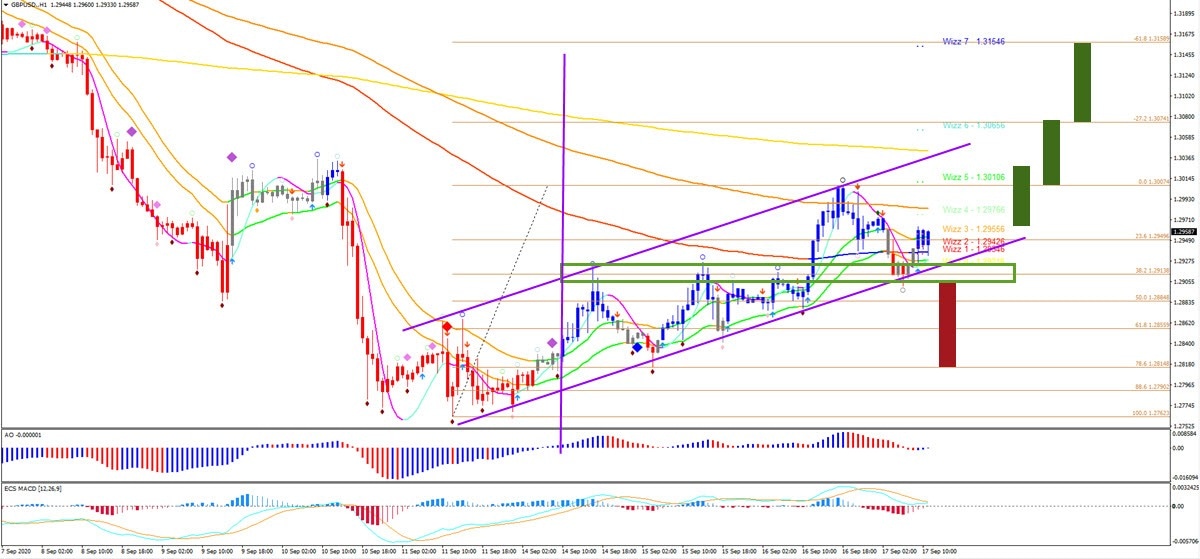

GBP/USD bulls regain control and aim at 1.3040 and 1.3150

The GBP/USD is building a well balanced uptrend channel. The bulls took over control when price broke through the resistance zone (dotted orange) and 144 ema. But can they push price action up higher?

Price Charts and Technical Analysis

The GBP/USD have the upper hand at the moment. And they are expected to keep it. A break above the resistance Fractal (red box) confirms the uptrend continuation. The main target is the long-term moving average and 38.2% Fibonacci retracement level of the 4 hour chart at 1.3040.

But price action could extend to higher levels. Especially if price action is able to show a bull flag pattern. Then the next breakout could take price to the -27.2% Fibonacci target and the Wizz 6 level. A break above that could even create an impulse towards the -61.8% Fibonacci target and Wizz 7 level at around 1.3150, which is where a larger retracement could take place.

The downside is only likely if price is able to break below the broken tops and support Fractals (blue box). The main target is then the 78.63% Fib level, which could easily be a bouncing spot. Only a break below the 100% Fib invalidates the bullish outlook. For the moment, the wave patterns suggest a completed ABC (pink) within wave A (purple) and a current wave B-C (purple) pattern.

Our own Elliott Wave software (see image below) already confirmed the bullish trend since the purple vertical line. The broken Fractals were a key confirmation of the upside (blue box). Now there seems to be more space to the upside (green boxes) than downside (red boxes - boxes were manually added in the image).

The analysis has been done with the ecs.SWAT method and ebook.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.