GBP/USD Forecast: Consolidating gains ahead of 1.3900

GBP/USD Current price: 1.3873

- UK monthly Gross Domestic Product posted a modest 0.1% gain in July.

- Persistent dollar weakness maintains GBP/USD afloat despite tepid UK data.

- GBP/USD holds on to gains near its weekly tops, further advances are likely.

The GBP/USD pair retains its latest gains and trades near a weekly high of 1.3884 set on Friday. The American dollar remains pressured, despite US government bond yields have recovered from Thursday’s plunge, with that on the 10-year Treasury note currently around 1.32%. The better performance of equities provides additional support to the pair.

The pound advanced despite mixed UK data. The July Total Trade Balance posted a deficit of £-3.117 billion, worse than the previous £-2.514 billion. The monthly Gross Domestic Product post a modest 0.1% advance, well below the previous 1% and the expected 0.6%. On a positive note, Industrial Production was up 3.8% YoY and 1.2% MoM, better than anticipated.

The US will publish the August Producer Price Index, foreseen at 8.2% YoY. The core annual reading is expected to have advanced from 6.2% in July to 6.6%.

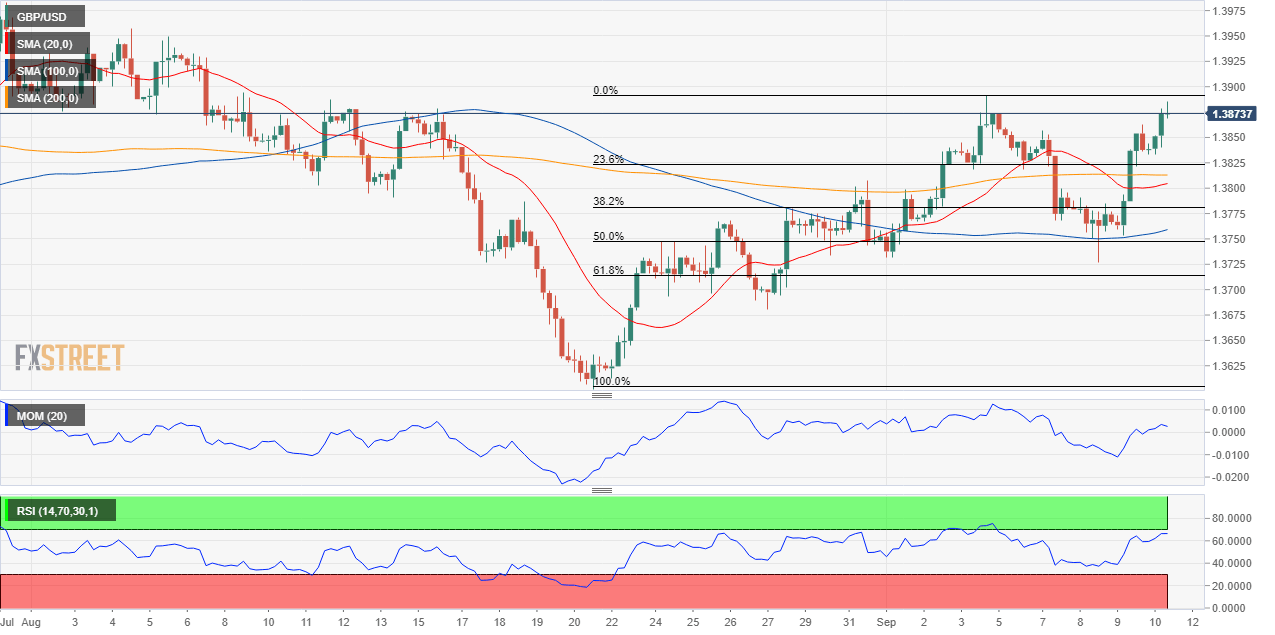

GBP/USD short-term technical outlook

The GBP/USD pair is bullish in the near term, although the positive momentum eases as the pair consolidates gains. The 4-hour chart shows that it is currently developing above all of its moving averages, although all of them lack directional strength. Technical indicators hold at daily highs near overbought levels, although losing their bullish strength. The pair needs to clear the 1.3890 resistance level to be able to extend its gains in the upcoming sessions, although selling interest beyond 1.3900 should be strong.

Support levels: 1.3820 1.3790 1.3745

Resistance levels: 1.3890 1.3930 1.3985

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.