GBP/USD Forecast: Bulls eye 1.3570 as the next target

- GBP/USD has extended its rebound after UK inflation data.

- The technical outlook suggests there is more room on the upside before GBP/USD turns overbought.

- The next bullish target is located at 1.3570.

GBP/USD has preserved its bullish momentum following Wednesday's advance and trades at fresh eight-day highs above 1.3500 early Thursday.

The stronger-than-expected Consumer Price Index (CPI) data from the UK reminded investors of the strong probability of the Bank of England (BoE) hiking the policy rate by 20 basis points in December and provided a boost to the British pound. Additionally, the modest selling pressure surrounding the greenback on falling US Treasury bond yields helped bulls to continue to dominate GBP/USD's action.

In the meantime, things remain relatively quiet on the Brexit front, allowing GBP/USD to continue to retrace the BoE-inspired drop.

The US Department of Labor's weekly Initial Jobless Claims will be the only data featured in the US economic docket. Furthermore, market participants will keep a close eye on US Treasury bond yields following Wednesday's sharp decline. Unless the benchmark 10-year US T-bond yield reclaims 1.6%, the greenback could find it difficult to outperform its rivals. Additionally, S&P Futures are up 0.2% in the early European session and the dollar could face additional selling pressure in case risk flows start to dominate the markets in the second half of the day.

GBP/USD Technical Analysis

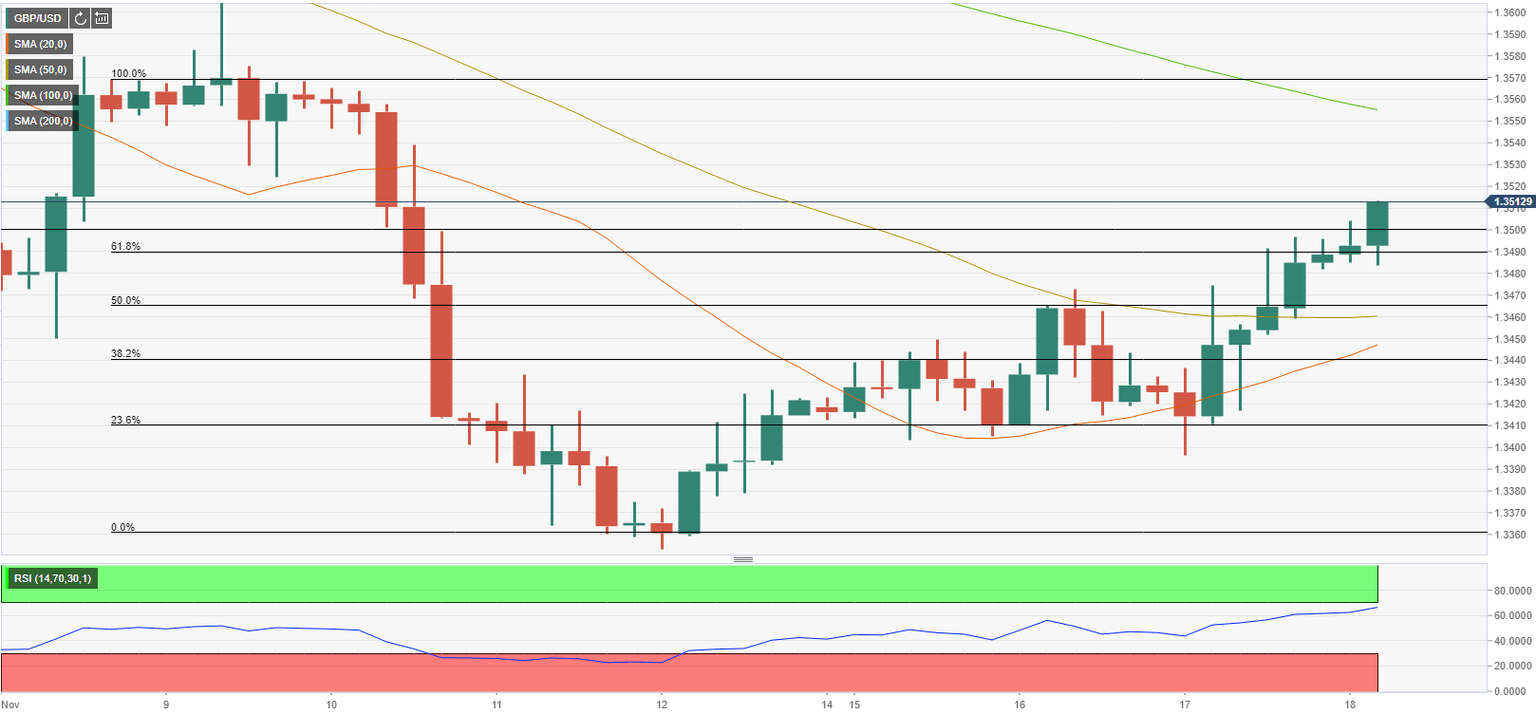

Although the last six candles on the four-hour chart closed in positive territory, the Relative Strength Index (RSI) indicator stays below 70, suggesting that there is more room on the upside before GBP/USD becomes technically overbought.

As of writing, the pair is trading above 1.3500 - the Fibonacci 61.8% retracement of the downtrend witnessed following the BoE's decision to leave its policy rate unchanged earlier in the month. In case buyers manage to continue to defend this level, GBP/USD could continue to push higher toward 1.3550 (100-period SMA) and 1.3570 (static level).

On the downside, 1.3470 (Fibonacci 50% retracement, 50-period SMA) aligns as the first support before 1.3440 (Fibonacci 38.2% retracement) if 1.3500 fails.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.