GBP/USD Forecast: 25 bps BoE hike might not be enough to lift Pound Sterling

- GBP/USD dropped to its lowest level in nearly a month below 1.2700.

- BoE is expected to raise its policy rate by 25 basis points to 5.25%.

- Safe-haven flows continue to support the US Dollar.

GBP/USD closed deep in negative territory on Wednesday and extended its weekly slide early Thursday, touching its lowest level since early July below 1.2700. The Bank of England (BoE) will announce monetary policy decisions at 11:00 GMT and BoE Governor Andrew Bailey will comment on the policy outlook in a press conference starting at 11:30 GMT.

The BoE is widely expected to raise its policy rate by 25 basis points to 5.25% after the August meeting. Such a decision by itself might not be enough to trigger a recovery in Pound Sterling. The BoE needs to reassure markets that they will continue to tighten the policy despite signs of easing price pressure. Additionally, Pound Sterling could gather strength if the policy statement reveals that some policymakers voted in favor of a 50 bps hike.

In case the BoE surprises the markets by opting for a larger, 50 bps, rate increase, GBP/USD is likely to turn north with the initial reaction. However, the BoE could also signal an end to the tightening cycle in that scenario, limiting the pair's potential gains.

On the other hand, a 25 bps BoE hike combined with a dovish message that acknowledges softer inflation and the loss of momentum in the economic growth could trigger a fresh leg lower in GBP/USD.

The US economic docket will feature weekly Initial Jobless Claims and the ISM Services PMI data on Thursday. A reading near 200K in weekly Jobless Claims could help the USD preserve its strength. Investors will also pay close attention to the Employment Index of the ISM Services PMI survey. A reading below 50 would reflect a decrease in service jobs and weigh on the USD ahead of Friday's all-important Nonfarm Payrolls report.

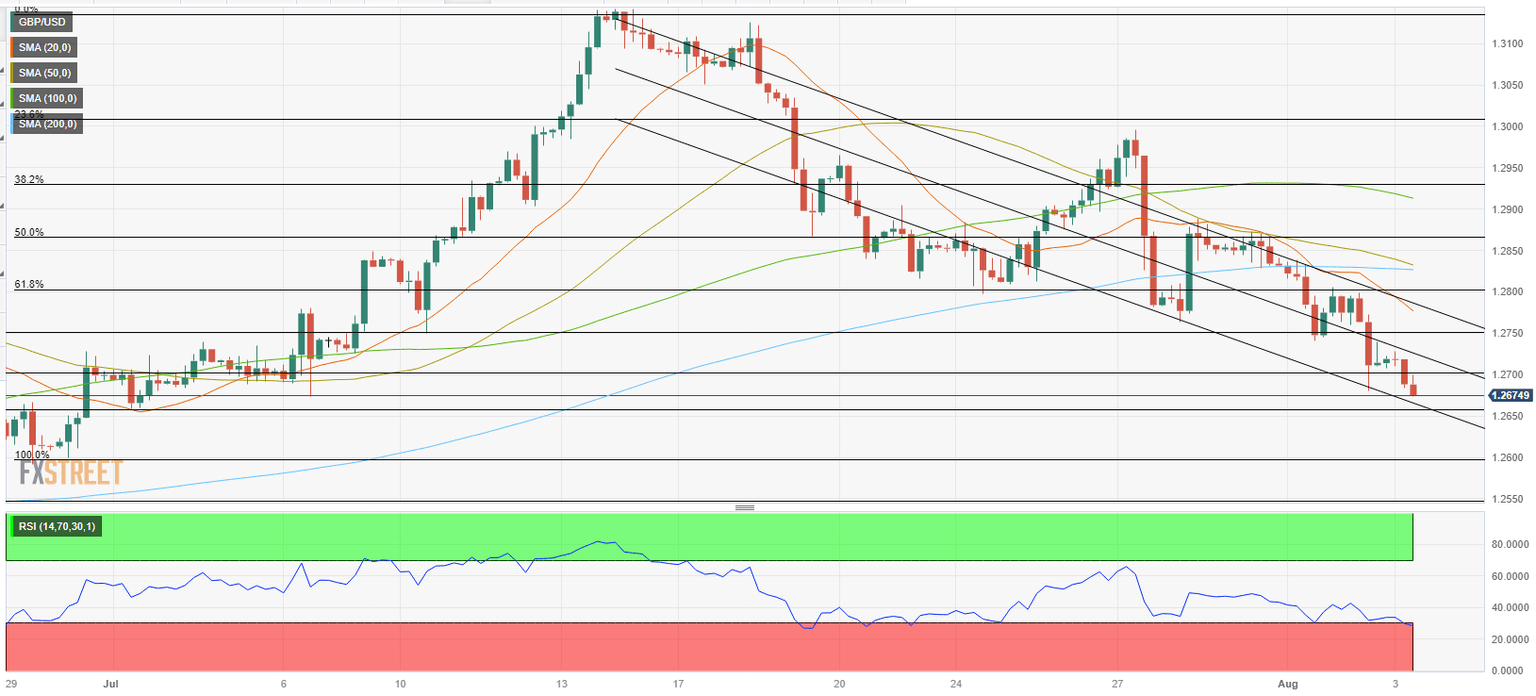

GBP/USD Technical Analysis

GBP/USD faces next support at 1.2650 (static level from July). That level is also reinforced by the lower-limit of the descending regression channel. It's also worth mentioning that the Relative Strength Index (RSI) indicator on the four-hour chart stays slightly below 30, pointing to oversold conditions. Nevertheless, investors could ignore technical conditions if Pond Sterling comes under selling pressure on a dovish BoE outcome. Below 1.2650, 1.2600 (psychological level, static level) aligns as next support before 1.2550 (static level from June).

On the upside, 1.2700 (mid-point of the descending channel, psychological level) aligns as first resistance before 1.2750 (static level) and 1.2780 (20-period Simple Moving Average (SMA), upper-limit of the descending channel).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.