- GBP/USD has been experiencing the calm before the storm ahead of the BOE.

- Additional QE from the central bank, Brexit, and US coronavirus are on the agenda.

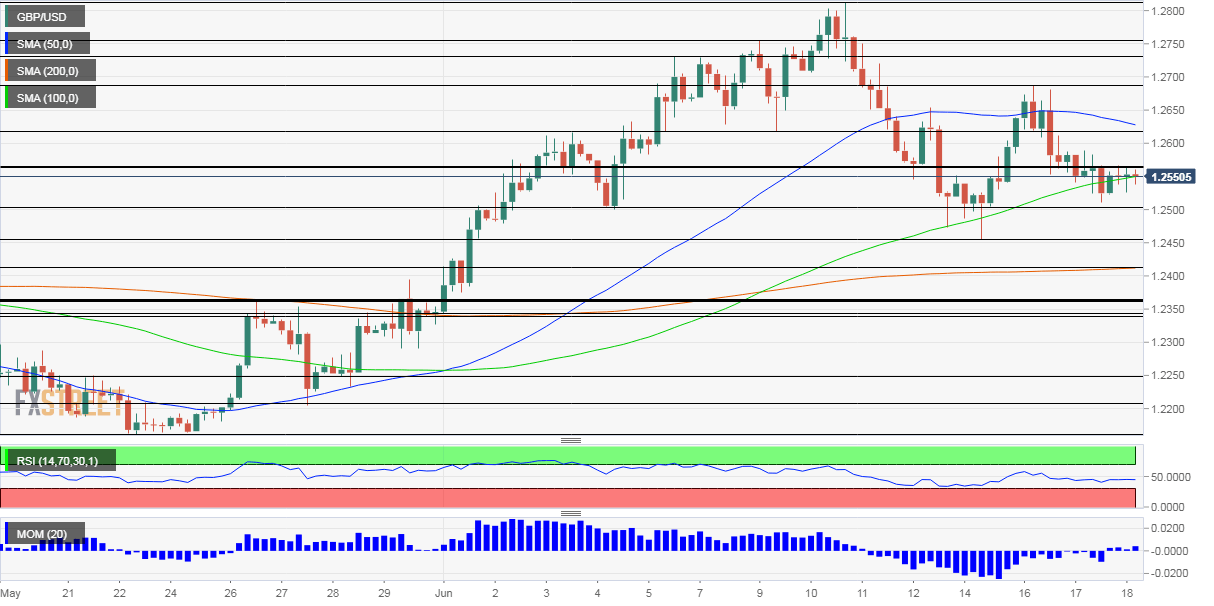

- Thursday's four-hour chart is showing an advantage for the bulls.

Another bailout from Andrew Bailey? The Governor of the Bank of England holds the keys to the next moves in sterling – limited ranges are set to make way for high volatility. To what direction?

The BOE is set to expand its bond-buying scheme by around £100 billion or as much as £150 billion according to some estimates. Pound-printing used to mean devaluing the currency in the pre-pandemic era – but that is no longer the case.

Bailey's previous expansion of the program to its current £645 billion enabled the government to support workers and provide another stimulus in times of trouble and thus supporting the economy. In Thursday's decision, a higher sum would send sterling higher while a sub £100 billion would weigh on the pound.

The meeting minutes may also reveal how the bank sees the economy as it emerges from lockdown and more importantly for the market reaction, the bank's opinion on negative interest rates. Bailey said that sub-zero borrowing costs are "under active consideration" but later hinted such a move is not imminent.

The BOE is likely to leave rates unchanged at 0.10%, but laying the ground for going further down would hurt sterling. That may come via a vote of one or more of the Monetary Policy Committee's members in such a direction. The probability is low but the impact could be significant.

See Bank of England Preview: Bailey may boost pound by going big on bond-buying, beware negative rates

Beyond the BOE

Sterling has been struggling with Brexit uncertainty, and recent developments have been somewhat worrying. While European Commission President Ursula von der Leyen may be ready to offer concessions on fisheries, Germany has reportedly lowered expectations for any progress during the summer.

French President Emmanuel Macron will visit Prime Minister Boris Johnson in London – a rare face-to-face encounter in coronavirus times. The two leaders are always friendly to each other but significant differences remain, with France often seen as the tougher player.

The UK is preparing a "shock and awe" campaign to prepare for Brexit, a headline that has raised eyebrows. It also triggered concerns for a no-trade-deal outcome to the current transition period which expires at year-end.

The US dollar has somewhat advanced amid rising coronavirus hospitalizations and cases in several US southern states such as Texas and Florida. The outbreak in Beijing – which resulted in substantial limits to transport – also worries investors.

President Donald Trump has responded angrily to revelations by former National Security Adviser John Bolton in his upcoming book. Bolton says that Trump sought the help of his Chinese counterpart Xi Jinping in his reelection campaign. The US elections are held only in November but are gaining more traction with Trump's rival Joe Biden benefiting from a growing lead in the polls.

Jerome Powell, Chairman of the Federal Reserve, called on Congress to do more at a critical juncture for the recovery, evidenced in robust retail sales. Weekly unemployment claims are eyed on Thursday.

See Jobless Claims Preview: Better is still a long way to go

Overall, the focus is on the BOE, but pound/dollar traders have many topics to ponder on.

GBP/USD Technical Analysis

Momentum on the four-hour chart has turned positive and the currency pair has recaptured the 100 Simple Moving Average, another positive development. On the other hand, it remains capped by the 50 SMA.

Some resistance awaits at 1.2565, the daily high, followed by 1.2615, a swing low from early June. It is followed by 1.2680, the weekly high, and then by 1.2730.

Support awaits at 1.25, a psychologically significant level, followed by 1.2450, the weekly low, and then by 1.2410, where the 200 SMA hits the price.

More Why EUR/USD may rally, where to find the key to gold move, lots more – Interview with Richard Perry

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD accelerates its rebound to the 1.0930 region, focus remains on US election

Further selling pressure continues to hurt the US Dollar and lends extra support to EUR/USD, motivating it to flirt with the area of four-week peaks past 1.0930, as the US election remains under way.

GBP/USD approaches 1.3050 on weaker Dollar, US election

Further optimism around the British pound and the broad risk complex lends extra legs to GBP/USD and sends it to new multi-day highs near the 1.3050 zone as investors continue to closely follow the developments around the US election.

Gold extends consolidative phase as US election result looms

Gold attracts dip-buyers after touching a one-week low on Tuesday but remains below $2,750. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.3% as markets eye US election exit polls, limiting XAU/USD's upside.

Crypto markets brace for volatility in tight race between Trump and Harris

The US presidential election is one of the most significant events in the world. Due to the influence of the country’s political decisions, policies, and economic approaches, it can significantly impact crypto and global markets.

US election day – A traders’ guide

Election day volatility: Brace for potential wild market swings. Election days bring opportunities, but also risks. Unclear results can increase volatility further.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.