GBP/USD eyes UK wage growth

-

UK wage growth expected to drop to 6.8%.

-

UK GDP rises 0.3%, but risk of recession remains.

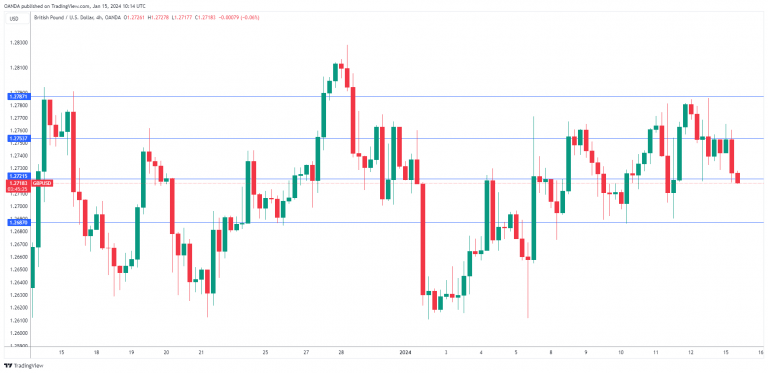

The British pound has started the week with slight losses. In the European session, GBP/USD is trading at 1.2725, down 0.21%.

Wage growth expected to continue falling

The UK will release employment data on Tuesday and the spotlight will be on wage growth. Over the past few months, wages have been falling and the Bank of England would like to see that trend continue as wages have been driving inflation. Average earnings including bonuses dropped to 7.2% in the three months to September, down from 7.7% in the previous release. The market estimate stands at 6.8% for the three months to October.

The UK economy is in trouble, although there was some good news on Friday, as November GDP rebounded with a gain of 0.3% m/m after a 0.3% decline in October. Retail sales drove the gain as shoppers took advantage of Black Friday sales late in November. Still, the probability of a recession, which is defined as two consecutive quarters of negative growth, remains high. The economy declined by 0.1% in the third quarter and a fourth quarter of negative growth would mean that the economy is technically in a recession. Even if a recession is avoided, the economy has flatlined and isn’t showing any growth.

The lack of economic growth puts the Bank of England in a dilemma. The central bank has sharply raised interest rates in order to curb high inflation and significant progress has been made. A year ago, inflation was in double digits, galloping at a 10.1% clip. Inflation has fallen to 3.9%, which is still double the 2% target. Governor Bailey has pushed back against rate cuts and insisted that the BoE would maintain a ‘higher for lower’ rate path, but lowering rates would increase economic activity and lessen the likelihood of a recession. The BoE has maintained the cash rate at 5.25% three straight times and meets next on February 1.

GBP/USD technical

-

GBP/USD is testing support at 1.2721. Below, there is support at 1.2687.

-

There is resistance at 1.2753 and 1.2787.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.