GBP/USD Forecast: Comfortable consolidation above 1.3000 continues

GBP/USD Current price: 1.3049

- UK employment data mixed, unemployment rate steady, claimant count sharply up.

- The preliminary estimate of the UK Q2 GDP is foreseen at -20.5% from -2.2% in Q1.

- GBP/USD would gain bearish traction on a break below 1.2980.

The GBP/USD pair posted a modest intraday advance for a second consecutive day, although still trading within Friday’s range. The pair was supported by mixed UK employment data and a weakening dollar. According to the official figures, the kingdom’s ILO unemployment rate remained steady at 3.9% in the three months to June, better than the 4.2% expected. However, the Claimant Count Change for July disappointed by jumping to 94,400, far worse than the 10K projected. The pair peaked at 1.3131 right after the release, later retreating towards the current 1.3050 price zone.

This Wednesday, the UK will have quite a busy day, as it will publish several relevant reports, including the preliminary estimate of Q2 GDP, foreseen at -20.5% from -2.2% in Q1. The country will also publish June Industrial Production, foreseen at -12.8% YoY, and Manufacturing Production for the same month, anticipated at -15% from -22.8% previously.

GBP/USD short-term technical outlook

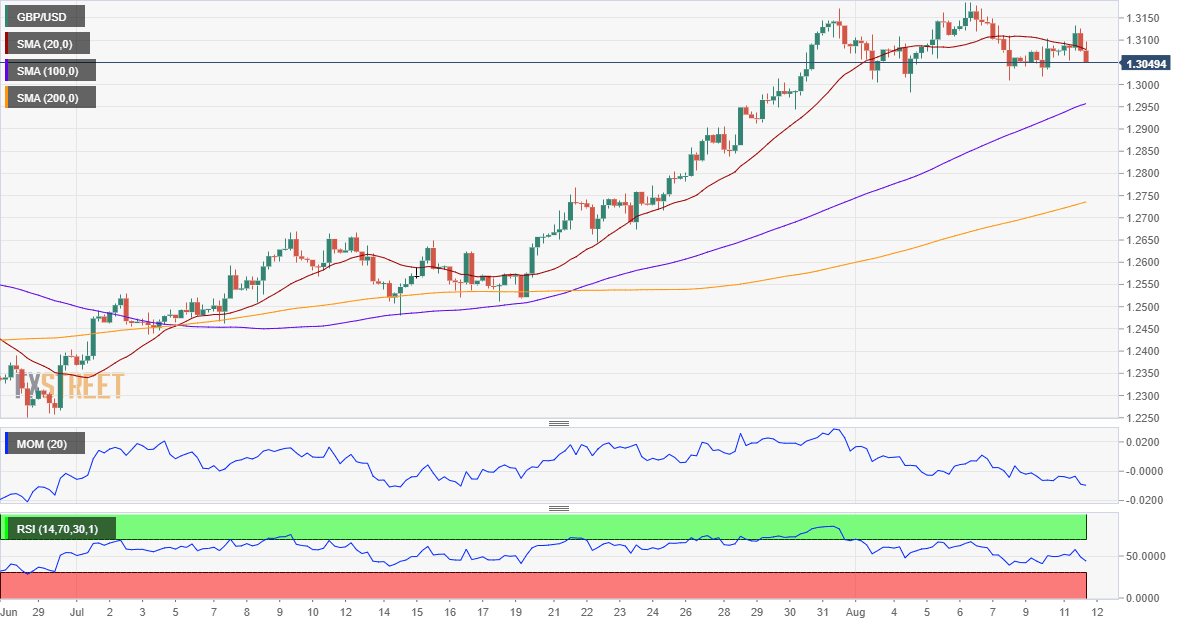

The GBP/USD pair is technically neutral according to intraday readings. The 4-hour chart shows that the pair is hovering around a mildly bearish 20 SMA, while still below the larger ones. Technical indicators, in the meantime, lack directional strength around their midlines. The upcoming direction will mostly depend on the dollar’s behaviour, with increased chances of a bearish extension on a break below 1.2980.

Support levels: 1.3030 1.2980 1.2940

Resistance levels: 1.3105 1.3150 1.3190

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.