GBP/USD Forecast: A dovish BoE guidance could drag Pound Sterling lower toward 1.2600

- GBP/USD trades in negative territory nearly 1.2650 early Thursday.

- The BoE is forecast to maintain the bank rate at 5.25%.

- Markets will try to figure out whether the BoE will delay the policy pivot to the second half of the year.

After closing the second consecutive day in negative territory on Wednesday, GBP/USD continued to edge lower early Thursday and was last seen trading at around 1.2650. Although the technical outlook points to a bearish tilt in the near term, the pair faces a two-way risk heading into the Bank of England's (BoE) policy announcements.

The US Dollar started to gather strength late Wednesday after Federal Reserve (Fed) Chairman Jerome Powell said that he doesn't think that a rate reduction in March in the base case scenario. The Fed left the policy rate unchanged at 5.25%-5.5% as expected and the policy statement didn't make a reference to willingness to tighten policy further if needed.

Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.12% | 0.18% | 0.14% | 0.56% | -0.25% | 0.31% | 0.04% | |

| EUR | -0.13% | 0.06% | -0.01% | 0.45% | -0.33% | 0.20% | -0.08% | |

| GBP | -0.16% | -0.06% | -0.07% | 0.40% | -0.38% | 0.13% | -0.14% | |

| CAD | -0.14% | 0.01% | 0.06% | 0.46% | -0.33% | 0.17% | -0.01% | |

| AUD | -0.52% | -0.46% | -0.35% | -0.47% | -0.79% | -0.26% | -0.46% | |

| JPY | 0.24% | 0.34% | 0.40% | 0.32% | 0.80% | 0.52% | 0.27% | |

| NZD | -0.32% | -0.16% | -0.12% | -0.16% | 0.26% | -0.54% | -0.26% | |

| CHF | -0.06% | 0.08% | 0.14% | 0.10% | 0.52% | -0.28% | 0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

The BoE is widely expected to leave the key rate unchanged at 5.25%. Revised macroeconomic projections and Governor Andrew Bailey's comments on the policy outlook could impact Pound Sterling's valuation in the second half of the day.

The latest data from the UK showed that inflation remained sticky at the end of the year while the economy performed better than expected lately, especially the private sector, with PMI surveys pointing to ongoing expansion in the business activity in January.

In case the BoE makes a dovish tweak to the section that read "further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures" in the policy statement, markets could start pricing in a rate cut in spring and trigger a selloff in Pound Sterling. If that sentence is left unchanged, this could provide a short-term boost to the currency and help GBP/USD push higher.

On the other hand, Bailey could refrain from giving any hints on the timing of a policy pivot and reiterate the data-dependent approach to policy. In this scenario, investors could focus on projections. If inflation forecasts for 2024 and 2025 are revised significantly lower, Pound Sterling could struggle to find demand even if Bailey sounds neutral.

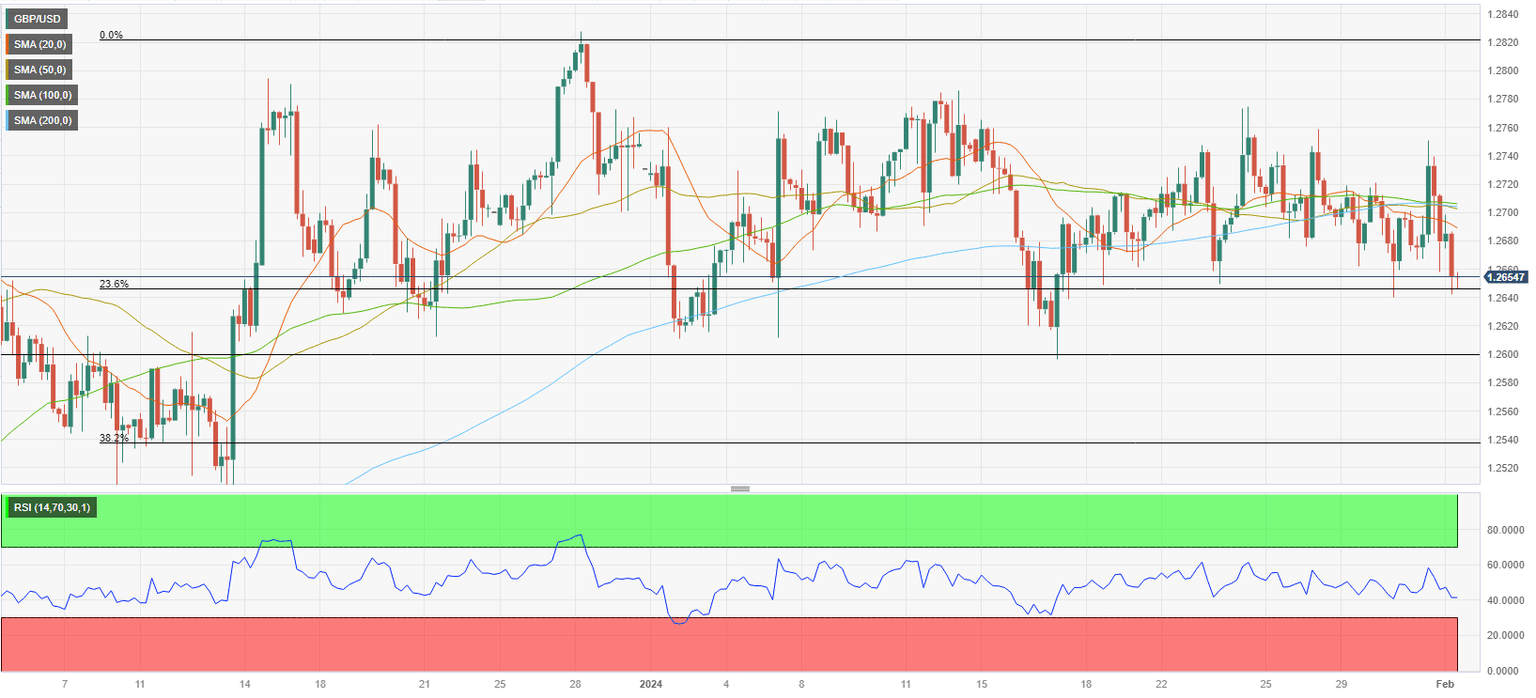

GBP/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart declined to 40 and GBP/USD closed the last three 4-hour candles below the 100-period and 200-period Simple Moving Averages (SMA), reflecting a build-up of bearish momentum.

On the downside, 1.2650 (Fibonacci 23.6% retracement of the latest uptrend) aligns as immediate support. If GBP/USD starts using that level as resistance, 1.2600 (psychological level, static level) could be seen as next bearish target before 1.2540 (Fibonacci 38.2% retracement).

Looking north, strong resistance could be seen at 1.2700 (100-period SMA, 200-period SMA) before 1.2760 (static level) and 1.2780 (static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.