GBP/USD Forecast: Bulls pause ahead of first-tier data, central banks’ speakers

GBP/USD Current price: 1.2684

- BoE Governor Andrew Bailey and several Federal Reserve officials will be on the wires.

- US Treasury yields retreat to multi-week lows, limiting US Dollar's upward potential.

- GBP/USD eases from a fresh multi-month high, but chances of a steeper decline are limited.

Following Tuesday's sharp US Dollar decline, the GBP/USD pair traded as high as 1.2732, its highest since late August. The Greenback collapsed following surprising dovish comments from Federal Reserve (Fed) officials, reinforcing the market's belief that the central bank is done with rate hikes.

The US Dollar found some favor early on Wednesday as investors took some profit away from the table ahead of first-tier data releases. GBP/USD trades around 1.2680 mid-European session, with United Kingdom (UK) minor figures posted earlier in the day resulting encouraging. On the one hand, October Consumer Credit unexpectedly rose by £1.289 billion, missing expectations and less than in September. On the other hand, M4 Money Supply rose 0.3% MoM in October, while Mortgage Approvals in the same month jumped to 47.38K.

Meanwhile, a continued decline in US government bond yields limits USD gains. The 10-year Treasury note currently offers 4.29%, its lowest in two months, while the 2-year note pays 4.70%, the lowest since mid-July.

The United States (US) will release the second estimate of the Q3 Gross Domestic Product (GDP), which is expected to confirm the annual pace of growth at 5%, slightly better than the previous 4.9%. Additionally, multiple Federal Reserve speakers will be on the wire, while Bank of England (BoE) Governor Andrew Bailey will deliver brief remarks at an event celebrating the 50th anniversary of the London Foreign Exchange Joint Standing Committee.

GBP/USD short-term technical outlook

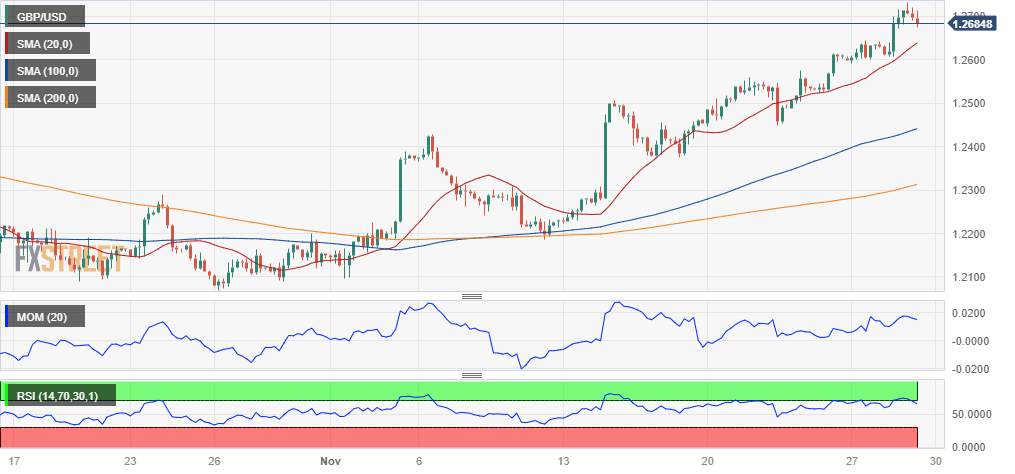

The daily chart for the GBP/USD pair shows it trades around its opening level but also that it posted a higher high and a higher low, maintaining the risk skewed to the upside. At the same time, the Momentum indicator heads firmly north, well above its 100 level, while the Relative Strength Index (RSI) indicator is losing its strength at around 70. Finally, the pair develops above all its moving averages, with the 20 Simple Moving Average (SMA) maintaining its solid upward slope just below directionless 100 and 200 SMAs.

GBP/USD is overbought in the near term, but a steeper decline remains out of the picture. Technical indicators are in retreat mode after reaching extreme levels, but their downward strength is limited. At the same time, the pair develops far above a bullish 20 SMA, which keeps advancing above also bullish 100 and 200 SMAs.

Support levels: 1.2650 1.2605 1.2570

Resistance levels: 1.2690 1.2730 1.2780

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.