GBP/USD Forecast: Brexit-related litters undermine demand for the pound

GBP/USD Current price: 1.3886

- The French government rejected Britain’s latest regulation for fishing in its waters.

- The UK Markit Manufacturing PMI expanded at a faster-than-anticipated pace in April.

- GBP/USD is trading around the 1.3900 level with a near-term neutral stance.

The GBP/USD pair fell to 1.3838 within London trading hours amid persistent tensions between the UK and France over fisheries rights. The French government rejected Britain’s latest regulation for fishing in its waters near the Channel Islands. French fishermen have complained that they are being prevented from operating in British waters because of difficulties in obtaining licenses, a Brexit-related issue that has escalated in the last few weeks.

UK data was mixed, as the April Markit Manufacturing PMI printed at 60.9, better than the 60.7 previously estimated. March Mortgage Approvals decreased to 82.7K while Consumer Credit printed at £-0.5 billion. The UK won’t publish relevant macroeconomic data on Wednesday, with speculative interest focused on the BOE Monetary Policy’s announcement next Thursday.

GBP/USD short-term technical outlook

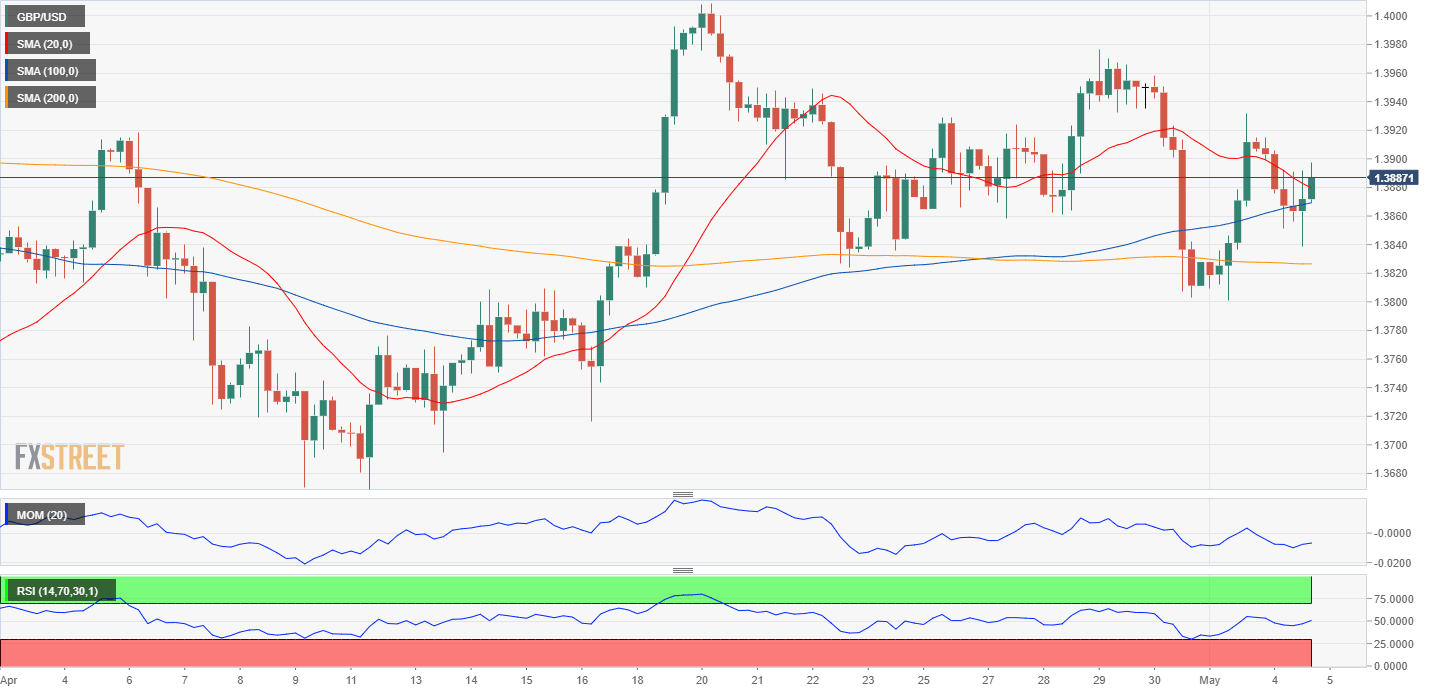

The GBP/USD pair is trading a few pips below the 1.3900 level, with a neutral-to-bullish technical stance. The 4-hour chart shows that it is above its moving averages, although just a few pips above a bearish 20 SMA. The Momentum indicator advances around its 100 level while the RSI is stable at 51. The pair bottomed at around the 50% retracement of its April advance but ends the day above the 38.2% retracement of the same rally at 1.3880.

Support levels: 1.3880 1.3840 1.3800

Resistance levels: 1.3930 1.3975 1.4010

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.