GBP/USD Price Forecast 2020: Pound may continue to fall on hard Brexit deadline

- The post-UK election rally fizzles out amid renewed fears of a no-deal Brexit.

- BoE rate cut speculations might exert some additional pressure on the pound.

- Bulls might gain some respite from expected modest weakness in the US dollar.

The GBP/USD pair gained some positive traction during the early part of 2019 but then recorded some heavy losses over the subsequent six months and dropped to levels below the key 1.20 psychological mark in early September. The pair then rallied nearly 12%, hitting its highest level since May 2018 during the latter half of December in reaction to a landslide victory for the incumbent Conservative Party in the most important UK Parliamentary elections on December 12. The outcome is expected to break the longstanding gridlock and provide a clear path for ratification of the Withdrawal Agreement before the January 31, 2020 deadline.

Brexit uncertainty prevails on Cable forecast

The optimism proved to be beneficial for the sterling and lifted the pair to levels beyond the 1.3500 handle, albeit the momentum turned out to be rather short-lived amid renewed fears of a no-deal Brexit. The pair reversed its post-election relief rally after the UK Prime Minister Boris Johnson signaled hard Brexit deadline. Johnson’s is set to seek to pass legislation, which would require having a trade deal within months and make it illegal for the government to extend the Brexit transition period beyond the end of 2020. It is worth mentioning that the UK will leave the EU on January 31 but will remain in the single market and customs union until December 31, 2020. The current arrangement allows the Brexit transitions period to be extended by mutual agreement for up to two years up until the middle of next summer. Johnson's amendment will prevent such an extension, setting a tight deadline for complex talks.

Given the scale of issues to be resolved, the EU officials have already warned that ratifying trade deals in a year is highly unlikely. Market participants believe that a Canada-style free trade agreement, called the Comprehensive Economic and Trade Agreement (CETA), could still be a template for the UK's trading relationship with the EU after Brexit. Nevertheless, the latest developments have resurfaced concerns that Britain might end up crashing out of the EU on World Trade Organization trade rules unless Johnson succeeds in securing an agreement by the end of next year. The pound’s latest leg of a downfall further reinforces the market belief that Brexit is still far from being done and should continue to play a key role in influencing the sentiment surrounding the sterling over the next 12 months.

Gloomy UK economic outlook likely to weigh further

Apart from renewed Brexit uncertainty, investors will also take a closer look at UK economic fundamentals. The incoming UK economic data have been indicating that the UK economy is slowing down and if the recent doldrums continue or deepen further, it would set the stage for rate cut speculations and might exert some additional pressure on the pound. In its December policy statement, the BoE lowered the forecast for quarterly growth in the final three months of 2019 to 0.1% from 0.2% but expected the economic growth to pick up in early 2020. The UK central bank, however, warned that monetary policy might need to reinforce the expected recovery in UK GDP growth and inflation if global growth failed to stabilize or if Brexit uncertainties remained entrenched.

Economists also expect the UK economic growth to pick up some pace in 2020 if British businesses and investors feel that there’s clarity about the outlook. Furthermore, Johnson has pledged to significantly increase UK government spending in the next five years and bring an end to austerity, which could further boost the UK economy. The BoE has already said that it might need to raise borrowing costs at a gradual pace and to a limited extent if the risks did not materialize and the economy grew as expected, lending some support to the sterling.

Modest USD weakness might extend some support

Adding to this, expected modest weakness in the US dollar may further limit the downside. Against the backdrop of a slew of interest-rate cuts from the world’s central banks, a resolution to the US-China trade war remained supportive of the recent rally in the global stock markets and has eventually weighed on the greenback's perceived safe-haven status. Moreover, the US economic growth has started showing some signs of deceleration. Meanwhile, most leading indicators have been indicating a further slowdown and might prompt the Federal Reserve to provide support to the economy by cutting interest rates further. The Fed, however, has calmed concerns that the economy could falter and indicated an indefinite pause at its policy meeting on December 11. This eventually feeds into the expectations of only a modest depreciation, rather than a clear bear trend for the buck in 2020.

GBP/USD technical set-up

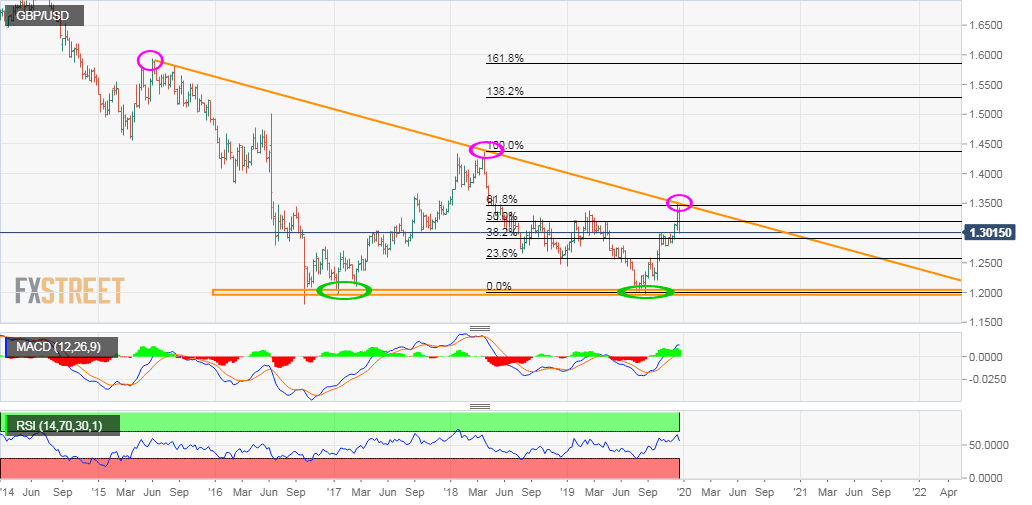

Looking at the technical picture, the pair had shown some resilience below the key 1.20 psychological mark, forming a firm base near the mentioned handle. However, the attempted recovery moves have been capped near a descending trend-line resistance, extending from June 2015 swing highs. The combination seemed to have constituted towards the formation of a bearish descending triangle, which usually forms during a well-established downtrend as a continuation pattern that indicates distribution.

The descending trend-line resistance coincides with the 61.8% Fibonacci level of the 2018-19 downfall from 1.4377 to 1.1959 and should act as a key pivotal point for bullish traders. Sustained break through the mentioned confluence barrier, currently near mid-1.3400s, will negate the negative outlook and set the stage for a move towards the next major resistance near the 1.3750-60 region.

Meanwhile, acceptance below the 1.2800 round-figure mark will reinforce the bearish scenario and pave the way for the resumption of the downward trajectory. The pair then could accelerate the slide further towards challenging the 1.2500 handle before eventually dropping to 2019 monthly closing lows support near the 1.2160 horizontal zone. Any subsequent slide, however, might continue to attract some buying interest near the 1.20 handle, which if broken will be seen as the opening of a new chapter in the GBP downfall.

Gregor Horvat projects a bearish outlook for the Pound on his Elliott Wave analysis:

GBP/USD Elliot Wave Analysis

Despite that recovery at the end of 2019, GBPUSD is still pointing lower for the final wave V of an ending diagonal, which should be sub-structured by three waves A)-B)-C). If we are on the right track then Cable might be finishing an expanded flat correction in wave B), so there is still a valid bearish outlook for an impulsive move down in 2020 for the final wave C) of V.

Forecast Poll 2020

| Forecast | H1 - Jun 30th | H2 - Dec 31st |

|---|---|---|

| Bullish | 53.3% | 65.9% |

| Bearish | 35.6% | 22.7% |

| Sideways | 11.1% | 11.4% |

| Average Forecast Price | 1.3215 | 1.3557 |

| EXPERTS | H1 - Jun 30th | H2 - Dec 31st |

|---|---|---|

| Alexander Douedari | 1.3700 Bearish | 1.4400 Bearish |

| Andrew Lockwood | 1.3000 Bullish | 1.4000 Bullish |

| Andrew Pancholi | 1.2962 Bullish | 1.3698 Bullish |

| ANZ FX Strategy Team | 1.2900 Bullish | 1.3100 Bullish |

| Brad Alexander | 1.3200 Bullish | 1.3600 Bullish |

| BBVA Bancomer Team | 1.3300 Sideways | 1.3900 Bearish |

| BMO Capital Markets | 1.2800 Bearish | 1.2500 Bearish |

| BNP Paribas Team | 1.3600 Bearish | 1.3800 Bearish |

| BoA FX, Rates and Commodities Team | 1.3300 Bearish | 1.3100 Bearish |

| Chris Svorcik | 1.3000 Bearish | 1.4200 Bullish |

| Chris Weston | 1.3700 Bearish | 1.4000 Bearish |

| Christina Parthenidou | 1.3900 Bullish | 1.3200 Sideways |

| CIBC World Markets Team | 1.3500 Bearish | 1.3600 Bearish |

| CitiFX | 1.3600 Bearish | 1.3800 Bearish |

| Danske Research Team | 1.2700 Sideways | 1.2900 Sideways |

| Dmitriy Gurkovskiy | 1.1450 Bullish | 1.1150 Bullish |

| Dukascopy Bank Team | 1.2200 Bearish | 1.1800 Bearish |

| Eagle FX Team | 1.3400 Bullish | 1.5100 Bullish |

| ForexGDP Team | 1.4200 Bullish | 1.5100 Bearish |

| FX Trading Revolution Team | 1.3500 Bearish | 1.4200 Bearish |

| Goldman Sachs Global Investment Team | 1.3600 Bearish | 1.3700 Bearish |

| Gregor Horvat | 1.1280 Bearish | 1.2000 Bullish |

| ING Global Economics Team | 1.3100 Bearish | 1.3800 Bearish |

| Ipek Ozkardeskaya | 1.3500 Bearish | 1.3700 Bearish |

| Jamie Saettele | 1.3300 Bearish | 1.3800 Bearish |

| Jeff Langin | 1.3000 Bullish | 1.3200 Sideways |

| Jose Blasco | 1.3700 Bullish | 1.3100 Bearish |

| LMAX Exchange Team | 1.4000 Bearish | 1.4500 Bearish |

| NAB Global Market Research Team | 1.3500 Sideways | 1.3400 Sideways |

| National Bank of Canada Eco. & Strat. Team | 1.2600 Bullish | 1.2100 Sideways |

| Nenad Kerkez | 1.4091 Bullish | 1.4701 Bullish |

| OctaFx Analyst Team | 1.4317 Bullish | 1.5000 Bearish |

| Rabobank Financial Markets Research Team | 1.2900 Bearish | 1.3500 Bearish |

| RBC Economic Research Team | 1.2600 Bullish | 1.2800 Sideways |

| Societe Generale Analyst Team | 1.3500 Bearish | 1.4000 Bearish |

| Standard Bank Research Team | 1.3400 Bearish | 1.3900 Bearish |

| Stelios Kontogoulas | 1.3200 Bearish | 1.3500 Bearish |

| Stephen Innes | 1.3800 Bearish | 1.4200 Bearish |

| TD Securities Research Team | 1.2600 Bearish | 1.2700 Bearish |

| Tomasz Wisniewski | 1.3700 Bullish | 1.4300 Bullish |

| UniCredit Research Team | 1.3100 Sideways | 1.3400 Bearish |

| UOB Group Team | 1.3000 Bearish | - |

| Wells Fargo Research Team | 1.3600 Bearish | 1.3800 Bearish |

| Westpac Institutional Bank Team | 1.3200 Bearish | 1.3100 Bearish |

We expect the Pound to benefit from yield differentials and soft Dollar trade policy, while outperforming, as the one major currency that isn't motivated to partake in a currency war, with the UK economy operating well historically with a strong GBP - This as opposed to the Yen, Swiss Franc, Euro and US Dollar all fighting to be weaker.

Connect the 2018 and 2019 low levels and set the parallel line at 04/2018 high level. One then can see that the rate is about to met with the upper trend line of an unconfirmed channel down pattern. If one combines that with the fundamentals, most likely near that trend line a bounce off or breaking of the trend would be caused by a Brexit event.

Related 2020 Forecast Articles

EUR/USD: Lean times soon to turn into flush times for euro dollar

USD/JPY: A journey from trade fears to high-stakes elections

AUD/USD: May the aussie live in interesting times

USD/CAD: Canada and loonie are well positioned but not in control

Gold: XAU/USD bulls likely to remain in control

Crude Oil: WTI bulls to hold their horses despite tighter market, rosier economy

USD/INR: Domestic factors barely support a turnaround for Indian rupee

Bitcoin: BTC, the ultimate store of value

Ethereum: Calm on ETH/USD after the storm is over

Ripple's XRP: The glimpse of hope

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.