GBP/USD Forecast: Buyers could retain control while Pound Sterling holds above 1.2650

- GBP/USD fluctuates in a narrow range above 1.2650 to start the week.

- Sellers could show interest in case the pair returns below 1.2650.

- The pair's action could remain subdued ahead of this week's key macroeconomic events.

GBP/USD gained traction in the American session on Friday and erased a large portion of its weekly losses. The pair clings to small daily gains above 1.2650 in the European morning on Monday.

Following a mixed opening to the day, Wall Street's main indexes gathered bullish momentum and registered strong gains on Friday. In the meantime, the benchmark 10-year US Treasury bond yield retreated to 4.2% ahead of the weekend, making it difficult for the US Dollar (USD) to stay resilient against its rivals.

Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.04% | -0.06% | 0.10% | 0.12% | 0.18% | 0.11% | -0.18% | |

| EUR | 0.03% | -0.02% | 0.13% | 0.15% | 0.21% | 0.14% | -0.14% | |

| GBP | 0.06% | 0.03% | 0.15% | 0.17% | 0.24% | 0.16% | -0.11% | |

| CAD | -0.09% | -0.11% | -0.14% | 0.05% | 0.09% | 0.03% | -0.27% | |

| AUD | -0.13% | -0.16% | -0.17% | -0.03% | 0.05% | -0.02% | -0.30% | |

| JPY | -0.16% | -0.21% | -0.26% | -0.09% | -0.06% | -0.09% | -0.35% | |

| NZD | -0.09% | -0.12% | -0.17% | 0.01% | 0.03% | 0.09% | -0.26% | |

| CHF | 0.14% | 0.11% | 0.08% | 0.24% | 0.26% | 0.32% | 0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

The Federal Reserve's Semi-annual Monetary Policy Report published on Friday didn't offer any fresh clues on the timing of the policy pivot. The publication reiterated that it would not be appropriate to start reducing interest rates until policymakers have greater confidence that inflation will move toward the 2% target in a sustainable manner.

Fed Chairman Jerome Powell will present the policy report and respond to questions in a two-day testimony before Congress on Wednesday and Thursday. On Friday, the US Bureau of Labor Statistics will publish the February jobs report.

Market participants could opt to remain on the sidelines ahead of these key risk events and not allow GBP/USD to make a decisive move in either direction.

GBP/USD Technical Analysis

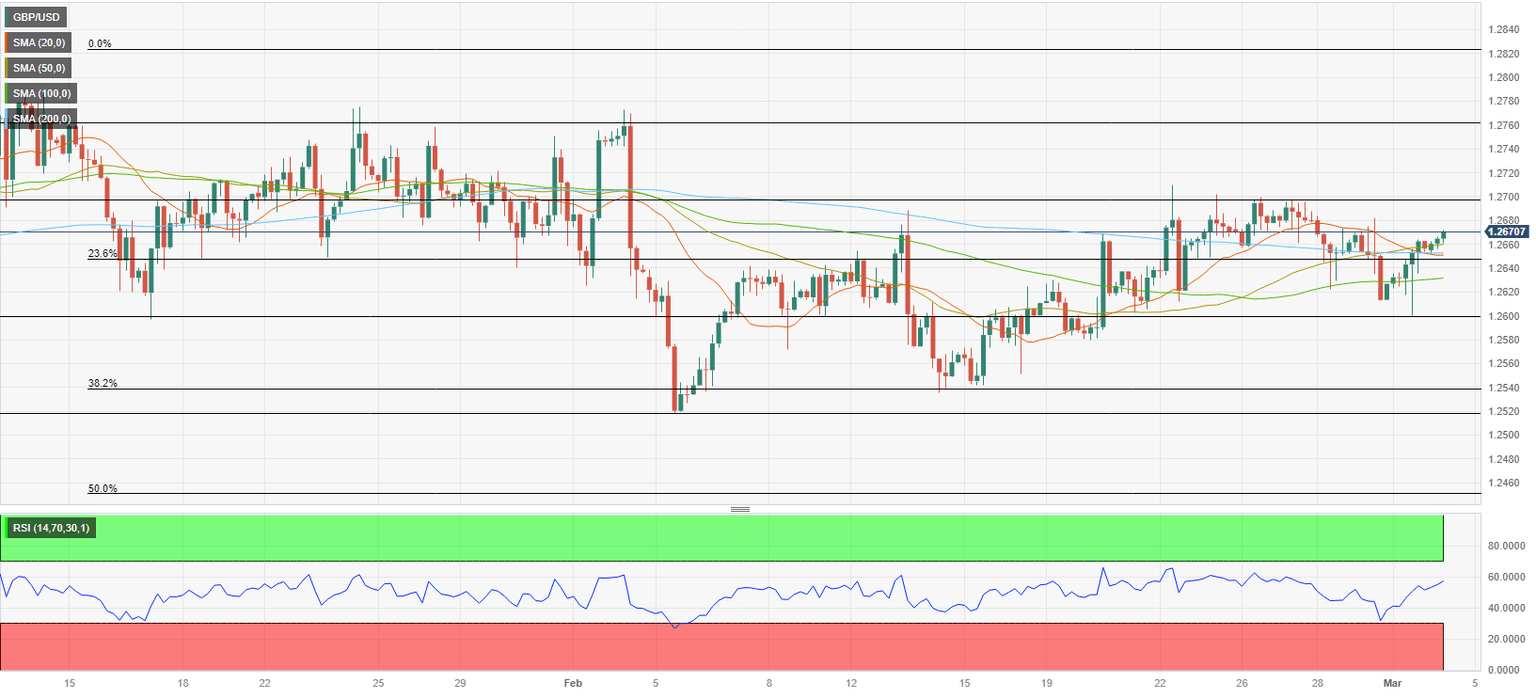

The 200-period Simple Moving Average (SMA) and the Fibonacci 23.6% retracement level of the long-term uptrend form a pivot level at 1.2650 for GBP/USD. As long as this level holds as support, technical buyers could remain interested. In this scenario, 1.2700 (psychological level, static level) could be seen as next resistance before 1.2760 (static level).

In case GBP/USD drops below 1.2650 and starts using that level as resistance, sellers could take action and open the door for a leg lower toward 1.2630 (100-period SMA) and 1.2600 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.