- GBP/USD been under pressure amid global fears yet received help from the BOE.

- Lockdown easing details, UK GDP and US retail sales stand out in the upcoming week.

- Mid-May's daily chart is painting a mixed picture.

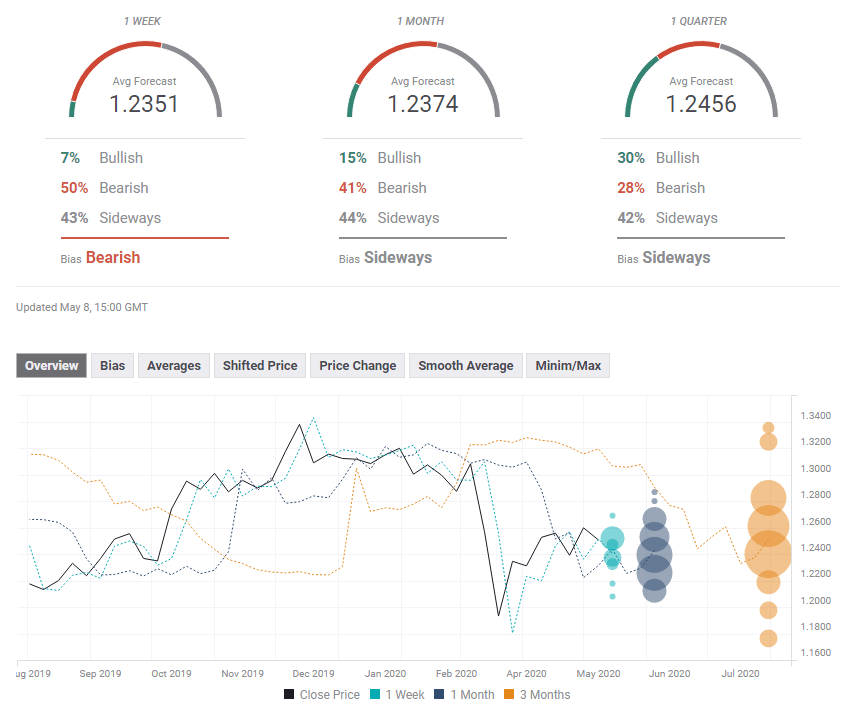

- The FX Poll is showing an upgrade from the past week, but a wide diversity of targets.

The Bank of England has prevented further losses in an otherwise downbeat week. The safe-haven dollar has been gaining ground amid catastrophic US figures and rising Sino-American tensions. The fate of the lockdown and several critical data points will determine the next moves.

This week in GBP/USD: Bailey has his say

The Bank of England may act soon to stimulate the economy, funding the government, and boosting the economy. Two out of nine members were ready to expand the Quantitative Easing program from its current £645 billion already now, yet Governor Andrew Bailey and most other members wanted to wait longer.

Nevertheless, the BOE is determined to act aggressively and vowed to do whatever is needed. It published an "illustrative scenario" in which output plunges by 14% in 2020, providing a basis for further action. Bailey stressed that the next decision in June depends on the shuttering of the economy.

Several details of a plan to lift the UK lockdown came out of Westminister, but publishing a clear schedule was pushed back by Prime Minister Boris Johnson. Businesses are urging him to return to normal and improving COVID-19 statistics is also pointing to that direction.

On the other hand, his own brush with the disease and Brits' concerns about a second wave have caused doubts. At the time of writing, British political analysts were leaning toward projecting only minor loosening.

The number of coronavirus deaths continued dropping beyond the "weekend effect" yet total UK mortalities surpassed Italy and now top the list in Europe.

Terrible US data: The US labor market is reeling with a loss of 20.5 million jobs in April. The Unemployment Rate leaped to 14.7%, and could have been worse according to officials. Wages jumped, showing low-earners were the lion's share of those out of work. However, the devastation was already priced in.

Hints for a disastrous employment report were prevalent throughout the week. Employment components of ISM's Purchasing Managers' Indexes and ADP's private-sector jobs report all pointed to a substantial squeeze in America's workforce.

Sino-American relations: President Donald Trump and Secretary of State Mike Pompeo continued accusing China of its handling of the illness and repeated the unproven claim that the virus escaped a lab in Wuhan. Trump also threatened to step away from the trade deal he worked hard to secure with Beijing. Friction between the world's largest economies weighed on sentiment and supported the dollar, yet blaming China resonates with the US public ahead of the elections.

Trump also continued urging a return to normal, going further to admit it may cause more human suffering. Apart from insufficient tracking and tracing means, coronavirus cases are growing at a worryingly high rate in several states that have loosened stay-at-home orders. These include large California and Texas, which also have outsized economies.

UK events: Next coronavirus steps, GDP

The PM is set to provide full details of his plans to ease the lockdown over the weekend. A three-staged program has been leaked, but a timetable has yet to be set. It probably depends on the final deliberations in Downing Street and on another looks at coronavirus statistics. The trend has been encouraging and will likely result in some kind of immediate easing, yet it could be minor, disappointing markets.

Gross Domestic Product figures for the first quarter stand out on the economic calendar. Will they track the BOE's worrying forecasts? The UK fully shut down only on March 23, yet economic activity began dropping beforehand. The UK officially left the EU on January 31, but remained in a transition period, therefore having little effect on the overall economic performance.

Apart from the headline quarterly figure, the GDP statistic for March will also be of interest. Industrial output, which should be better than other sectors. may also rock markets.

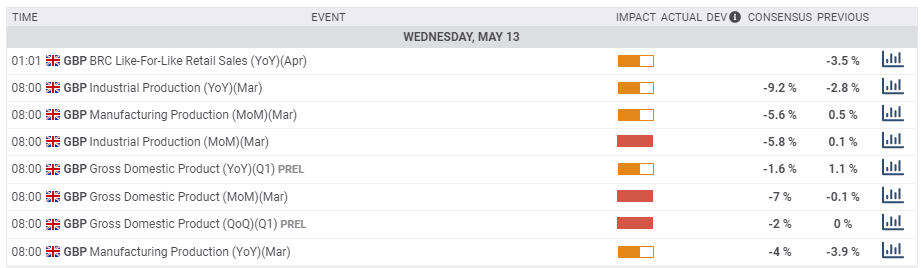

Here is the list of UK events from the FXStreet calendar:

US events: More states reopen, the consumer in focus

Several additional US states loosen restrictions in the week beginning May 11, adding pressure for others to follow suit, with New York standing out. Have previous moves to lift lockdowns impacted the spread of coronavirus? During the week, 14 days will have passed since the White House's guidelines expired at the end of April. If the illness remains under control, it could boost markets and weaken the dollar, while a setback could have the opposite effect.

Tensions between the US and China will also remain high on investors' minds. If recent clashes remain in the realm of rhetoric and fade away, it would be positive for risk. Otherwise, it is "risk-off."

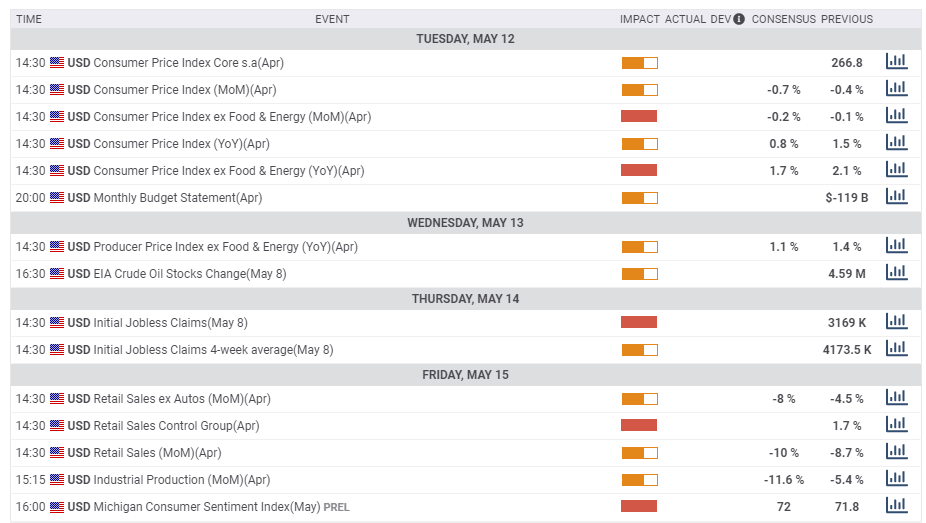

Inflation figures kick off the week on the economic calendar. After stabilizing in recent months, the fall in energy prices and the retreat of consumers could send the Consumer Price Index – especially the headline – substantially lower.

Weekly jobless claims remain of interest, yet they may fade in importance as markets still digest the Non-Farm Payrolls report. However, Retail Sales figures for April will likely rock markets. Spending crashed by 8.7% in March – when shelter-in-place orders came into effect – another substantial decrease is likely in April. The Control Group, which surprised with a rise in March, will likely correct lower.

Last but not least, the University of Michigan's preliminary Consumer Sentiment gauge for May could bounce from the lows as states reopen. A persistently low score would imply that Americans remain concerned about the disease and the economy.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar is trading alongside a moderate uptrend support line that has been accompanying it since early April. The dip below it proved to be a false one. Momentum on the daily chart has slipped back down and GBP/USD is capped by the 50, 100, and 200-day Simple Moving Averages. All in all, losing the uptrend support line could trigger a sharp sell-off.

Some support awaits at 1.2405, which held cable down in late April and later served as support. The line is closing in around 1.2320, and the next line to watch is 1.2250, which was a low point in late April. It is followed by 1.2165, last month's trough. The next lines are 1.1980 and 1.18.

Resistance is at 1.2520, which was a temporary high in late April. Further up, the double-top of 1.2645 awaits sterling. It is also where the 200-day SMA hits the price, making it critical resistance. The next level is 1.2720.

GBP/USD Sentiment

Downbeat US data and ongoing UK lockdowns may bring GBP/USD's recovery to an end. The 1.2645 level is critical.

The FXStreet Forecast Poll is showing that traders are bearish in the short term but are significantly split on the moves afterward, with forecasts ranging from sub 1.20 to above 1.30 in the long term. The average targets have been upgraded in the past week.

Related Reads

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds steady near 0.6250 ahead of RBA Minutes

The AUD/USD pair trades on a flat note around 0.6250 during the early Asian session on Monday. Traders brace for the Reserve Bank of Australia Minutes released on Monday for some insight into the interest rate outlook.

USD/JPY consolidates around 156.50 area; bullish bias remains

USD/JPY holds steady around the mid-156.00s at the start of a new week and for now, seems to have stalled a modest pullback from the 158.00 neighborhood, or over a five-month top touched on Friday. Doubts over when the BoJ could hike rates again and a positive risk tone undermine the safe-haven JPY.

Gold price bulls seem non-committed around $2,620 amid mixed cues

Gold price struggles to capitalize on last week's goodish bounce from a one-month low and oscillates in a range during the Asian session on Monday. Geopolitical risks and trade war fears support the safe-haven XAU/USD. Meanwhile, the Fed's hawkish shift acts as a tailwind for the elevated US bond yields and a bullish USD, capping the non-yielding yellow metal.

Week ahead: No festive cheer for the markets after hawkish Fed

US and Japanese data in focus as markets wind down for Christmas. Gold and stocks bruised by Fed, but can the US dollar extend its gains? Risk of volatility amid thin trading and Treasury auctions.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637245460589142700.png)