GBP/USD Forecast: Boris's Brexit and lockdown decisions stand out after the vaccine-driven rally

- GBP/USD has bounced from the lows amid vaccine hopes but dropped amid a souring mood, negative rate talks.

- Coronavirus figures, reopening calculations, and several numbers are eyed.

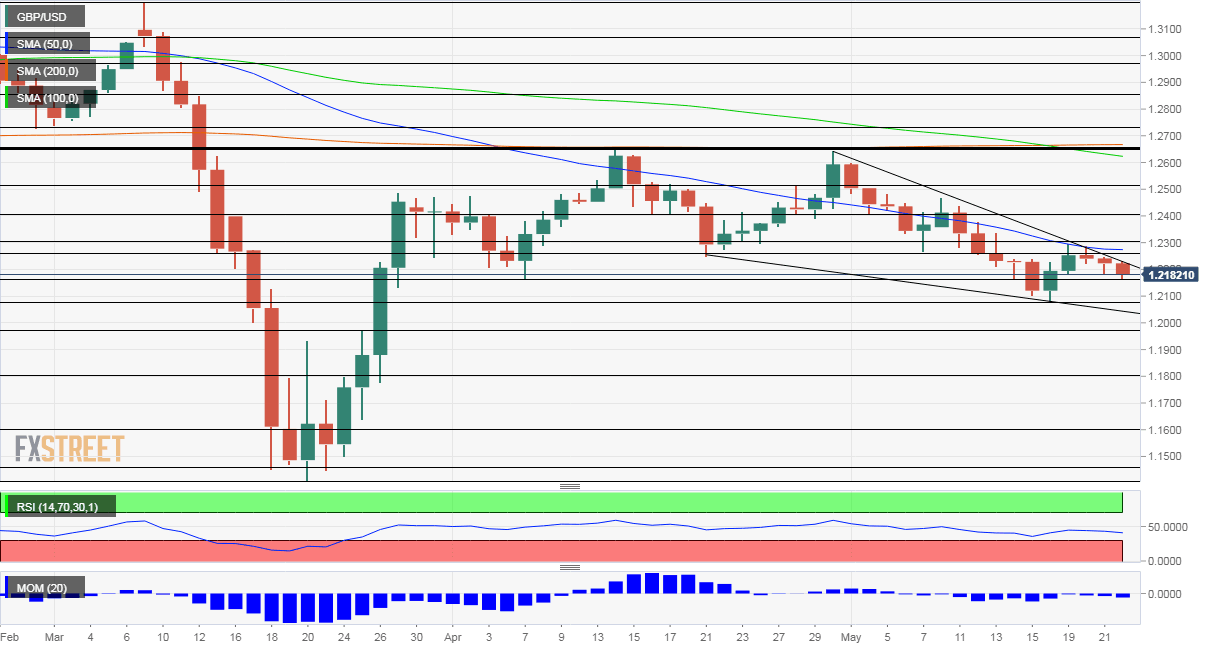

- Late May's daily chart is showing bears are in control.

- The FX Poll is pointing to short-term falls and then a significant recovery.

Hope has trumped reality– even President Donald Trump's criticism of China and a slew of concerns in the UK. Promising results were enough to keep the pound positive on the week, but only just. Will this continue? With economic indicators taking a pause, the importance of COVID-19 statistics and reopening questions will likely increase.

This week in GBP/USD: Vaccine and Fed hopes outweigh geopolitics

Coronavirus vaccine? Perhaps the most significant upside driver for stocks – and downside driver for the safe-haven dollar – came from Moderna. The Massachusets-based pharma firm announced the eight subjects in its trial developed antibodies to COVID-19. Scientists raised doubts amid missing details, yet markets remained mostly hopeful.

Jerome Powell, Chairman of the Federal Reserve, was on the airwaves throughout the week. While he warned of a long recovery, he reiterated the bank's commitment to do whatever is necessary – albeit refraining from negative interest rates. Powell's 60 Minutes interview initially weighed on markets, but his testimony on Capitol Hill was more upbeat.

The world's most powerful central banker also tried to nudge elected officials to do more. House Democrats passed a $3 trillion stimulus bill that Republicans called "dead on arrival." While the ruling party seems reluctant to increase expenditure – preferring a rapid opening of the economy – investors see additional assistance from Washington.

President Trump and his team stirred up tensions with China – which also responded with intense rhetoric. The world's largest economies are tussling about the handling of coronavirus, Huawei, America's new "super-duper" missiles – in Trump's words – and more.

While Washington sees Beijing's compliance with the trade deal as satisfactory, the White House is working to re-shore American manufacturing. Investors eventually took note, especially as Trump also pointed fingers at his counterpart Xi Jinping, saying, "it all comes from the top." Markets finally came to grips with rising tensions as China moved to tighten its grip on Hong Kong.

In the UK, top-tier economic figures missed expectations – but only temporarily slowed GBP/USD. The UK's Claimant Count Change leaped by 856,500 in April and inflation slipped to 0.8% yearly. Both missed expectations.

While Markit´s Purchasing Managers´Indexes beat expectations, they remained well below 50 – indicating deep contraction. Retail sales plunged by 18.1% in April, worse than expected.

Tensions around Brexit intensified with David Frost, Britain's chief negotiator, stating that the EU is offering the UK a "low-quality deal." Michel Barnier, his counterpart in Brussels, lashed back by saying that London only wants the benefits of membership without the obligations. Contrary to the previous week's adverse impact, the pound resisted. A no-trade-deal Brexit is becoming more priced in.

Negative rates? Silvana Ternyero, an external member of the Bank of England's Monetary Policy Committee, warmed up to setting sub-zero borrowing costs. She joined Andy Haldane, the bank's Chief Economist, who also held an open the door to that idea.

Andrew Bailey, the BOE Governor, said that negative rates are "under active review," and that seemed to have a more adverse effect on the pound. The government raised debt at marginally negative rates. Late in the week, he was joined by David Ramsden, another BOE member. The wind is clearly blowing in that direction.

Overall, a week that kicked off on a positive note ended a slide.

UK events: Next steps in the lockdown

When Prime Minister Boris Johnson loosened some of the restrictions in early May, he talked about taking further steps in June and July. As May draws to an end, the government may release more information about its new measures.

Decisions depend on coronavirus statistics – which have been trending down – yet at a stubbornly slow rate. Therefore, the daily updates may have a growing impact on the pound. Significant easing of the shuttering has room to boost sterling and baby steps to keep it under pressure.

Speculation about negative rates is also likely to remain rife, yet Brexit may overtake it. The clock is ticking down to June 2, the deadline until which the EU and the UK can agree to prolong the transition period from its current expiry at year-end – or conclude a deal.

This pressure may push both sides to compromise and strike an accord – something that looks unlikely for now. If Britain insists on refusing to lengthen the implementation phase, it will revert to World Trade Organization terms in 2021, an unfavorable prospect for investors. Another option is a classic "kick the can down the road" – allowing more time for talks without a prolongation and without an angry walkout.

The economic calendar is light, with the only noteworthy publication being consumer confidence, which is set to further dive within negative territory, showing pessimism.

Here is the list of UK events from the FXStreet calendar:

US events: Relations with China, GDP update, and more

The US and China had begun decoupling well before the coronavirus crisis. The impact on the global economy depends on the pace and the severity of this long process. Any acceleration in re-shoring US manufacturing and ongoing heightened rhetoric between the world's largest economies may weigh on sentiment and boost the safe-haven dollar.

COVID-19 cases have been gradually declining in America, as all 50 states have taken steps to return to normal. Both trends are positive for markets and adverse to the greenback. The mood may change if infections and deaths begin rising and if some authorities reimpose restrictions. The warmer weather gives hope that the positive trends continue.

The US economic calendar is packed with events. Several housing figures are set to show substantial drops in April, in line with previous falls in the sector. The Conference Board's Consumer Confidence gauge for May is set to recover, following the lead of the parallel figure from the University of Michigan.

An update on Gross Domestic Product for the first quarter stands out on Thursday. Economists expect the annualized plunge of 4.8% to be confirmed, owing mostly to a sharp decline in consumption.

Durable Goods Orders for April provide a look into investment in the second quarter, with aircraft sales skewing the headline statistics. Weekly jobless claims will likely remain in the millions for another week, and continuing claims for the week ending on May 15 are of higher importance – that is when the Non-Farm Payrolls surveys are held.

Friday is the last trading day of May, and it could see end-of-month adjustments that may cause choppy trading. The Fed's preferred gauge of inflation, Core Personal Consumption Expenditure (Core PCE) will likely dive, perhaps below 1%. Personal spending and the final Consumer Sentiment Index from the University of Michigan are also eyed.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar is setting lower lows and lower highs – a bearish trend. It has also failed to break above the 50-day Simple Moving Average. While downside momentum is minor, the currency pair trades below the 100 and 200-day SMAs.

All in all, bears are in control.

Initial support awaits at 1.2165, which cushioned the currency pair twice in recent months. The May low of 1.2085 is the next level to watch. Further down, 1.1980 was a temporary peak on the way up. It is followed by 1.18.

Resistance is at 1.2250, a former double-bottom, followed by 1.23, a round number that was a high point in mid-May.,Further above, 1.2385, provided some support in late April, and it is followed by 1.2520, a swing high from around the same time.

GBP/USD Sentiment

Without a considerable improvement in COVID-19 cases, the UK lockdown may last for longer. Alongside worsening Sino-American relations and potential flare-ups in the US, there is a higher chance for a decline that a rise.

The FXStreet Forecast Poll is showing that experts are, on average, bearish in the short term but see gains in the medium and long terms. Targets are little-changed in the past week.

Related Reads

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.