GBP/USD drops below 1.3000 on soft inflation report

The British pound has finally showed some movement on Wednesday after a week of limited movement. In the European session, GBP/USD is trading at 1.2992, down 0.62% on the day. The pound fell below the symbolic 1.30 level for the first time since August 20.

UK inflation drops more than expected

The UK inflation report for September was projected to hit a milestone and fall below the BoE’s 2% target, but the reading exceeded expectations. CPI fell to 1.7% y/y, down from 2.2% in August and below the market estimate of 1.9%. This was the lowest level since April 2021 and was driven by lower prices for petrol and airfares.

Services inflation, which has been stubbornly high, dropped from 5.6% y/y to 4.9%, its lowest level since May 2022. Monthly, CPI was flat, below 0.3% in August and below the market estimate of 0.1%. Core CPI also decelerated in September and was lower than expected (3.2% y/y and 0.1% m/m). As well, wage growth slowed to 4.9% in the three months to August, down from 5.1% previously.

The Bank of England will be encouraged by the drop in inflation and in wages. The UK economy is groaning under the weight of a cash rate of 5% and the markets are looking at a rate cut in November as a done deal, while a December cut is a strong possibility. Many major central banks have shifted their primary focus from inflation risks to the labor market, and we could see the same with the BoE, now that inflation is back below the BoE’s target.

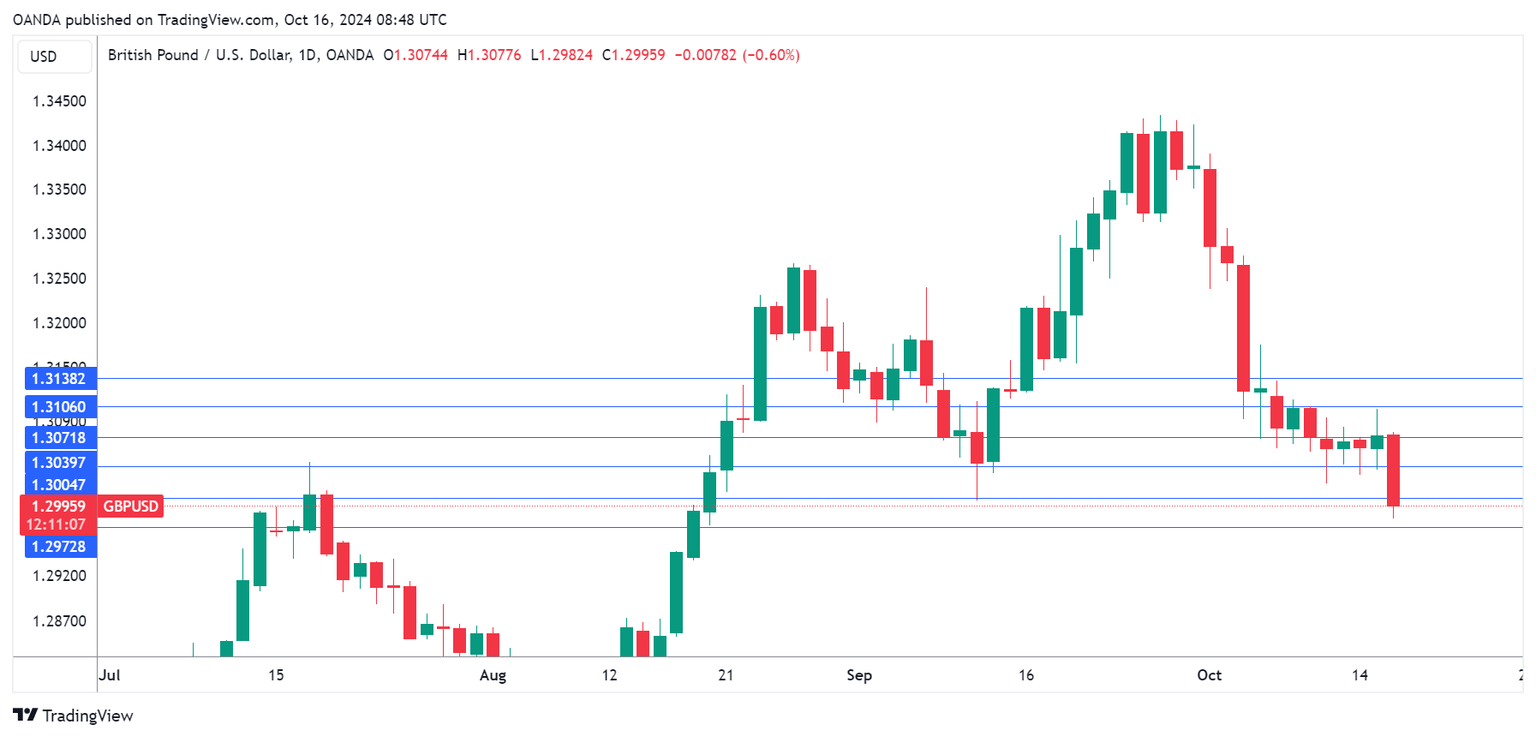

GBP/USD technical

-

GBP/USD has pushed below support at 1.3071, 1.3039 and 1.3004. The next support level is 1.2972.

-

1.3106 and 1.3138 are the next resistance lines.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.