GBP/USD Forecast: Can a 25 bps BOE hike lift the pound?

- GBP/USD has extended rebound toward 1.3200 early Thursday.

- Bank of England is widely expected to hike its policy rate by 25 basis points.

- A dovish hike could cause the British pound to weaken against its rivals.

GBP/USD has capitalized on the broad-based selling pressure surrounding the greenback and continued to push higher toward 1.3200 after posting gains in the previous two days. The pair faces strong resistance at 1.3200 and needs the Bank of England (BOE) to deliver a hawkish surprise to clear that hurdle.

On Wednesday, the US Federal Reserve raised its policy rate by 25 basis points (bps). The Summary of Economic Projections pointed to six more rate hikes in 2022 and helped the greenback outperform its rivals. With FOMC Chairman Jerome Powell sounding confident on their ability to tame inflation while keeping the strong growth intact, risk flows took control of markets in the late American session and caused the dollar to lose interest.

The US Dollar Index stays on the back foot early Thursday and allows GBP/USD to stay afloat in positive territory.

Later in the session, the BOE is expected to hike its policy rate to 0.75% from 0.5%. This decision by itself, however, might not be enough for pound bulls to dominate the pair's action.

After the BOE raised its policy rate by 25 bps in February, Governor Andrew Bailey argued that higher interest rates will raise unemployment and slow growth. In case the BOE's policy statement suggests that the bank will take a cautious stance with regards to rate hikes moving forward, the pound could come under renewed bearish pressure. If the BOE holds the policy rate unchanged at 0.5%, that would be a nightmare scenario for the GBP and trigger a sharp decline in GBP/USD.

On the other hand, a surprise 50 bps hike in March should open the door for a decisive rally in GBP/USD. The bank could also adopt a hawkish tone by opening the door for one more rate hike in the upcoming meeting even if it goes for a 25 bps hike this time around. The worsening inflation outlook amid the Russia-Ukraine conflict could force the BOE to consider tightening the policy at a faster pace than previously expected.

BOE Interest Rate Decision Preview: A hat-trick and a difficult balancing act.

GBP/USD Technical Analysis

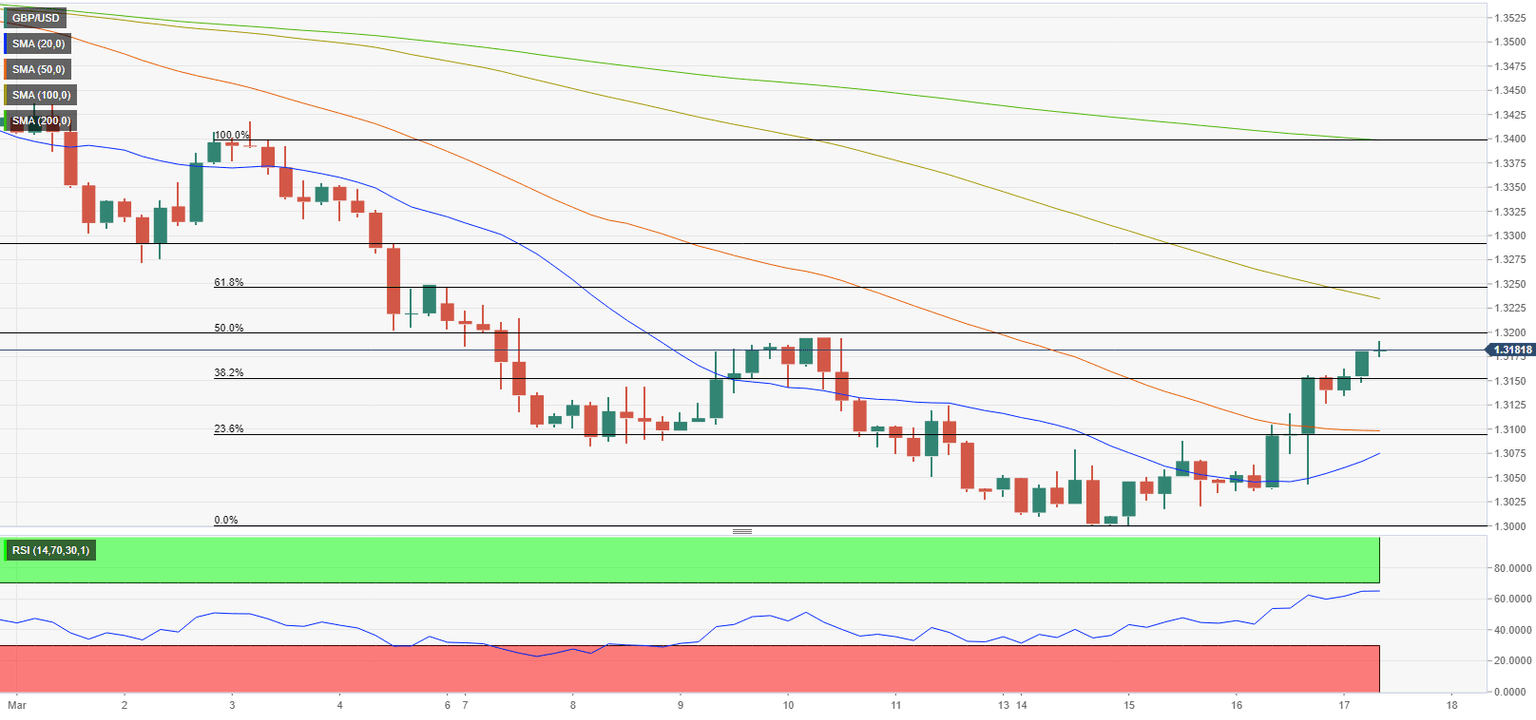

The technical picture suggests that the pair remains bullish in the near term with the Relative Strength Index (RSI) indicator on the four-hour chart staying near 60. Additionally, GBP/USD trades above the 20-period and the 50-period SMAs on the same chart.

On the upside, 1.3200 (psychological level, Fibonacci 50% retracement of the latest downtrend) aligns as the first technical resistance. In case a four-hour candle closes above that level on a hawkish BOE hike, the next bullish target is located at 1.3250 (100-period SMA, Fibonacci 61.8% retracement) before 1.3300 (former support).

Supports could be seen at 1.3150 (Fibonacci 38.2% retracement), 1.3100 (psychological level, Fibonacci 23.6% retracement, 50-period SMA) and 1.3075 (20-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.