnessed if sellers fail to defend that level.

Ukrainian President Volodymyr Zelenskyy said on Tuesday that they were ready to discuss commitment not to join NATO and added that they could also discuss the status of Crimea and Donbass after the ceasefire. Although it's too early to say whether or not these remarks could be taken as convincing signs toward a diplomatic solution, risk-sensitive assets are gathering interest.

The UK's FTSE 100 Index is up 0.6% and US stock index futures are rising between 0.35% and 0.4%. Meanwhile, the US Dollar Index, which came within a touching distance of 99.00 on the back of hawkish Fed commentary, is posting small daily gains near 98.60.

The economic docket will not feature any high-impact data releases on Tuesday and GBP/USD needs risk flows to continue to dominate the financial markets in order to extend the recovery.

GBP/USD Technical Analysis

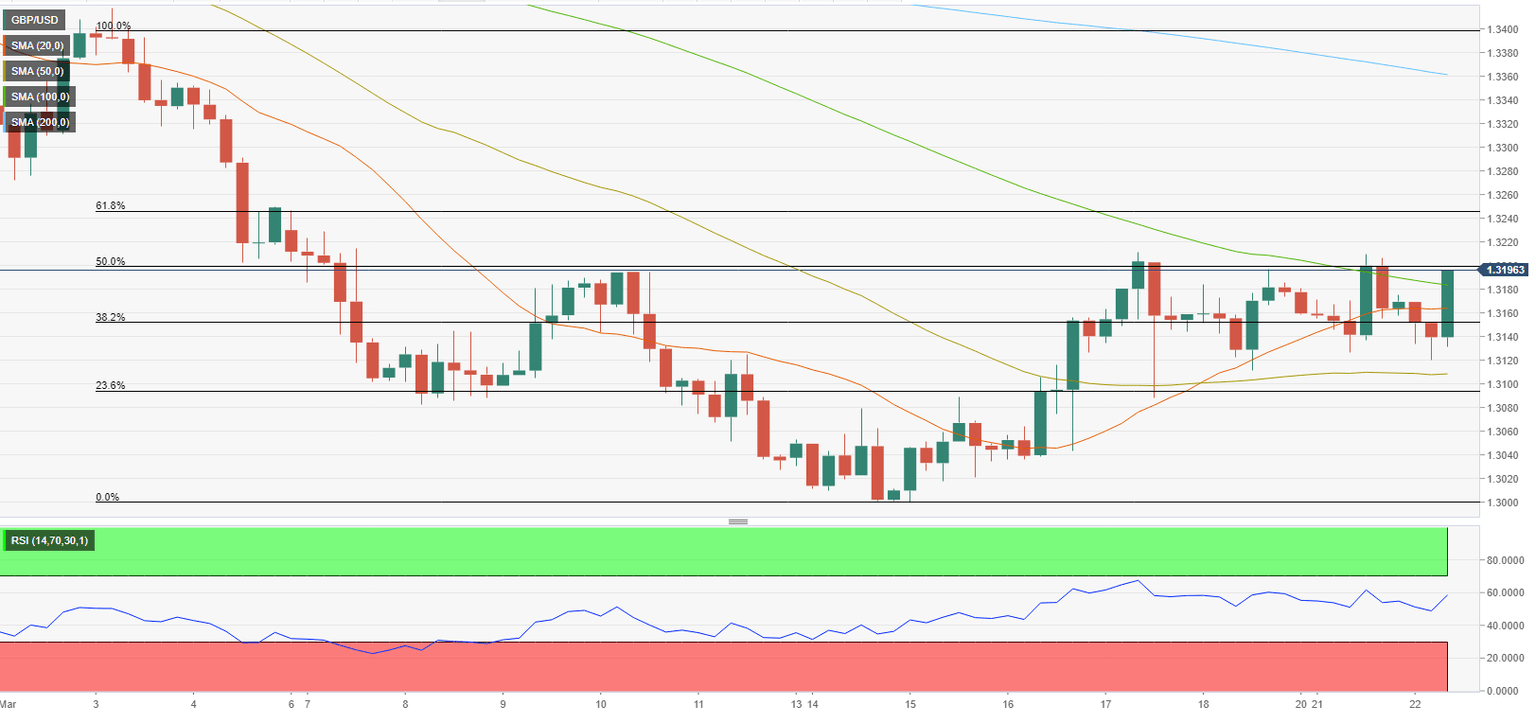

On the four-hour chart, GBP/USD is testing the 100-period SMA, which forms interim resistance at 1.3180 ahead of the critical 1.3200 (psychological level, Fibonacci 50% retracement of the latest downtrend) hurdle.

Meanwhile, the Relative Strength Index (RSI) indicator is holding above 50 on the same chart, suggesting that buyers are looking to take control of the pair's action. In case 1.3200 level turns into support, the next bullish target could be seen at 1.3250 (Fibonacci 61.8% retracement).

On the downside, 1.3150 (Fibonacci 38.2% retracement) aligns as first support before 1.3100 (50-period SMA, Fibonacci 23.6% retracement, psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.