- GBP/USD has succumbed to US dollar strength as panic gripped markets.

- Further coronavirus headlines, and policy responses, including from the Fed, are on the cards.

- Mid-March's daily chart is pointing to further, yet limited falls.

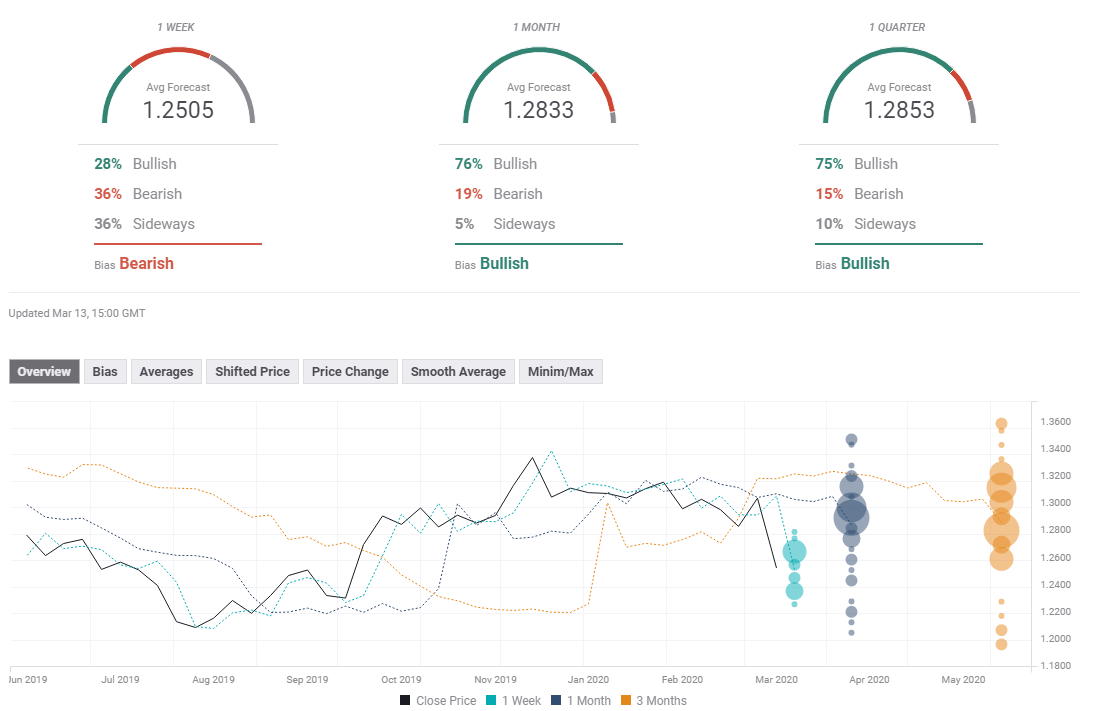

- The FX Poll is pointing to a surge in the medium and long terms.

Prime Minister Boris Johnson's coronavirus response is better than that of President Donald Trump – but that is insufficient as global investors rush to the safety of the dollar. The next moves depend on the virus news, policymakers' fiscal stimulus, and several data points.

This week in GBP/USD: Safe-haven dollar beats Boris' leadership

The UK has given an example to the world in its confrontation of coronavirus – a well-coordinated response from all involved. The Bank of England announced an unscheduled double-dose rate cut of 50 basis points – with both outgoing Governor Mark Carney and successor Andrew Bailey explaining the move.

A few hours later, Chancellor of the Exchequer Rishi Sunak presented a budget with funds towards battling the virus, relief for businesses and workers, and also a massive fiscal stimulus. The opposition Labour Party – whose policies the government partially copied – aligned behind the government.

Johnson later told the nation that many will lose loved ones, somber message preparing the public for the next steps.

On the other side of the pond, President Donald Trump failed to provide the needed measures to support the economy and to fight the disease, which he labeled a "foreign virus." While Democrats and Republicans worked on a plan, White House officials scrambled to clarify some of the details in the president's words.

Nevertheless, the massive sell-off in markets triggered a rush to the US dollar – with the greenback rising regardless of the sharp moves US yields. GBP/USD dropped with the market sell-off and extended its drop when it recovered, and returns on US debt advanced.

The Federal Reserve intervened twice in markets to provide liquidity, showing the severity of the situation. The Fed reignited Quantitative Easing by buying long-term bonds in addition to short-term ones.

Both governments refrained from imposing significant restrictions such as closing schools, unessential shops, and transport as Italy did and as other European countries are gradually following. Nevertheless, football matches are canceled in the UK, and the US NBA, MLB, and other leagues are suspended. Disney shut down its parks, and significant events are being called off. The economic damage – for two countries dependent on services sectors – is becoming severe.

The University of Michigan's preliminary Consumer Sentiment measure for March showed a drop of

UK events: Potential new UK restrictions, the jobs report

Will the UK close schools and impose other restrictions? Johnson is under pressure to jump forward, yet experts have been reluctant to recommend that. Nevertheless, the pace of events is rapid, and new instructions – that would significantly curb economic activity – may be slapped. It could have an adverse impact on the pound.

Andrew Bailey assumes office as Governor of the BOE, and he may hint at additional steps such as introducing more bond-buying – a step the bank refrained from so far – could also have an impact. If Bailey makes such an announcement without additional actions from the government, it could weigh on sterling. However, if it comes in tandem with more government spending, the pound has room to rise as more fiscal stimulus would be good news for the economy. Criticism about monetary funding would probably be reserved for another day.

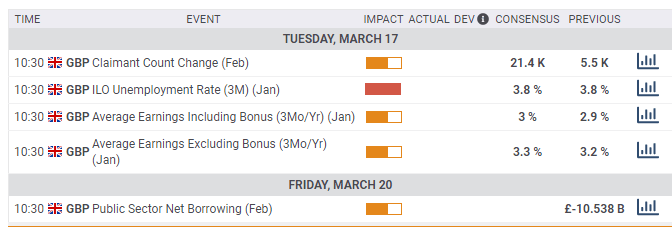

The only figure that stands out on the British economic calendar is the employment report for January. While it is stale – pre-coronavirus – the numbers provide insights for how the economy performed before the virus hit Britain's shores. The jobless rate is projected to remain at the historic low of 3.8% while wage growth is expected to edge up.

Here is the list of UK events from the FXStreet calendar:

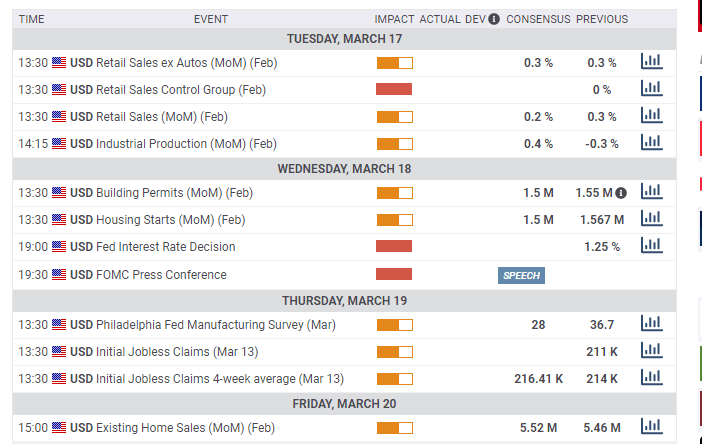

US events: The Fed's second cut and coronavirus news

The US has been lagging in testing for coronavirus, and the number of cases is set to rise. If the mood severely sours, the greenback has room to climb on safe-haven flows. If things are relatively under control, the dollar may move with yields, as it did before the most recent market crash.

Investors will follow deliberations on Capitol Hill. If lawmakers manage to muster a majority for a considerable package, stocks have room to rise while failure could push them down. Outside Washington, things are moving at a faster clip. A succession of event cancelations, restrictions on travel – and a jump in infections – could move markets more than presidential decisions.

The Federal Reserve's rate decision stands out on the economic calendar. After the fed surprised with an unscheduled reduction of borrowing costs early in March, it may now double down and slash the remaining 100 basis points and bring the rates to zero. Given the recent injections of liquidity into markets, such a move would not be surprising. The focus is on what governments would do.

Nevertheless, Fed Chair Jerome Powell may shed more light on the new bond-buying schemes and on the bank's readiness to do more. A failure to cut rates could send markets tumbling, while massive money-printing can send stocks up and the dollar down.

Retail sales figures for February will likely show a moderate increase in spending. The release – which usually grabs investors' attention – is now seen as stale given the rapid pace of coronavirus developments.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar has been on the back foot, and the Relative Strength Index on the daily chart is just above 30 – currently outside oversold conditions, but only just. Another small downside move, and it would already indicate a correction.

Support awaits at 1.2405, 1.23, and 1.22 – all dating to October 2019.

Resistance is at 1.2495, 1.2625, 1.2720, and 1.2850, all stepping stones on the way down in March.

It is essential to note that volatility has significantly increased, making some of the technical lines obsolete. Nevertheless, these extraordinary times may pass.

GBP/USD Sentiment

The dollar has been king, but if Trump finally presents action to calm markets, the pound is one of the best-positioned currencies to rise.

The FX Poll is showing that experts see a moderately bearish sentiment in the short term and a rise afterward, with a potential rise above 1.28. While the average target tumbled for the upcoming week, it remained mostly unchanged for the medium and long terms.

Related Forecasts

-

Market crash, dollar surge, are only the beginning If leaders fail to act

-

Gold Price Forecast: Coronavirus, Oil War and King Dollar

-

EUR/USD Forecast: Bears taking over, but Fed in the way

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD: Next stop emerges at 0.6580

The downward bias around AUD/USD remained unabated for yet another day, motivating spot to flirt with the area of four-week lows well south of the key 0.6700 region.

EUR/USD looks cautious near 1.0900 ahead of key data

The humble advance in EUR/USD was enough to partially leave behind two consecutive sessions of marked losses, although a convincing surpass of the 1.0900 barrier was still elusive.

Gold extends slide below $2,400

Gold stays under persistent bearish pressure after breaking below the key $2,400 level and trades at its lowest level in over a week below $2,390. In the absence of fundamental drivers, technical developments seem to be causing XAU/USD to stretch lower.

Why this week could be explosive for Ethereum

Ethereum (ETH) is down nearly 1% on Monday as exchanges have begun confirming Tuesday as the launch date for ETH ETFs. Considering the ETH ETF launch and the upcoming Bitcoin Conference, this week could prove crucial for Ethereum.

What now for the Democrats?

Like many, I applaud Biden’s decision. I would have preferred that he’d made it sooner, but there’s still plenty of time for the Democrats to run a successful campaign. In fact, I wish something on the order of a two-month campaign – as opposed to a two-year campaign – were the norm and not the exception.

-637197074045296197.png)