- Renewed Brexit uncertainties exerted some intraday pressure on Monday.

- Reports that negotiators turn optimistic helped regain traction on Tuesday.

- Investors will further take cues from Tuesday's release of UK jobs report.

The GBP/USD pair had some good two-way price moves on the first day of a new trading week and remains at the mercy of Brexit news/developments. Having faced rejection near the very important 200-day SMA, the pair witnessed some intraday selling in reaction to Irish Foreign Minister Simon Coveney's comments, saying that a deal is possible but we are still not there yet. Coveney's remarks suggested prevailing differences between the two sides on the issue related to the Northern Irish border and turned investors sceptical about the chances of reaching a deal by Thursday's EU Summit.

Brexit headlines acting as an exclusive driver

This was followed by reports, which cited senior EU officials saying that they are not optimistic about chances of the UK PM Boris Johnson getting a Brexit deal through parliament and exerted some additional downward pressure on the British Pound. Meanwhile, the latest optimism over a positive outcome from the much-hyped US-China trade negotiations turned out to be short-lived and was reinforced by a cautious mood around equity markets, which benefitted the US Dollar's perceived safe-haven status against its British counterpart and further collaborated to the pair's intraday slide.

The pair stalled its sharp intraday pullback during the early North-American session and managed to attract some decent buying interest just ahead of the key 1.2500 psychological mark. The pair finally ended the day off around 85 pips from daily lows and regained some positive traction during the Asian session on Tuesday amid reports that negotiators turned cautiously optimistic about nearing a potential solution to the Irish backstop problem. With the incoming Brexit-related headlines acting as an exclusive driver of the broader market sentiment surrounding the Sterling, traders on Tuesday will further take cues from the UK monthly jobs report in order to grab some short-term opportunities.

Short-term technical outlook

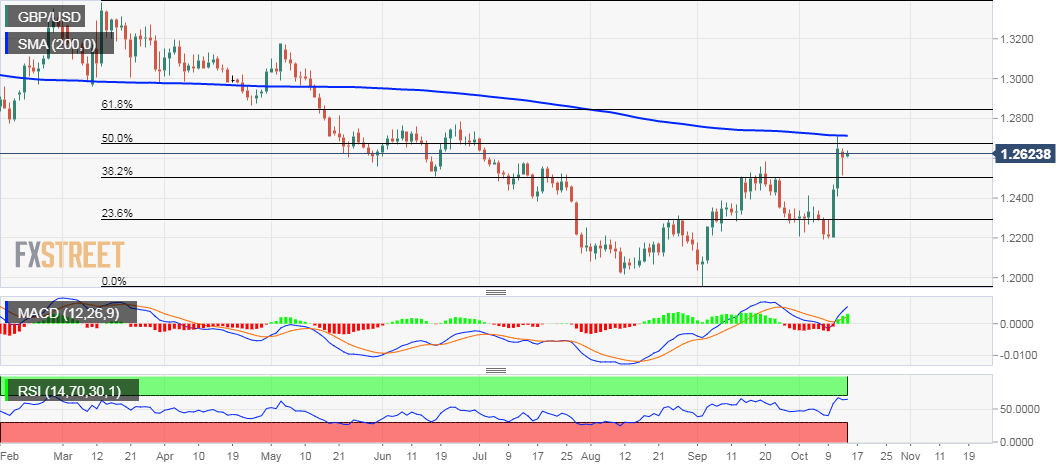

From a technical perspective, nothing seems to have changed much and the pair still needs to find acceptance above 50% Fibonacci level of the 1.3381-1.1959 downfall to support prospects for any further near-term appreciating move. The mentioned hurdle, around the 1.2675 region, is closely followed by the very important 200-day SMA near the 1.2700-1.2710 area, which should act as a key pivotal point for short-term traders.

A sustained move beyond the 200-DMA might further fuel the recent strong bullish bias and lift the pair further towards the 1.2785 intermediate resistance en-route the 1.2800 round-figure mark and 61.8% Fibo. level – around the 1.2835 region.

On the flip side, the 1.2520-15 region – nearing 38.2% Fibo. level – now seems to have emerged as immediate strong support, which if broken might be seen as a key trigger for bearish traders and set the stage for a further near-term downfall back towards the 1.2400 round-figure mark.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD struggles below 1.0500, awaits key US data

EUR/USD keeps its range trade intact below 1.0500 in the European morning on Wednesday. Traders prefer to stay on the sidelines, awaiting a series of US economic data, including the high-impact PCE inflation data for placing fresh directional bets on the pair.

GBP/USD holds higher ground above 1.2550 ahead of US PCE inflation data

GBP/USD trades on a stronger note above 1.2500 in Wednesday's early European session. The pair remains underpinned by a sustained US Dollar weakness and a negative shift in risk sentiment as traders turn cautious ahead of top-tier US data releases.

Gold price sticks to modest intraday gains, bulls seem cautious ahead of US PCE data

Gold price builds on the overnight bonce from the $2,600 neighborhood, or a one-week low and gains some follow-through positive traction for the second straight day on Wednesday.

Ripple's XRP sees decline as realized profits reach record levels

Ripple's XRP is down 6% on Tuesday following record profit-taking among investors as its percentage of total supply in profit reached very high levels in the past week.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.