GBP/USD Forecast: Pound bulls eye 1.1300 next

- GBP/USD has extended its rebound toward 1.1200 early Friday.

- Upbeat UK GDP data seems to be helping the British pound find demand.

- Technical outlook suggests that buyers retain control of the pair's action.

GBP/USD has gathered further bullish momentum following Thursday's impressive rally and advanced to a fresh weekly high near 1.1200. The near-term technical outlook shows that the bullish bias stays intact.

After the Bank of England (BoE) decided to intervene in the gilt market mid-week and reassured markets that fiscal easing will prompt a significant policy response, the British pound managed to stage an impressive comeback. The dollar's extreme overbought conditions triggered a correction in the US Dollar Index as well, providing an additional boost to GBP/USD. The pair has gained nearly 400 pips since Wednesday and turned positive on the week.

Earlier in the day, the data published by the UK's Office for National Statistics (ONS) revealed that the Gross Domestic Product expanded at an annualized rate of 4.4% in the second quarter, surpassing the market expectation of 2.9% by a wide margin.

Meanwhile, the improving market mood seems to be putting additional weight on the dollar's shoulders ahead of the Personal Consumption Expenditures (PCE) Price Index data from the US. US stock index futures are up between 0.6% and 0.8% during the European trading hours. In case the PCE inflation data come in below analysts' estimates, the risk rally could pick up steam and force the greenback to continue to weaken against its rivals.

It's worth noting that quarter-end flows could ramp up the market volatility in the second half of the day and cause irregular movements in financial assets' prices.

GBP/USD Technical Analysis

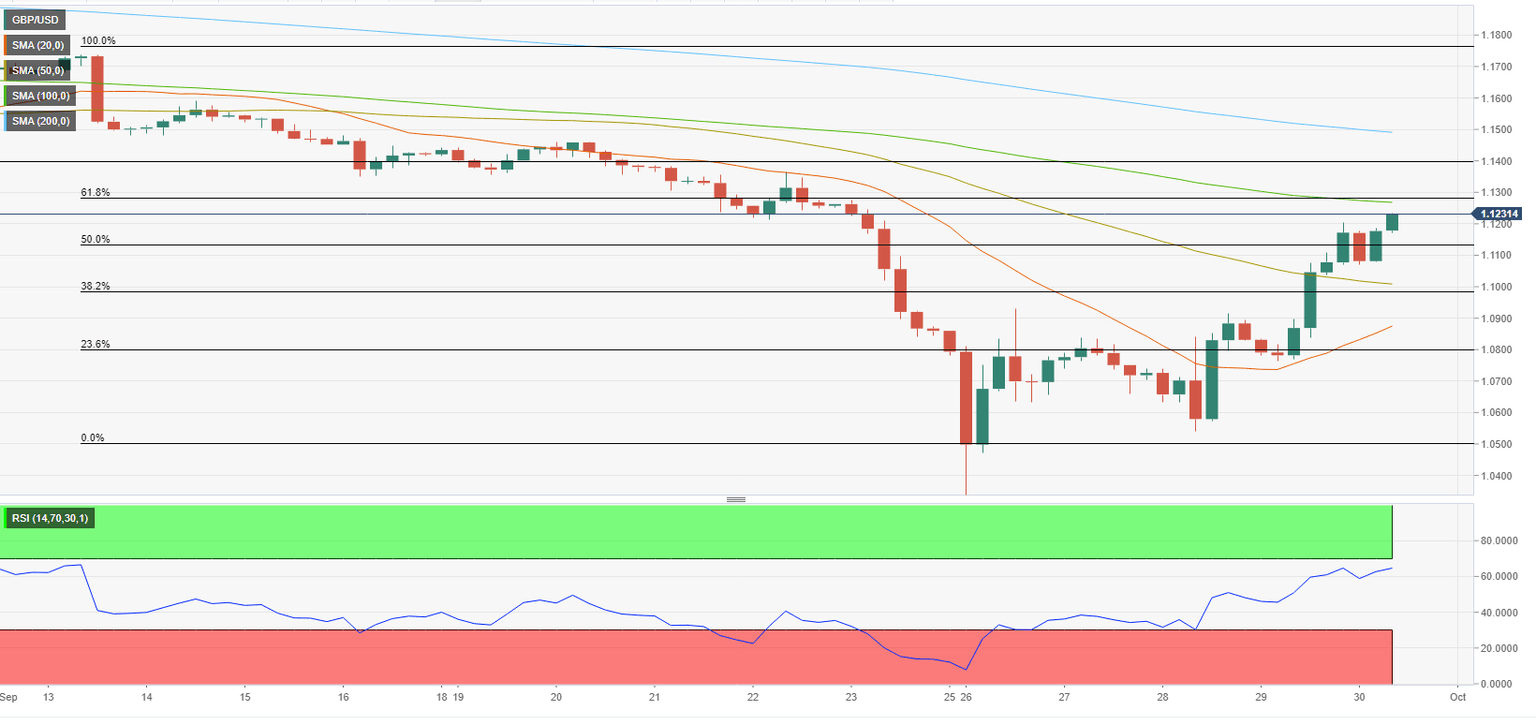

The Relative Strength Index on the four-hour chart stays below 70, suggesting that there is more room on the upside for the pair before it turns technically overbought. Additionally, GBP/USD closed the last five four-hour candles above the 50-period SMA, confirming the bullish bias.

On the upside, 1.1300 (Fibonacci 61.8% retracement of the latest downtrend, 100-period SMA) aligns as the next target. In case buyers flip that level into support, the pair could continue to push higher toward 1.1400 (static level) and 1.1500 (200-period SMA).

First support is located at 1.1130 (Fibonacci 50% retracement) before 1.1100 (psychological level) and 1.1000 (psychological level, 50-period SMA, Fibonacci 38.2% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.