GBP/USD Forecast: Next round of sellers aligned around 1.3060

GBP/USD Current Price: 1.3009

- The UK CBI Distributive Trade Survey on realized sales showed a modest 1.0% increase in February.

- EU Political Declaration repeats the need for a level playing field for the future EU-UK trade relationship.

- GBP/USD could extend its gains up to 1.3065 on the back of dollar’s weakness.

The GBP/USD pair reached a daily high of 1.3017 on the back of the dollar’s weakness and despite soft UK figures. The February UK CBI Distributive Trade Survey on realized sales showed a modest 1.0% increase against the 4.0% expected. The report showed that sales remained flat and orders fell in the year to February, although there has been an improvement in investment plans when compared to the previous quarter.

The EU released the Political Declaration, a document set to be the base of the upcoming trade relationship with the UK. The kingdom will release its declaration next Thursday, although Downing Street responded to the EU, claiming that the UK deserves the same respect to autonomy as other major economies such as Canada and Japan, and mentioned that the EU doesn’t demand a level playing field when dealing with the US. The UK won’t release macroeconomic figures this Wednesday.

GBP/USD short-term technical outlook

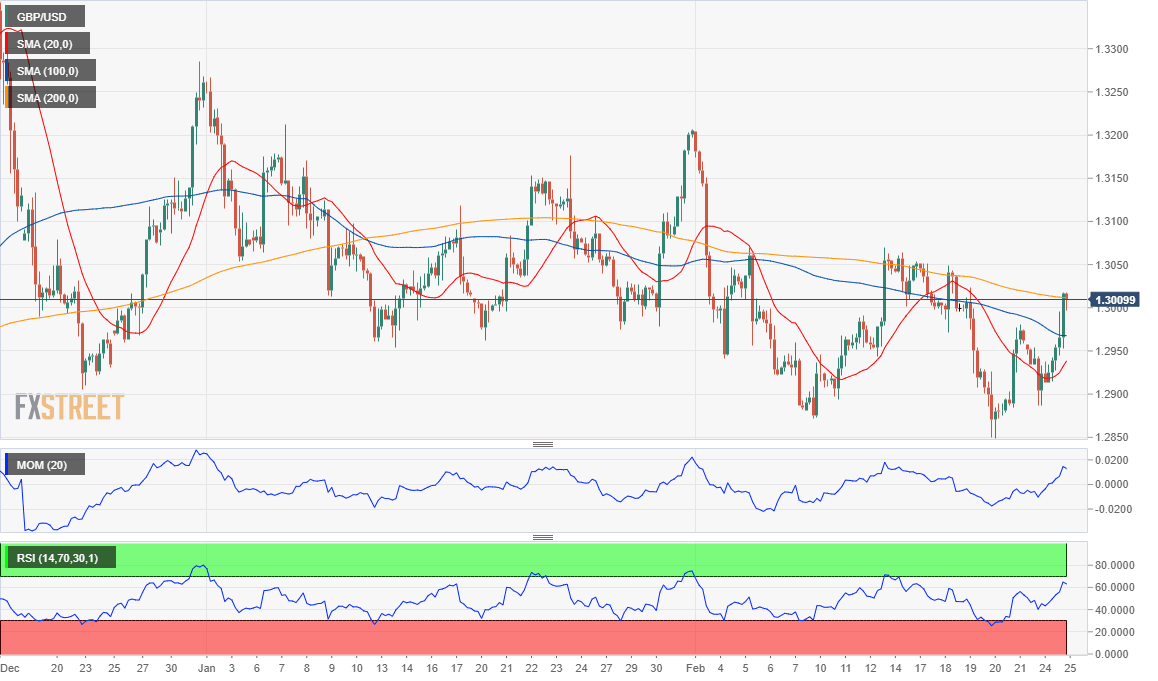

The GBP/USD pair is trading near its daily high above 1.3000, bullish in the short-term. The 4-hour chart shows that the pair, however, is still unable to surpass a mild-bearish 200 SMA, although it holds above the 20 and 100 SMA. Technical indicators, in the meantime, have lost their bullish strength, but remain within positive levels. An immediate resistance level comes at 1.3020, while multiple intraday highs stand in the 1.3050/60 region.

Support levels:1.2995 1.2950 1.2910

Resistance levels: 1.3020 1.3065 1.3100

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.