GBP/USD Forecast: Buyers need to defend 1.2600 to remain in control

- GBP/USD has lost its bullish momentum early Friday.

- Buyers could move to the sideline if 1.2600 support fails.

- Focus shifts to PCE inflation data from the US.

GBP/USD has erased its daily gains after having advanced to a monthly high of 1.2667 earlier in the day. The pair faces key support at 1.2600 and buyers could struggle to dominate the price action in case this level turns into resistance.

The broad-based selling pressure surrounding the greenback fueled GBP/USD's upside in the second half of the week. The improving market mood made it difficult for the dollar to stay resilient against its rivals and the US Dollar Index fell to its weakest level since late April below 102.00.

In the meantime, British Finance Minister Rish Sunak announced on Thursday that they will send one-off payments of £650 to lowest-income households to help them with rising prices. In an interview with Sky News on Friday, Sunak argued that the support package would have a "minimal impact" on inflation. These comments, however, failed to help the British pound gather strength.

The US economic docket will feature the Personal Consumption Expenditures (PCE) Price Index data from the US. In case the annual Core PCE Price Index, which the Fed uses when conducting its monetary policy, comes in lower than the market expectation of 4.9%, the dollar could face renewed selling pressure. On the other hand, investors could start seeking refuge if the data suggests that inflation continued to run hot in April.

In short, the risk perception is likely to impact the dollar's valuation ahead of the weekend and drive GBP/USD's action.

GBP/USD Technical Analylsis

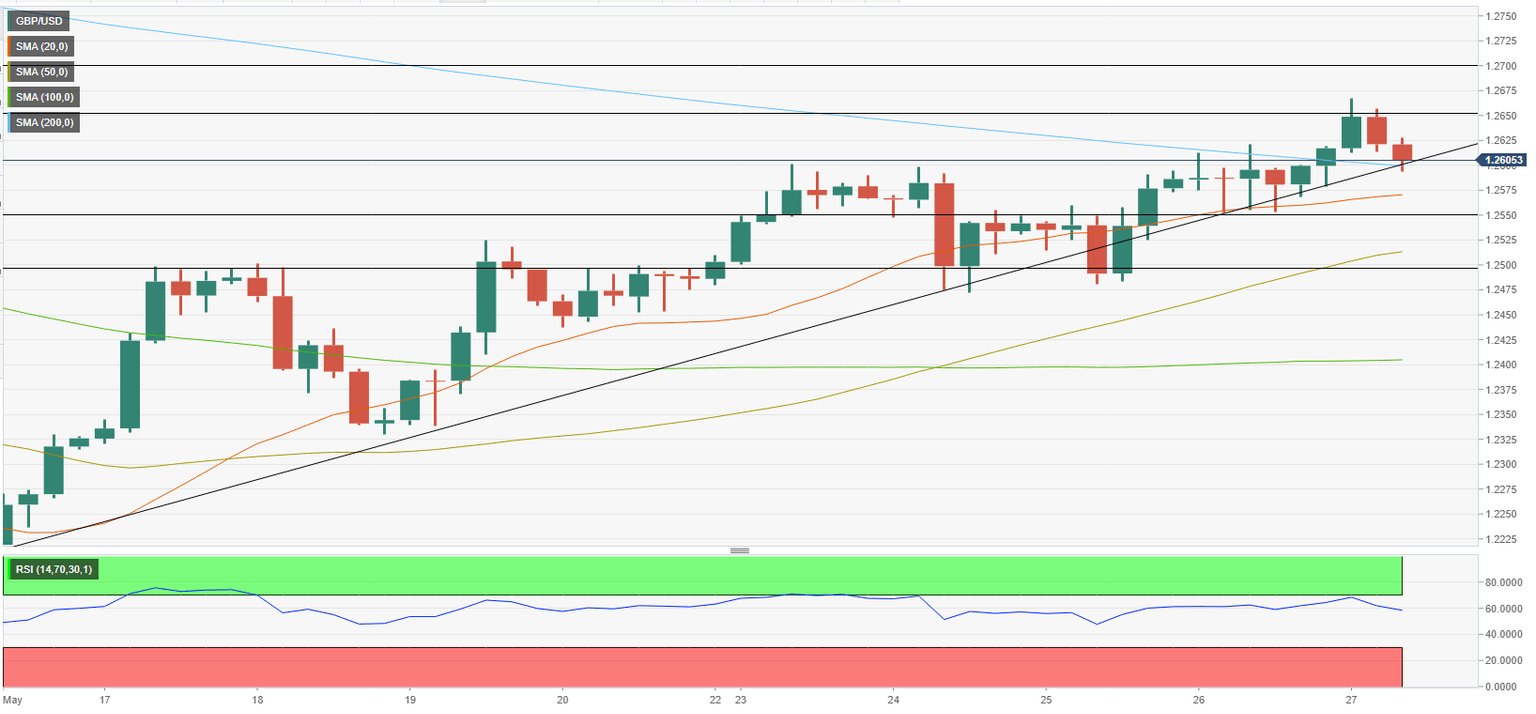

GBP/USD was last seen trading near 1.2600, where the 200-period SMA is located. If the pair falls below that level and starts using it as resistance, buyers could move to the sidelines and allow GBP/USD to go into a consolidation phase.

On the downside, next support is located at 1.2550 (static level) ahead of 1.2500 (50-period SMA, psychological level).

On the flip side, static resistance seems to have formed at 1.2650. A four-hour close above that level could open the door for additional gains toward 1.2700 (psychological level, static level). Meanwhile, the Relative Strength Index (RSI) indicator on the four-hour chart stays near 60, suggesting that sellers are yet to take control of the action.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.