GBP/USD Forecast: Dead-cat bounce points to further falls, Fed minutes could pummel the pound

- GBP/USD has been licking its wounds after weak UK and US data.

- The Federal Reserve's meeting minutes could send the pair further down.

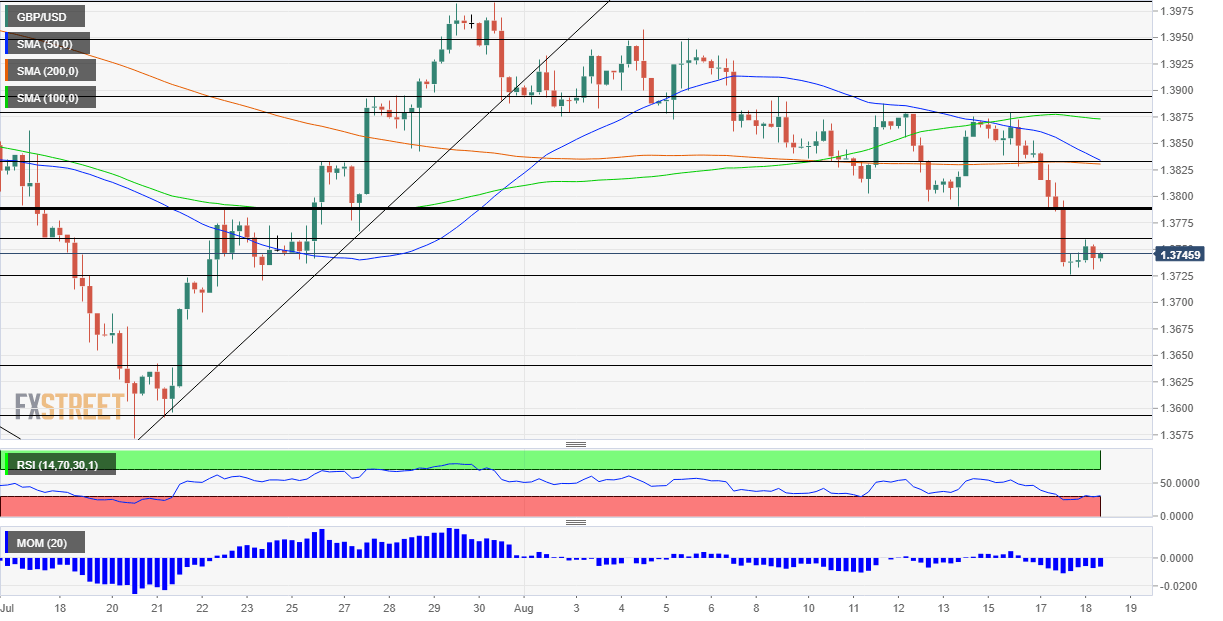

- Wednesday's four-hour chart is showing cable is flirting with oversold conditions.

No mercy in the summer – the safe-haven dollar has been gaining ground and the pound has been suffering from weak data. That has resulted in a mere "dead-cat bounce" for GBP/USD, following its sharp drop below 1.38. It is now trading at the lowest since late July.

Britain reported an annual inflation rate of 2% in July, softer than 2.3% that was projected and implying no rush from the Bank of England to tighten its monetary policy. The news joins stubbornly high coronavirus cases in Britain, where improvement has stalled.

In the US, bad news is good news for the dollar. Starting from COVID-19, America reported a daily caseload of over 250,000, pushing the daily average to near 140,000. Several hospitals in the south are coming under strain. The safe-haven greenback is gaining ground amid concerns about global growth stemming from weakness in the US.

Moreover, American consumers are also cautious. After consumer confidence shocked with a drop to below pre-pandemic levels in August, July's Retail Sales also missed estimates with a fall of 1.1%, worse than expected.

US July Retail Sales: Poor but not yet a trend

The focus now shifts to the Federal Reserve's meeting minutes from its latest meeting. In the press conference that followed that decision, Fed Chair Jerome Powell deferred some of the questions to the broader committee, revealing a growing split between hawks and doves.

Public comments from the bank's officials and media reports also suggest that those calling for tapering the Fed's bond-buying scheme are gaining ground. Therefore, the meeting minutes could show the bank is nearing a decision about reducing its $120 billion/month printing press as early as September. That would boost the greenback.

FOMC Minutes July Preview: More new questions than answers

GBP/USD Technical Analysis

Pound/dollar has tumbled below the 200 Simple Moving Average on the four-hour chart, adding to the bearish sentiment. Momentum is also to the downside. However, bulls may find solace in the fact that the Relative Strength Index is flirting with the 30 level – the threshold for oversold conditions. That implies a recovery, yet the bounce has been a dead-cat one.

Support awaits at 1.3725, the fresh August low. The next noteworthy cushion is only at 1.3640, which capped cable when it was trading on low ground in mid-July. Further down, 1.3595 is the next level to watch.

Resistance is at 1.3785, which provided support last week. It is followed by 1.3630, where the 50 and 200 SMAs hit the price.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.