GBP/USD Forecast: Additional recovery gains likely above 1.2070

- GBP/USD has staged a rebound after having tested 1.2000 on Wednesday.

- The near-term technical outlook suggests that buyers remain hesitant.

- Eyes on US data releases and Wall Street's opening bell.

GBP/USD has recovered modestly after having lost more than 1% on Wednesday. The pair faces strong resistance at 1.2070 and it could attract additional buyers once it stabilizes above that level.

Softer-than-expected January inflation figures from the UK weighed heavily on the Pound Sterling during the European trading hours on Wednesday. In the second half of the day, the US Dollar (USD) continued to gather strength against its rivals as the upbeat Retail Sales data reminded markets that the consumer activity remained health at the beginning of the year.

With Wall Street's main indexes managing to end the day in positive territory following a decisive rebound, however, the USD rally lost steam and helped GBP/USD erase a portion of its daily losses.

Early Thursday, the UK's FSTE 100 Index is up 0.3% and US stock index futures trade modesty higher on the day, pointing to a slightly positive risk mood. In case major equity indexes in the US build on Wednesday's gains after the opening bell, the USD could stay on the back foot and allow GBP/USD to stretch higher.

The US Bureau of Labor Statistics will release the Producer Price Index (PPI) data for January. On a yearly basis, the PPI is forecast to decline to 5.4% from 6.2% in December and the Core PPI is expected to edge lower to 4.9% from 5.5%. If the annual Core PPI comes in much stronger than expected, the US Dollar could keep its footing and vice versa. Nevertheless, PPI figures are unlikely to influence the market pricing of the Fed's rate outlook in a significant way and the market reaction should remain short-lived.

The US economic docket will also feature the weekly Initial Jobless Claims data alongside Housing Starts and Building Permits figures for January.

GBP/USD Technical Analysis

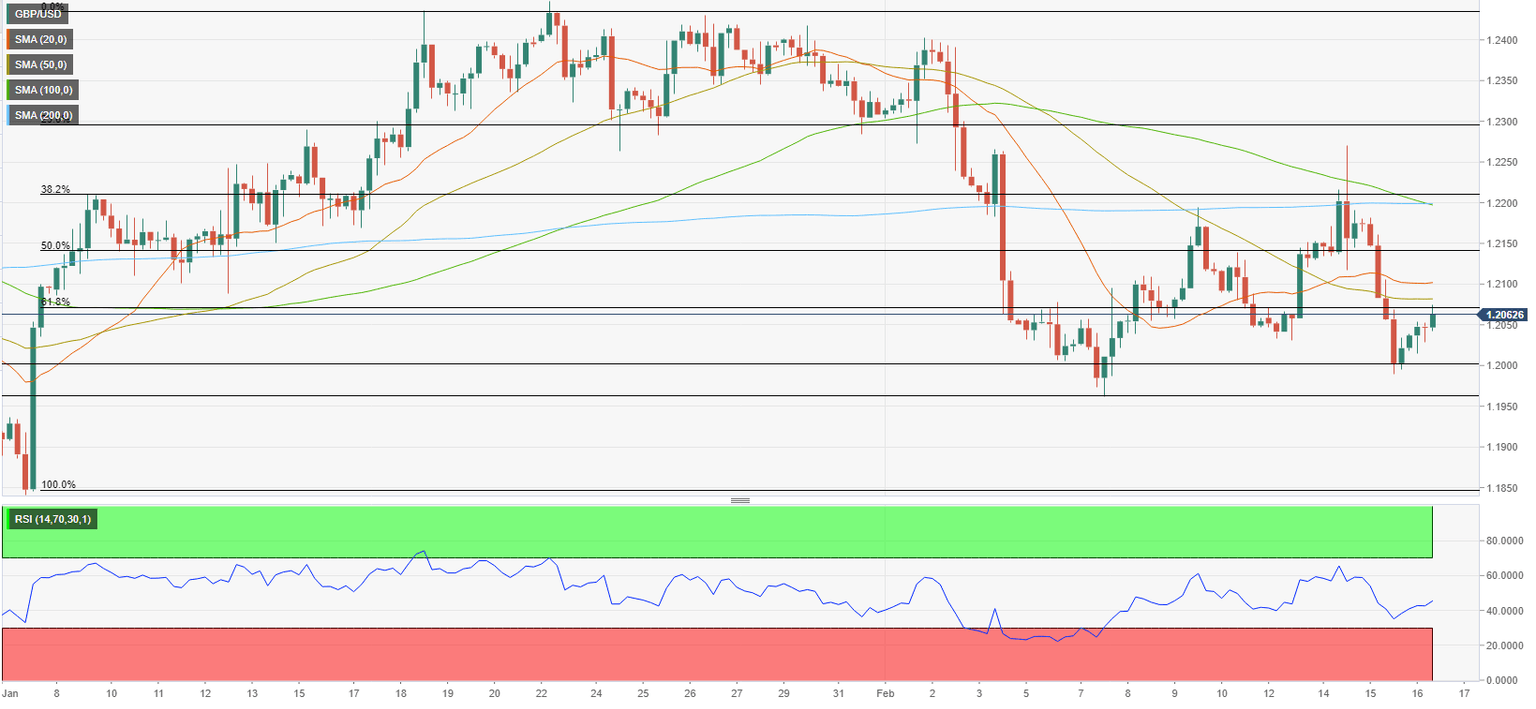

GBP/USD faces stiff resistance at 1.2070, where the Fibonacci 61.8% retracement of the latest uptrend and the 50-period Simple Moving Average on the four-hour chart align. Once the pair clears that level and stabilizes there, it could meet interim resistance at 1.2100 (20-period SMA, psychological level) before targeting 1.2150 (Fibonacci 50% retracement) and 1.2200 (200-period SMA, 100-period SMA).

On the downside, interim support is located at 1.2030 (static level) ahead of 1.2000 (psychological level,static level) and 1.1960 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.