GBP/USD Forecast: Pound approaches key resistance amid persistent dollar weakness

- GBP/USD has regained its traction following Thursday's consolidation.

- A negative shift in risk sentiment could limit the pair's upside.

- The latest data releases from the UK were largely ignored by market participants.

GBP/USD has reached its highest level since late October at 1.3750 on Thursday but erased a large portion of its daily gains before closing flat near 1.3700. The pair is edging closer to 1.3750 early Friday and additional gains could be witnessed if this level turns into support.

The data published by the UK's Office for National Statistics revealed on Friday that the economic activity in November expanded by 0.9%, compared to the market expectation of 0.2%. On a negative note, Industrial Production increased by only 0.1% on a yearly basis, falling short of analysts' estimate of 0.5%.

Although these data had little to no impact on the British pound's market valuation, the UK's FTSE 100 Index is trading in the negative territory, pointing to a souring market mood. In case the markets remain risk-averse in the remainder of the day, GBP/USD could find it difficult to extend its rally.

In the second half of the day, December Retail Sales and Industrial Production data will be featured in the US economic docket. More importantly, the University of Michigan's flash January Consumer Sentiment Index will be looked upon for fresh hints on the effect of inflation on consumer confidence.

The US Dollar Index is down more than 1% so far this week and profit-taking could trigger a rebound ahead of the weekend. In case today's data points to easing inflation concerns, however, the greenback is unlikely to attract investors.

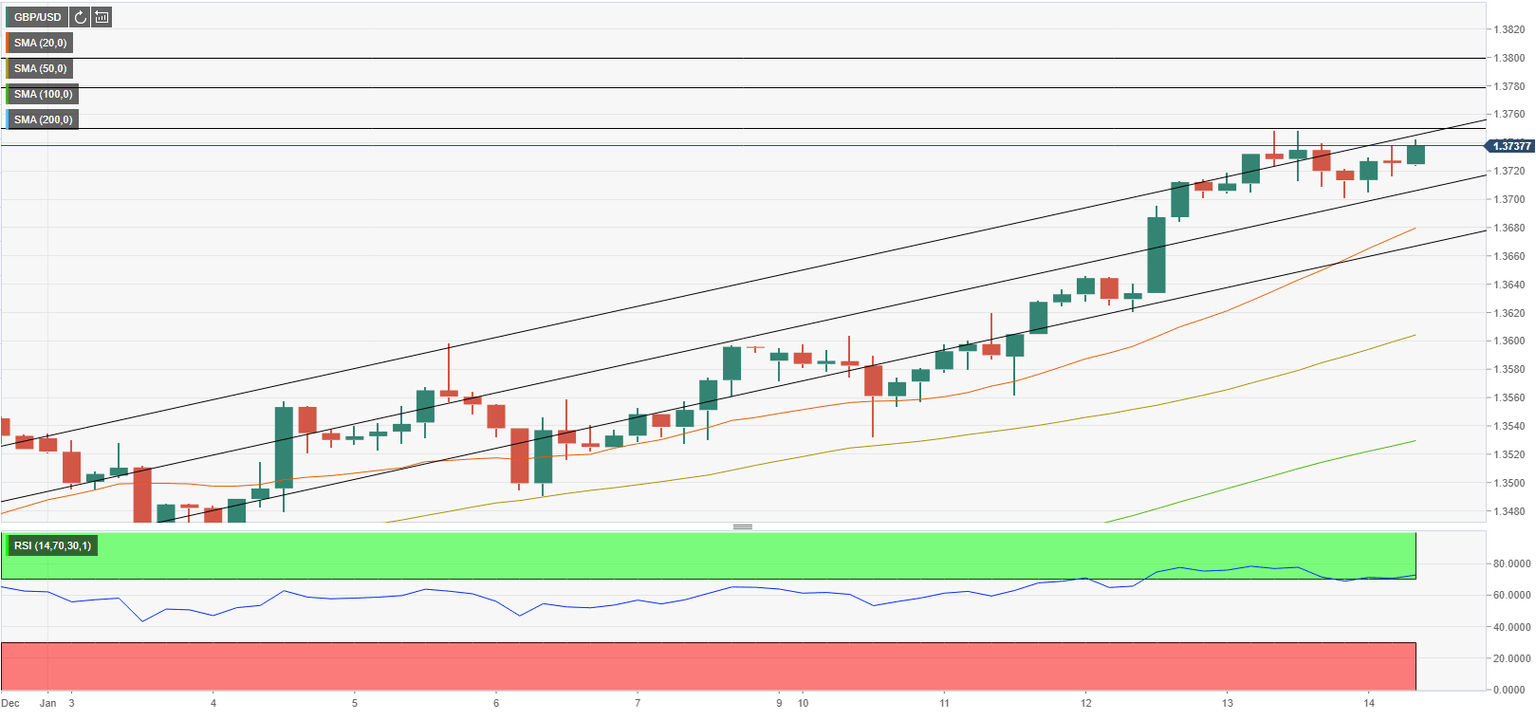

GBP/USD Technical Analysis

Buyers could move to the sidelines and await a correction, according to the Relative Strength Index (RSI) indicator which continues to stay in the overbought territory above 70 on the four-hour chart.

1.3750 (static level, upper limit of the ascending regression channel coming from December) aligns as key resistance and in case this level turns into support, the next target on the upside could be seen at 1.3780 (static level) before 1.3800 (psychological level).

On the downside, 1.3720 (middle line of the ascending channel forms dynamic support ahead of 1.3700 (psychological level) and 1.3680 (20-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.