GBP/USD Forecast: Bulls need to defend 1.2520 to retain control

- GBP/USD corrected lower after advancing to a fresh monthly high above 1.2560.

- The pair faces key technical support at 1.2520.

- Profit-taking ahead of the weekend could limit Pound Sterling's gains.

GBP/USD gathered bullish momentum and climbed to its highest level since May 10 near 1.2570 early Friday. The pair stays in a consolidation phase during the European trading hours and edges lower. In the absence of fundamental drivers, market mood and week-end flows could drive the pair's action.

The US Dollar (USD) came under heavy selling pressure on Thursday after the US Department of Labor's weekly report revealed that Initial Jobless Claims rose to 261,000 in the week ending June 2 from 233,000 a week earlier, highlighting looser jobs market conditions.

As a result, the 10-year US Treasury bond yield retraced a large portion of the gains it recorded mid-week following the Bank of Canada's unexpected decision to raise its policy rate by 25 basis points. The US Dollar Index turned south and lost more than 0.7%, reflecting the negative impact of this data on the USD's performance, while Wall Street's main indexes closed decisively higher.

In the European session, US stock index futures trade mixed and the UK's FTSE posts small gains. Unless risk flows continue to dominate market action in the second half of the day, investors could refrain from betting on a persistent USD weakness ahead of next week's key inflation data and FOMC policy meeting, preventing GBP/USD to stretch higher.

Following Thursday's impressive upsurge, market participants could also look to book their profits, causing GBP/USD to extend its downward correction.

GBP/USD Technical Analysis

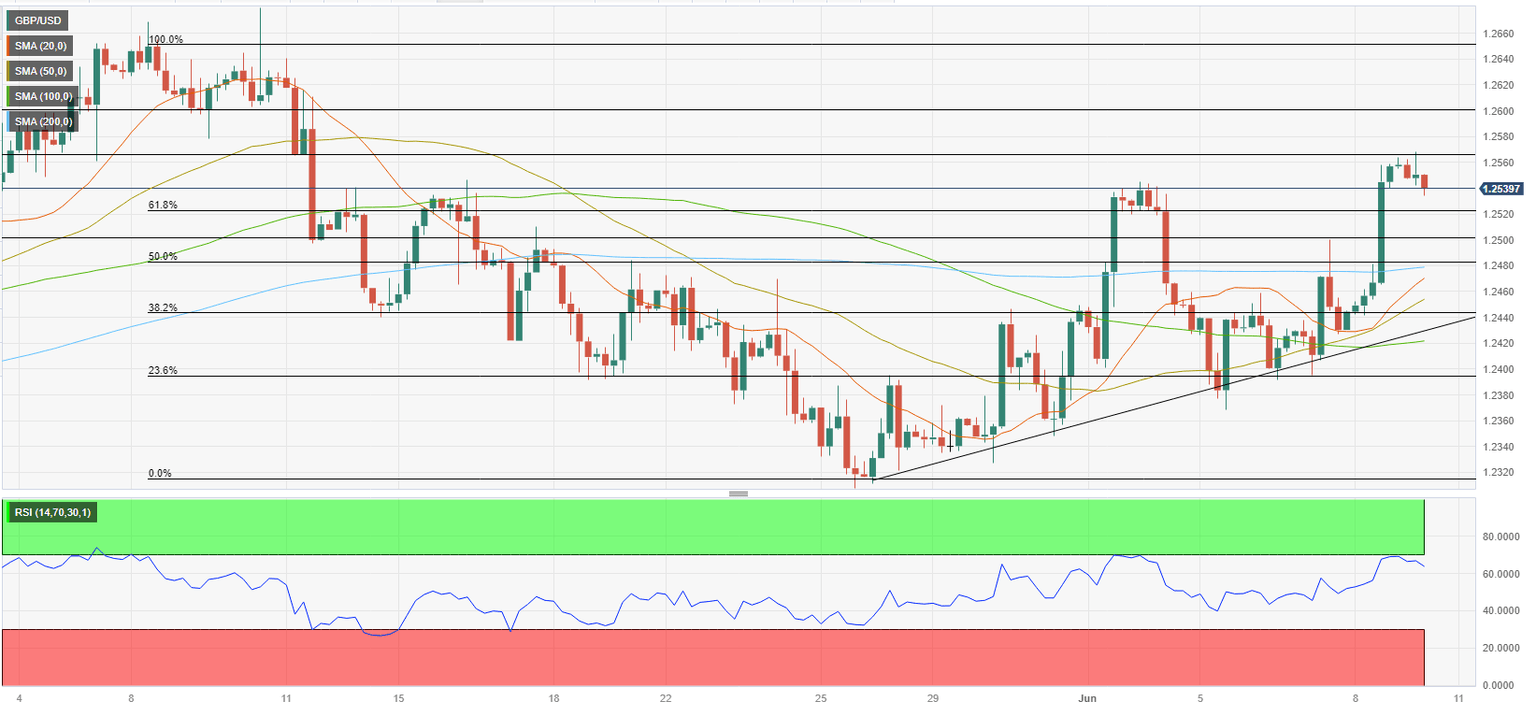

On Thursday, GBP/USD surged above the 200-period Simple Moving Average (SMA) on the four-hour chart, located at 1.2480. During that action, the Relative Strength Index (RSI) indicator climbed to 70. Since the RSI holds comfortably above 60, the latest pullback suggests that the pair is making a technical correction, while remaining bullish.

On the upside, static resistance seems to have formed at 1.2560. Once that level turns into support, GBP/USD could target 1.2600 (psychological level, static level) and 1.2650 (beginning-point of the latest downtrend).

The 1.2520 threshold (static level, former resistance) aligns as first support. If that level fails, GBP/USD could stretch lower toward 1.2500 (psychological level) and 1.2480 (200-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.