GBP/USD Forecast: At fresh five-month lows and bearish

GBP/USD Current price: 1.3658

- Mounting tensions related to the Brexit Northern Ireland Protocol hurt the pound.

- Freedom day has arrived in the UK despite the high number of fresh contagions.

- GBP/USD is at fresh multi-month lows and is poised to extend its decline.

The GBP/USD pair fell to 1.3655, a level that was last seen in February 2021. The dollar benefited from its safe-haven condition, while the pound suffered from Brexit woes. News over the weekend suggested that the UK will demand the EU more flexibility over the Northern Ireland Protocol. UK Brexit Minister David Frost is said to be preparing an announcement on the matter this week. When asked about the protocol, Frost said that it will always have to be a treaty due to the special situation of Northern Ireland, adding that “the question is what is the content.”

Meanwhile, “freedom day” arrived in the UK. The country lifted most COVID-19 restrictions, despite reporting roughly 40,000 new contagions and 19 deaths over the last 24 hours. At the same time, Prime Minister Boris Johnson has been put in isolation due to close contact. The rule of self-isolating will no longer apply to those fully vaccinated since mid-August. The UK macroeconomic calendar has nothing to offer until next Wednesday.

GBP/USD short-term technical outlook

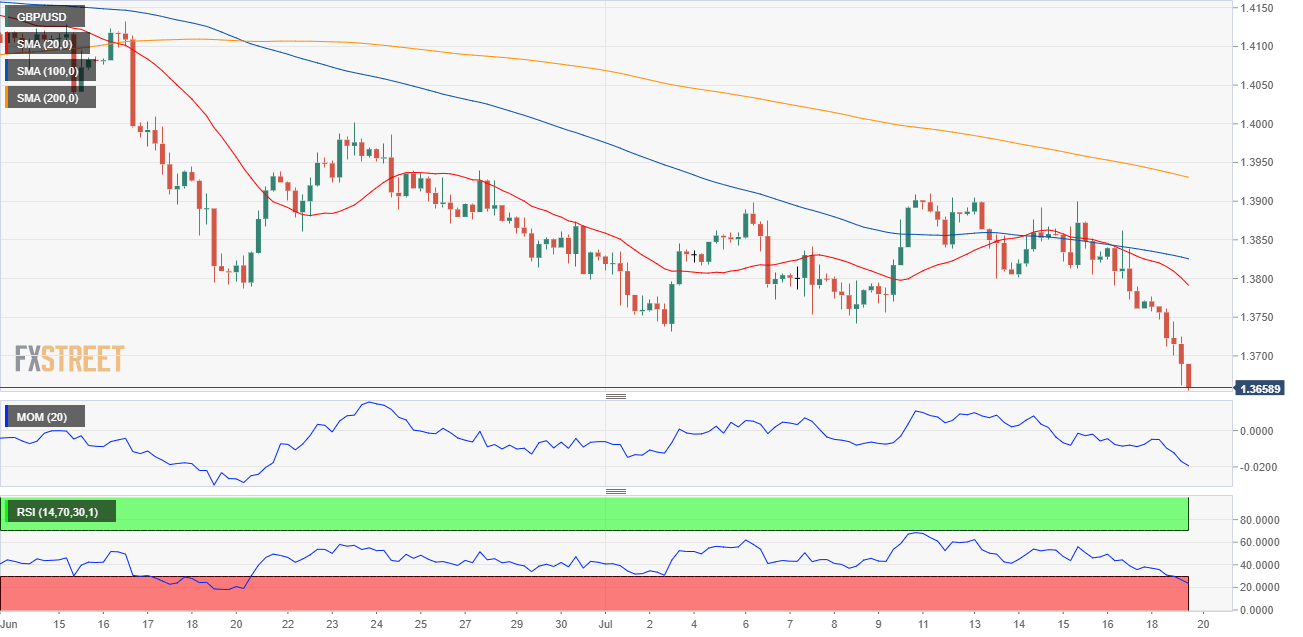

The GBP/USD pair trades near the mentioned daily low, unable to recover ground. The pair is oversold, but there are no signs it would change course. The 4-hour chart shows that GBP/USD develops below all of its moving averages, while technical indicators hold near weekly lows. The RSI indicator stands at 26, oversold for the first time since in a month. The pair has two relevant monthly lows in the 1.3660 area, which means a break below it should lead to a steeper decline during the upcoming sessions.

Support levels: 1.3650 1.3610 1.3575

Resistance levels: 1.3705 1.3760 1.3810

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.