GBP/USD Forecast: No-deal Brexit looms, pound under siege

GBP/USD Current price: 1.3227

- Odds for a no-deal Brexit continue to increase ahead of January 1.

- EU’s Ursula Von Der Leyen told EU leaders that a no-deal is the most likely outcome.

- GBP/USD is at risk of falling further, all eyes on the 1.3000 threshold.

Diminished chances of a Brexit deal had hit the Sterling Pound last week, resulting in GBP/USD plummeting to 1.3133, its lowest in almost a month. The pair bounced ahead of the weekly close to settle in the 1.3220 price zone, still at risk of collapsing on a no-deal between the UK and the EU. By the end of the week, UK PM Boris Johnson said that it is “very, very likely” that the UK will have to trade with the EU on WTO terms, while EU’s Ursula Von Der Leyen told EU leaders that a no-deal is the most likely outcome.

Both parts set a deadline for this Sunday to find an agreement, although, at the time being, no progress has been reported. Johnson and Von der Leyen agreed to continue discussions this week ahead of January 1, while the pair is expected to remain under selling pressure. The United Kingdom won’t publish relevant data this Monday.

GBP/USD short-term technical outlook

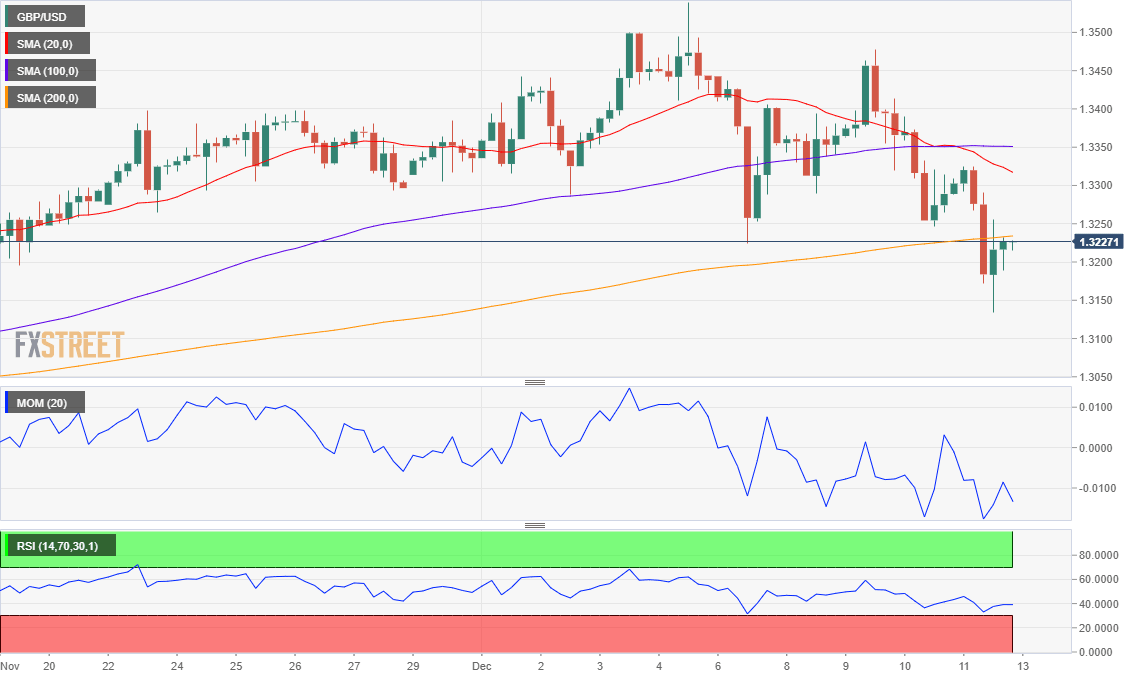

In the daily chart, the GBP/USD pair is poised to extend its decline, as it has broken below its 20 DMA and approached the 100 DMA, which provides support at 1.3090. Technical indicators have crossed their midlines into negative territory, maintaining their bearish slopes. In the 4-hour chart, the risk of a bearish extension is even higher, as the pair has broken below all of its moving averages, while technical indicators stand near oversold readings without signs of downward exhaustion.

Support levels: 1.3210 1.3165 1.3120

Resistance levels: 1.3255 1.3300 1.3345

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.