GBP/USD Forecast: Hawkish BoE commentary could push Pound Sterling higher

- GBP/USD advanced to its highest level in over two months above 1.2500.

- BoE Governor Bailey said on Monday that interest rates could rise again.

- BoE policymakers will testify before the UK Treasury Select Committee on Tuesday.

GBP/USD climbed above 1.2500 and reached its highest level since early September near 1.2550 on Tuesday. Bank of England (BoE) policymakers' comments on the policy outlook could drive the pair's action in the near term.

Late Monday, BoE Governor Andrew Bailey said that they must watch for signs of inflation persistence that may require interest rates to rise again. Bailey reiterated that the policy will need to be restrictive "for quite some time yet" and noted that it is far too early to be thinking about rate cuts.

Pound Sterling price this week

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies this week. Pound Sterling was the strongest against the Canadian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.36% | -0.65% | 0.03% | -0.76% | -1.48% | -1.14% | -0.21% | |

| EUR | 0.36% | -0.30% | 0.38% | -0.40% | -1.11% | -0.77% | 0.15% | |

| GBP | 0.65% | 0.31% | 0.69% | -0.08% | -0.80% | -0.47% | 0.46% | |

| CAD | -0.03% | -0.39% | -0.70% | -0.79% | -1.50% | -1.17% | -0.24% | |

| AUD | 0.73% | 0.38% | 0.09% | 0.77% | -0.73% | -0.39% | 0.53% | |

| JPY | 1.46% | 1.09% | 0.57% | 1.51% | 0.74% | 0.33% | 1.26% | |

| NZD | 1.13% | 0.77% | 0.48% | 1.16% | 0.37% | -0.34% | 0.92% | |

| CHF | 0.18% | -0.18% | -0.47% | 0.21% | -0.58% | -1.29% | -0.95% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Bailey and other members of the Monetary Policy Committee will be testifying before the Treasury Select Committee on Tuesday. In case officials continue to try to convince markets that they might not necessarily be done with rate hikes, Pound Sterling could gather strength against its major rivals.

In the American session, the US economic docket will feature Existing Home Sales data for October, which is unlikely to trigger a noticeable market reaction. The Federal Reserve (Fed) will release the minutes of the October 31-November 1 meeting. Since the weak inflation data, which caused markets to start pricing in a Fed policy shift next year, was published after that meeting, the commentary in this publication is likely to be outdated.

In the meantime, the UK's FTSE 100 Index opened lower and was last seen losing 0.5%. Similarly, US stock index futures turned negative on the day following a quiet Asian session. If safe-haven flows return to markets in the second half of the day, the US Dollar could shake off the bearish pressure and limit GBP/USD's upside.

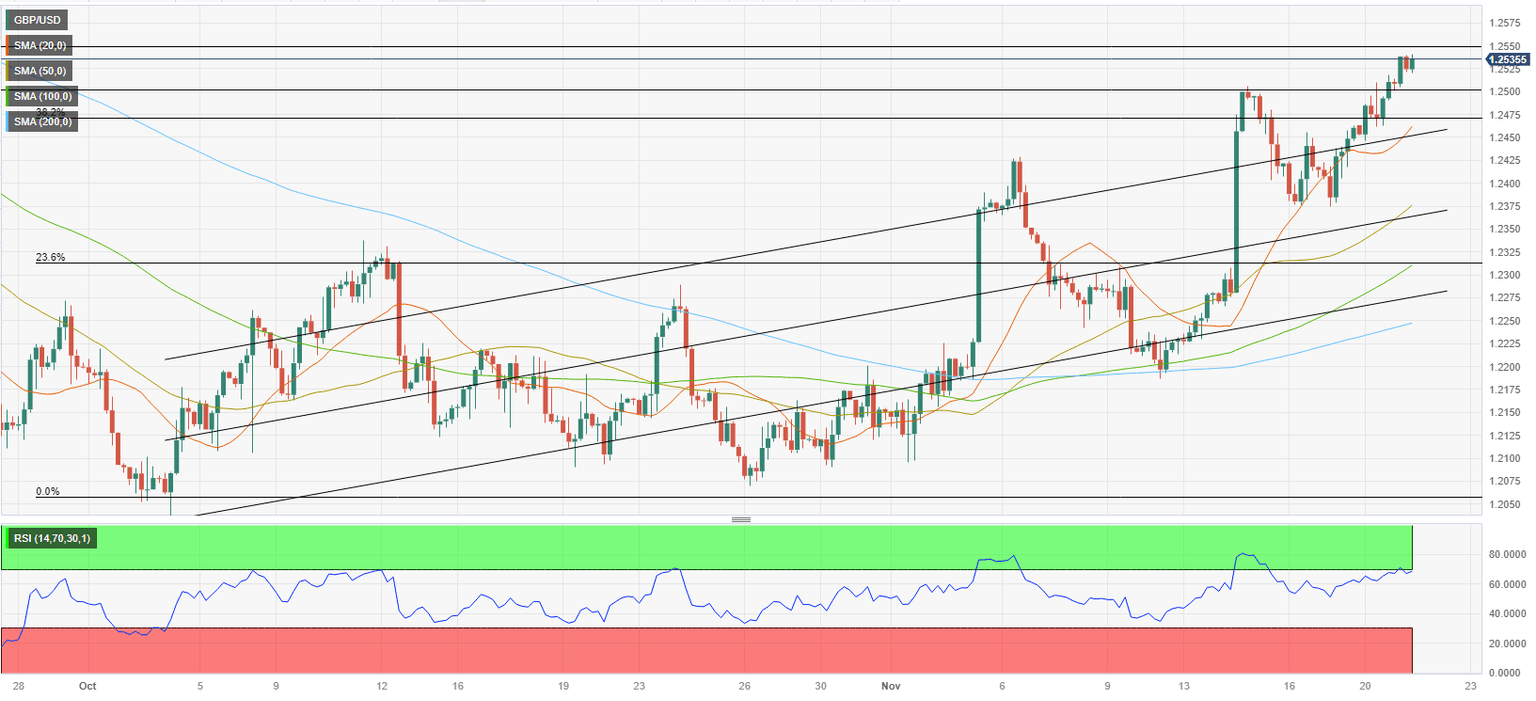

GBP/USD Technical Analysis

1.2550 (static level) aligns as immediate resistance for GBP/USD ahead of 1.2600 (Fibonacci 50% retracement of the July-October downtrend) and 1.2670 (static level from August).

On the downside, first support is located at 1.2500 (psychological level, static level) before 1.2470, where the Fibonacci 38.2% retracement level, the 20-period Simple Moving Average (SMA) and the upper-limit of the broken ascending regression channel meet. A daily close below the latter could open the door for a deeper correction toward 1.2400 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.