GBP/USD Forecast: Petrol problems pound the pound, BOE and upbeat mood could turn it up

- GBP/USD has been under pressure as a petrol shortage threatens the UK.

- BOE hawkishness, optimism about Evergrande and US data could turn the pair around.

- Monday's four-hour chart is painting a mixed picture.

Running dry – the UK Petrol Retailers Association has said 50-90% of stations are running dry in some areas, and the crisis may derail the recovery. Calls to avoid panic-stocking have only served to highlight the issue and to trigger long lines at pumps.

Contrary to natural gas, there is no shortage of fuel, but rather one of truck drivers, many of whom are EU nationals. Prime Minister Boris Johnson suspended rules relating to hiring foreigners, is contemplating sending the army to help and also suspended competition rules. The longer the crisis lasts, the greater the pressure on the pound.

Petrol problems have outweighed the Bank of England's hawkish decision on Thursday. The "Old Lady" hinted that interest rates could rise even before the BOE completes its bond-buying scheme. Moreover, two members voted to cut short debt purchases already now after consumer prices rose more than estimates. Annual inflation hit 3.2% in August.

On the other side of the pond, hawks also had the upper hand last week. The Federal Reserve signaled it would announce the tapering of bond buys in November and would end it by mid-2022. Fed members Lael Brainard, John Williams and Charles Evans will speak today and could somewhat soften the message. All are doves.

The Fed wins another round, but the endgame has not changed

The greenback also has room to fall as the Evergande crisis seems to be under control. While China's behemoth construction company is set to miss more debt payments, investors are less worried about the risks of contagion. Beijing has continued injecting liquidity into markets.

US Durable Goods Orders are due later on Monday and are projected to show an increase in investment. While employment statistics disappointed last month, retail sales were robust. Upbeat figures could weigh on the safe-haven dollar, especially as the Fed decision is already out of the way.

US Durable Goods Orders August Preview: Retail Sales have led the way

Overall, the pound has room to recover.

GBP/USD Technical Analysis

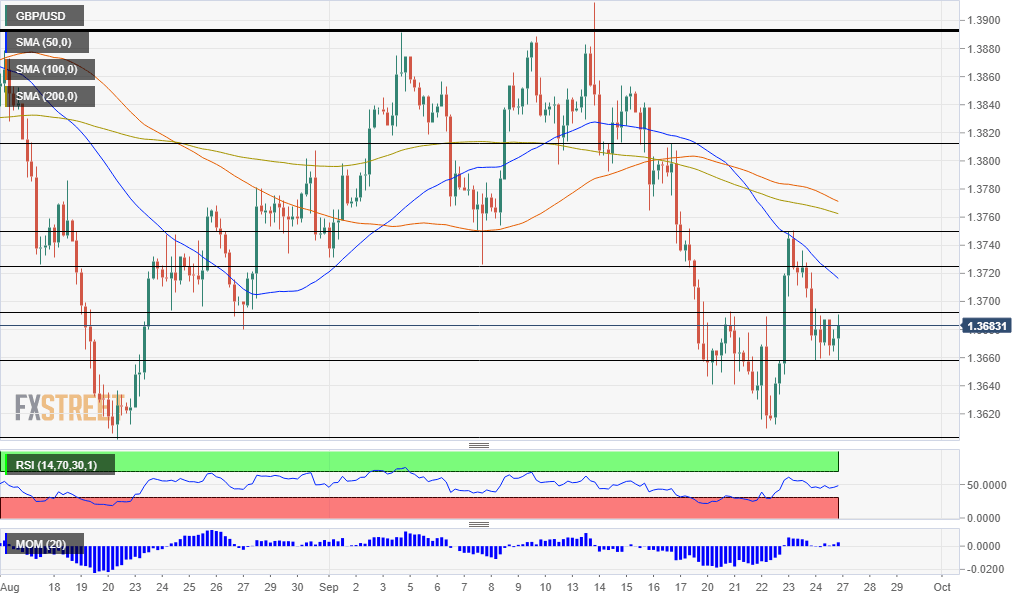

Pound/dollar is benefiting from upside momentum on the four-hour chart, in a positive turn. On the other hand, the pair trades below the 50, 100 and 200 Simple Moving Averages (SMAs) and thus remains under pressure.

Resistance awaits at the daily high of 1.3690. It is followed by 1.3725, a swing low from mid-September and 1.3750, last week's peak.

Support is at the daily low of 1.3660, followed by 1.36, the mid-August low. Further down, 1.3550 comes into play.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.