GBP/USD Forecast: Holding near a critical Fibonacci resistance

GBP/USD Current Price: 1.2453

- UK PM Johnson left hospital his health continues to improve.

- The pandemic-related crisis in the UK set to deepen in the upcoming weeks.

- GBP/USD needs to advance beyond 1.2515 to become attractive for bulls.

The GBP/USD pair has finished the week with gains around 1.2450, after topping at 1.2486 on Friday. It was the third consecutive week the pair reached the 1.2480 price zone and was unable to advance beyond it. The Sterling benefited from the broad dollar’s weakness and news indicating that UK PM Johnson is recovering from coronavirus. After spending some days in the ICU, reports came on Sunday that he has left the hospital, bringing some relief to those concerned about the UK leadership. There are other Cabinet members affected by coronavirus and quarantine, and Raab continues to lead the kingdom.

Meanwhile, the pandemic continues spreading in the UK with roughly 80,000 cases and the death toll nearing 10,000. The late response of the UK government to the pandemic suggests that the crisis may deepen in the upcoming weeks. Most markets will remain closed this Monday, included London, with no data scheduled to release.

GBP/USD short-term technical outlook

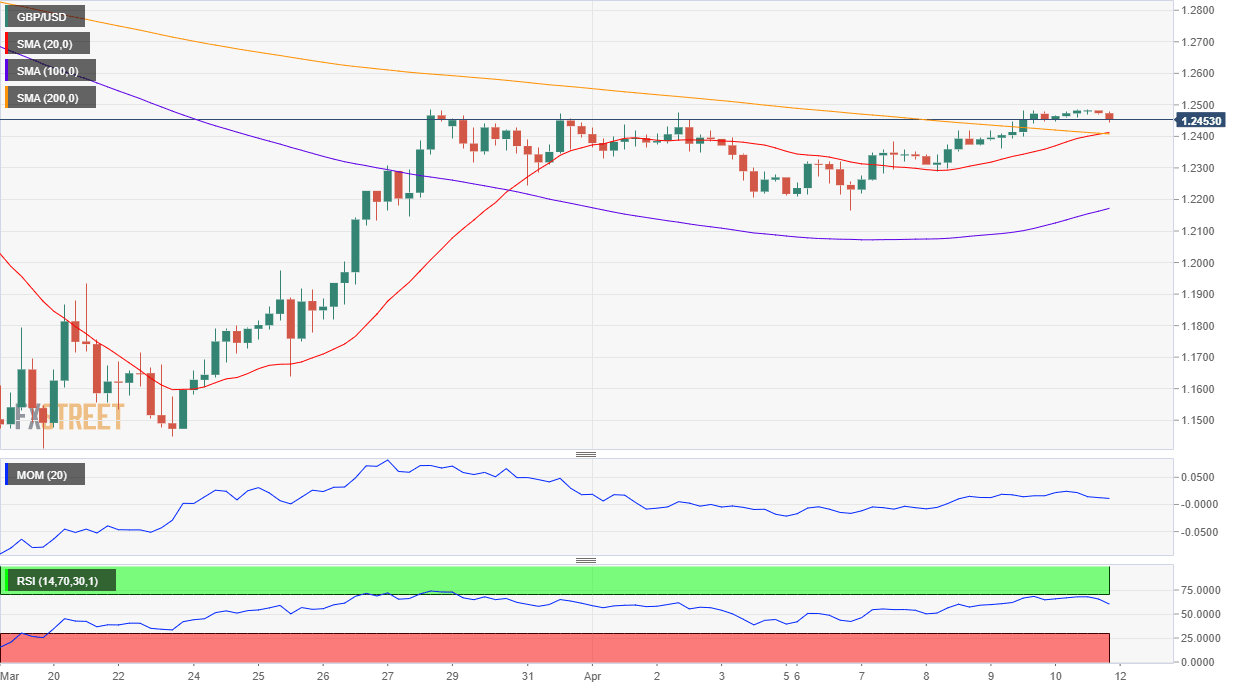

The GBP/USD pair is trading at the upper end of its latest range and close to a critical Fibonacci level, the 61.8% retracement of its latest weekly slump at 1.2515. In the daily chart, the pair is neutral-to-bullish as it extended its advance above a now flat 20 SMA, while the Momentum indicator advances in overbought territory. The RSI, however, is flat around its mid-line. In the shorter-term, and according to the 4-hour chart, the bullish potential is limited, given that the pair is hovering around its 20 and 200 SMA, both directionless, while technical indicators turned south, nearing neutral readings. Things could change if the pair firms up above the mentioned Fibonacci resistance.

Support levels: 12420 1.2370 1.2320

Resistance levels: 1.2515 1.2560 1.2600

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.