GBP/USD: Dollar weakness helps Cable bulls – The rally continues [Video]

![GBP/USD: Dollar weakness helps Cable bulls – The rally continues [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-1178148633_XtraLarge.jpg)

GBP/USD

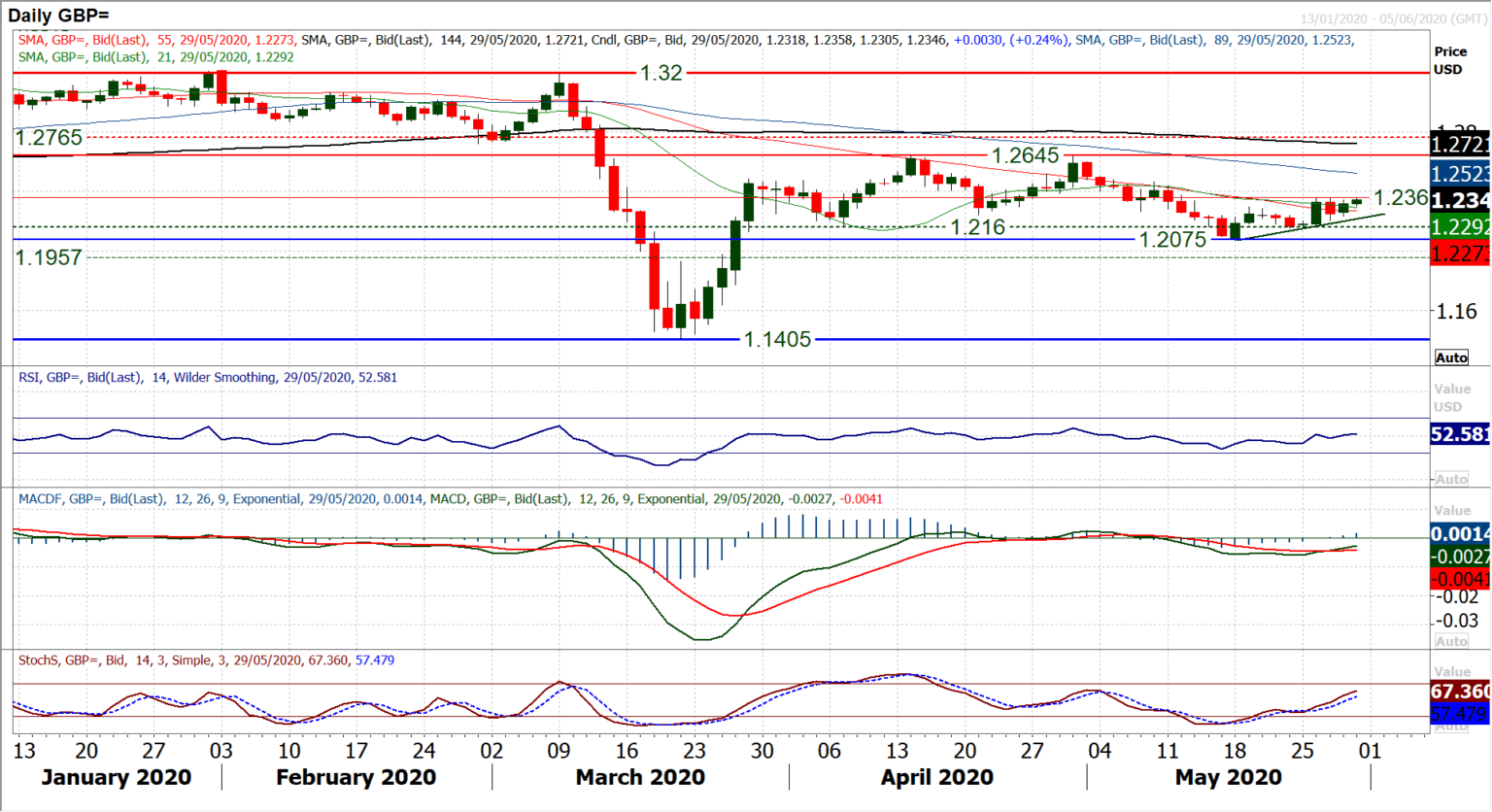

The broad dollar weakness is really helping Cable bulls at the moment, so much so that there is a renewed prospect of continued recovery. In the past couple of weeks, the market has been starting to pick up. Support at $1.2075 seems to now have a higher low at $1.2160 and a mini uptrend recovery is holding. With now three confirmed consecutive higher daily lows (and the prospect of a fourth now today) the market is pressuring recent resistance at $1.2360. Whilst as yet there is still no confirmation of the recovery being the dominant trend, a breakout above $1.2360 would then open a test of resistance at $1.2465 which is the first real lower high. If $1.2465 can be breached then there would be a decisive change in the outlook. For now, this is still a developing near term recovery which is unwinding the market from the key break below $1.2160. of mid-May. All the while, momentum indicators continue to pick up, with RSI into the 50s. However, the last two rebounds (from April) have seen RSI flounder at 59 before selling pressure took hold once more. This rally continues, but must be treated with caution until these conditions have seen positive breaks. The mini uptrend comes in at $1.2220 today. A close above $1.2360 would continue the rebound.

Author

Richard Perry

Independent Analyst