- GBP/USD has been falling as Brexit talks hit a fresh snag.

- EU-UK talks, vaccine developments and Nonfarm Payrolls are set to rock cable.

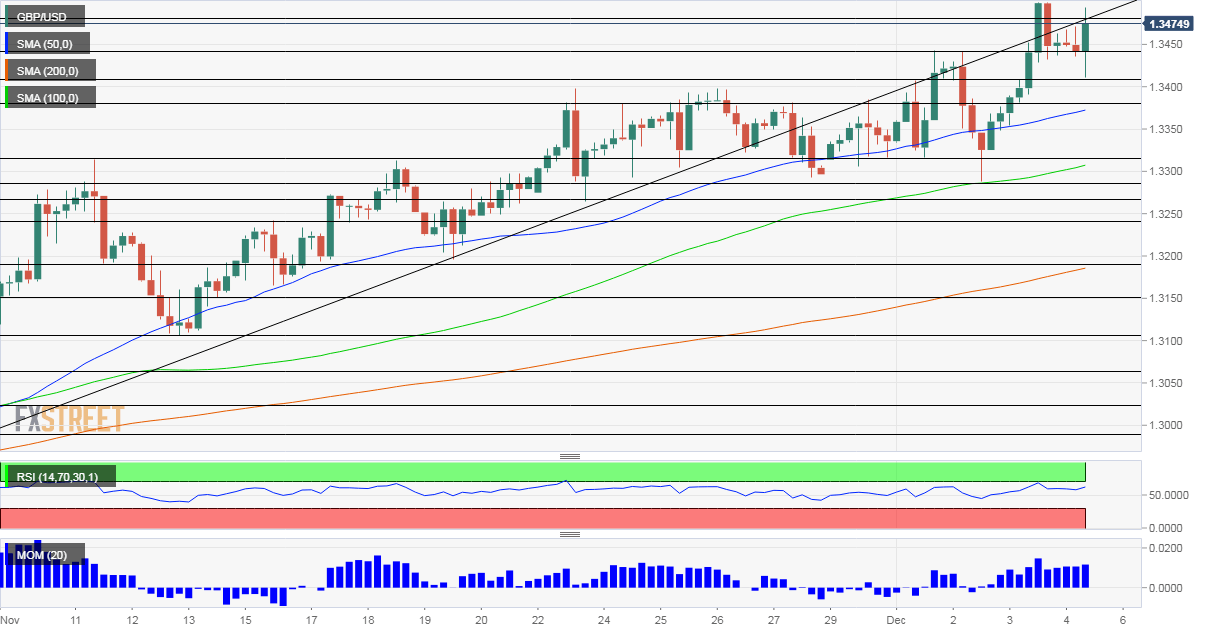

- Friday's four-hour chart is painting a bullish picture.

The Brexit mood is getting darker – but is it the darkest hour before dawn rises? The latest headlines in the saga are in offer something for everybody.

UK Business Secretary Alok Sharma said that talks are in a difficult phase and there are still some tricky issues to be resolved. Charles Michel, the President of the European Council, said that the next hours or days are critical and added that a no-deal is possible. A French minister seemed to confirm reports earlier in the week that Paris reserves the option to veto a deal if it is dissatisfied.

On the other hand, an unnamed EU official told Reuters that a deal is "imminent" – barring any last-minute breakdown. That latest development triggered a recovery, yet traders remain hesitant amid the flurry of headlines.

Fisheries, governance and a level-playing field remain the sticking points, and some horse-bargaining and perhaps some "ambiguous creativity" to round corners. A deal would boost the pound, while a breakdown of talks would probably result in efforts to secure an interim accord or arrangement. One thing is certain – uncertainty remains high.

For broader markets, the main event of the day and the week is the US Nonfarm Payrolls report. Economists expect an increase of 469,000 jobs and a small drop in the unemployment rate. The pace of the recovery has moderated, but the scale is unclear. Indicators leading toward the event have leaned to the downside, but it has been hard to assess the NFP in the volatile times of the pandemic.

See:

- US Nonfarm Payrolls November Preview: Orders now, hiring to come

- Nonfarm Payrolls Preview: Another dollar’s disappointment underway

Optimism about a COVID-19 vaccine has somewhat waned after Pfizer said that it faces supply chain strains, and will likely produce only 50 million doses this year, down from 100 million originally anticipated. Dr. Anthony Fauci, America's lead epidemiologist, criticized the UK's rapid authorization process but later retracted his words.

US coronavirus statistics remain worrisome, with yet another record US fiscal stimulus still hangs in the balance, despite a seemingly promising breakthrough early in the week. This laundry list of American developments has allowed the safe-haven dollar to partially recover.

Overall, Brexit remains left, right and center, but the NFP and other events are also likely to shape the next moves in cable.

GBP/USD Technical Analysis

Pound/dollar continues riding on upside momentum on the four-hour chart. It also remains above the 50, 100 and 200 Simple Moving Average while the Relative Strength Index remains below 70, outside overbought conditions. Bulls have the upper hand.

Some resistance is at 1.3483, September's high, followed by 1.35, the fresh peak recorded on Thursday. Close by, 1.3515 was a swing high in December 2019 and further above, 1.36 already dates back to 2018.

Some support is at 1.3440, a high point recorded early in the week. It is followed by 1.3410 and 1.3380.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to recovery gains near 1.0850 ahead of Fedspeak

EUR/USD trades in positive territory near 1.0850 on Friday following a four-day slide. China's stimulus optimism and a broad US Dollar correction help the pair retrace the dovish ECB decision-induced decline. All eyes remain on the Fedspeak.

GBP/USD pares UK data-led gains at around 1.3050

GBP/USD is trading at around 1.3050 in the second half of the day on Friday, supported by upbeat UK Retail Sales data and a pullback seen in the US Dollar. Later in the day, comments from Federal Reserve officials will be scrutinized by market participants.

Gold at new record peaks above $2,700 on increased prospects of global easing

Gold (XAU/USD) establishes a foothold above the $2,700 psychological level on Friday after piercing through above this level on the previous day, setting yet another fresh all-time high. Growing prospects of a globally low interest rate environment boost the yellow metal.

Crypto ETF adoption should pick up pace despite slow start, analysts say

Big institutional investors are still wary of allocating funds in Bitcoin spot ETFs, delaying adoption by traditional investors. Demand is expected to increase in the mid-term once institutions open the gates to the crypto asset class.

Canada debates whether to supersize rate cuts

A fourth consecutive Bank of Canada rate cut is expected, but the market senses it will accelerate the move towards neutral policy rates with a 50bp step change. Inflation is finally below target and unemployment is trending higher, but the economy is still growing.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.