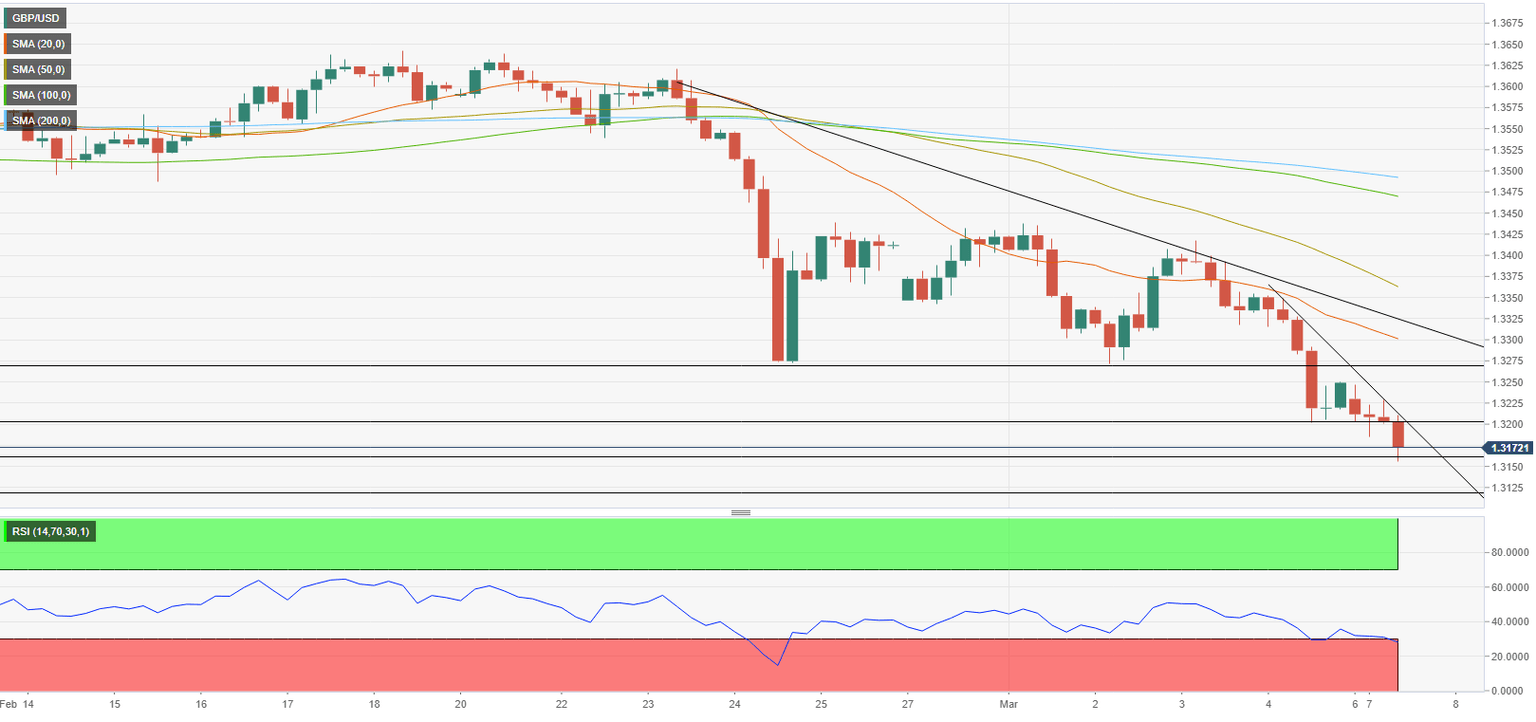

GBP/USD Forecast: Next bearish target aligns at 1.3120

- GBP/USD has declined toward key 1.3160 support early Monday.

- Next bearish target for the pair is located at 1.3120.

- Dollar is likely to preserve its strength amid risk aversion.

GBP/USD has started the new week under strong bearish pressure with the greenback capitalizing on safe-haven flows. The pair was last seen testing the 1.3160 support and additional losses are likely in case this level turns into resistance.

Russian President Vladimir Putin reiterated that they remain committed to ramping up the aggression against Ukraine until their demands are met. The Ukrainian defence ministry said early Monday that Russia was targeting infrastructure to disrupt the flow of information. Additionally, a Ukrainian army official noted that Russia was accumulating resources with the intention of attacking Kyiv in the near term.

Over the weekend, British Prime Minister Boris Johnson said that they should increase the economic pressure on Russia and added that they need to rapidly strengthen defences in Nato countries.

Delegations from Russia and Ukraine are scheduled to meet on Monday but talks are expected to be on humanitarian corridors rather than a diplomatic solution to the conflict.

As it currently stands, a steady rebound in GBP/USD looks unlikely with investors staying away from risk-sensitive currencies. Meanwhile, the UK's FTSE 100 Index is down nearly 2% in the early European session.

Reflecting the broad-based dollar strength, the US Dollar Index is trading above 99.00 for the first time since May 2020. The economic calendar will not be featuring any high-tier macroeconomic data releases on Monday and the risk perception should remain the primary market driver.

GBP/USD Technical Analysis

GBP/USD's downtrend that started in May 2021 ended at 1.3160 in December, highlighting the significance of this level. In case this support turns into resistance, the next bearish target aligns at 1.3120 (static level) ahead of 1.3100 (psychological level).

On the upside, the first resistance could be seen at 1.3200 (psychological level) before 1.3250 (static level) and 1.3270 (static level).

It's also worth noting that the Relative Strength Index (RSI) indicator remains below 30, suggesting that the pair could make a technical correction before targeting new multi-month lows.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.