GBP/USD Forecast: Can a BOE rate hike save the pound?

- Investors are undecided on the Bank of England's next policy action.

- A 15 basis points rate hike might not be enough to boost the British pound.

- 1.3700 aligns as a key resistance in the short term.

Markets are split on whether the Bank of England (BOE) will hike its policy rate on Thursday and GBP/USD has been struggling to build on Wednesday's recovery.

The market consensus points to a no-change in the BOE's policy rate, which currently stands at 0.1%. The CME Group's BoEWatch Tool, however, shows that markets have priced in a 55% chance of a 15 basis points rate hike, suggesting that such an action by itself might not be enough to boost the pound.

Investors will keep an eye on the vote split as well. In case the rate hike was a close call with only five policymakers voting for it, GBP/USD's upside is likely to remain limited. On the other hand, a seven vs two, or an eight vs one, split in favour of the hike could trigger a rally in the pair.

The BOE could also opt out to make a "dovish rate hike" and reassure markets that they will wait and see how inflation reacts to the policy before they figure out what to do next.

BOE Governor Andrew Bailey's remarks on the inflation outlook will also be critical. If Bailey adopts a cautious tone and says that they might have to do more to ease price pressure in the near future, that could be seen as a GBP-positive development.

Having said all of that, a no-change in the policy rate is probably the worst-case scenario for the GBP.

In the meantime, the dollar stays firm following a modest decline in the late American session on Wednesday. The US Federal Reserve announced that it will start reducing asset purchases by $15 billion per month. FOMC Chairman Jerome Powell reiterated that a rate hike is not a given when the quantitative easing program concludes but that doesn't seem to be having a lasting effect on the dollar.

GBP/USD Technical Analysis

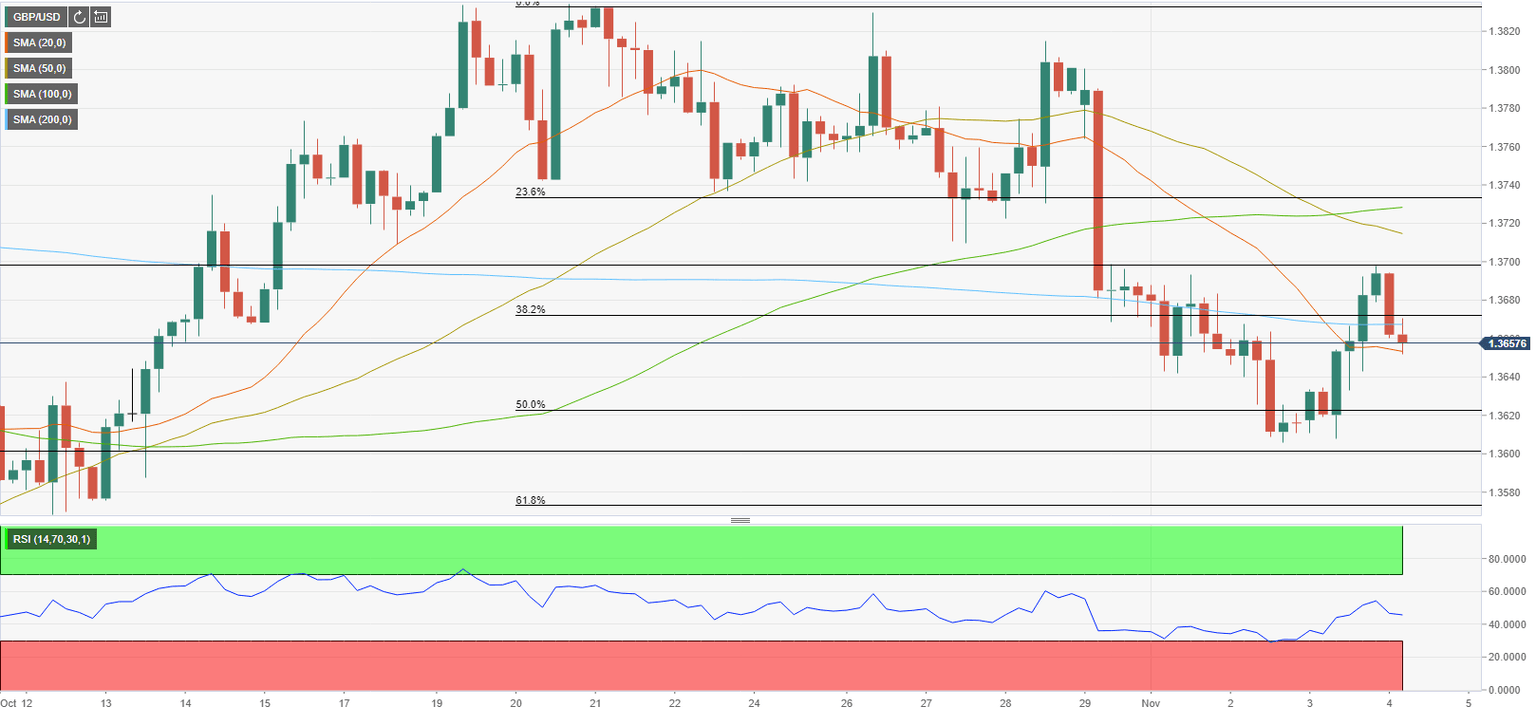

The Relative Strength Index (RSI) on the four-hour chart retreated to 50, suggesting that investors are staying on the sidelines ahead of the BOE's announcements.

Initial resistance is located in the 1.3670/80 area, where the 200-period SMA and the Fibonacci 38.2% retracement of the latest uptrend meet, ahead of 1.3700 (psychological level, static level). In case GBP/USD manages to flip that resistance into a support on the back of a hawkish BOE move, the next target on the upside is located at 1.3740 (Fibonacci 23.6% retracement).

On the other hand, a dovish move could ramp up the bearish pressure and drag GBP/USD toward 1.3630 (Fibonacci 50% retracement), 1.3570 (Fibonacci 61.8% retracement) and 1.3530 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.