GBP/USD Forecast: A technical correction is pound's only hope

- GBP/USD has slumped to its lowest level since 1985 on Friday.

- Disappointing Retail Sales data from the UK weighed heavily on the British pound.

- Technical outlook points to oversold conditions in the near term.

GBP/USD has extended its slide after having dropped below 1.1400 and touched its lowest level since 1985 at 1.1350. The risk-averse market environment is unlikely to allow the pair to shake off the bearish pressure but sellers could opt to book their profits ahead of the weekend, opening the door to a technical correction.

The disappointing data from the UK caused the British pound to suffer heavy losses against its major rivals. The UK's Office for National Statistics reported that Retail Sales declined by 1.6% on a monthly basis in August following July's increase of 0.4%. This print came much worse than the market expectation for a decrease of 0.5%.

Meanwhile, safe-haven flows continue to dominate the financial markets, helping the greenback preserve its strength against its major rivals. As of writing, US stock index futures were down between 0.9% and 1.3%.

In the second half of the day, the University of Michigan's preliminary Consumer Sentiment Survey for September will be featured in the US economic docket. The headline Consumer Confidence Index is forecast to improve modestly to 60 from 58.2 in August's final reading.

Investors are likely to pay close attention to the 5-year Inflation Expectations component of the survey, which stood at 2.9% in August. Following the uncomfortably high Consumer Price Index figures from the US earlier in the week, this data by itself is unlikely to influence the market pricing of the September Fed rate hike in a significant way. Nevertheless, investors could see a relatively soft print as an opportunity to book their profits ahead of the Bank of England's and the Fed's policy announcements next week.

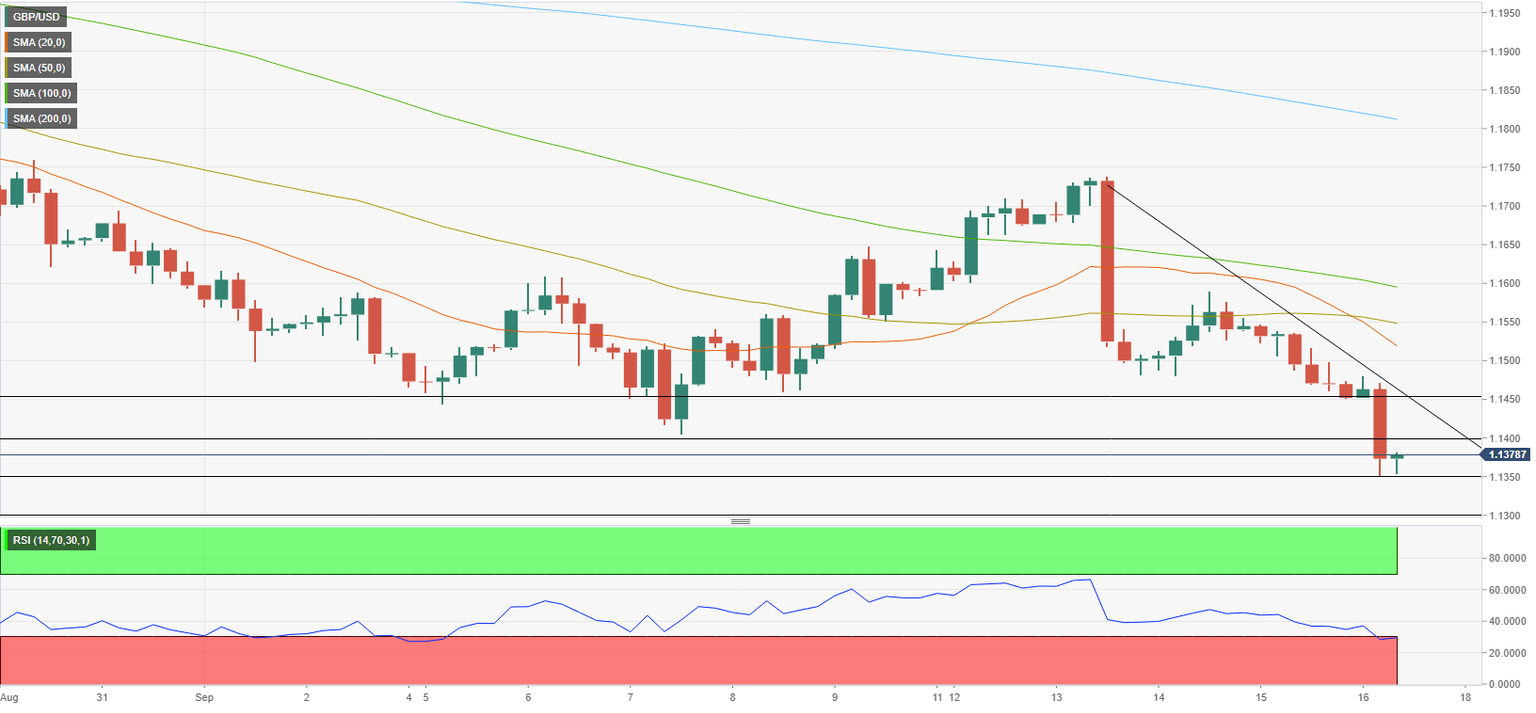

GBP/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the four-hour chart dropped into the oversold territory below 30. The last time the RSI fell below 30, earlier in the month, GBP/USD staged a 100-pip recovery.

In case the pair goes into a technical correction phase, it could face initial resistance at 1.1400 (former support, static level) ahead of 1.1450 (descending trend line, static level) and 1.1500 (psychological level).

On the downside, static support seems to have formed at 1.1350. With a four-hour close below that level, additional losses toward 1.1300 (psychological level) could be witnessed.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.