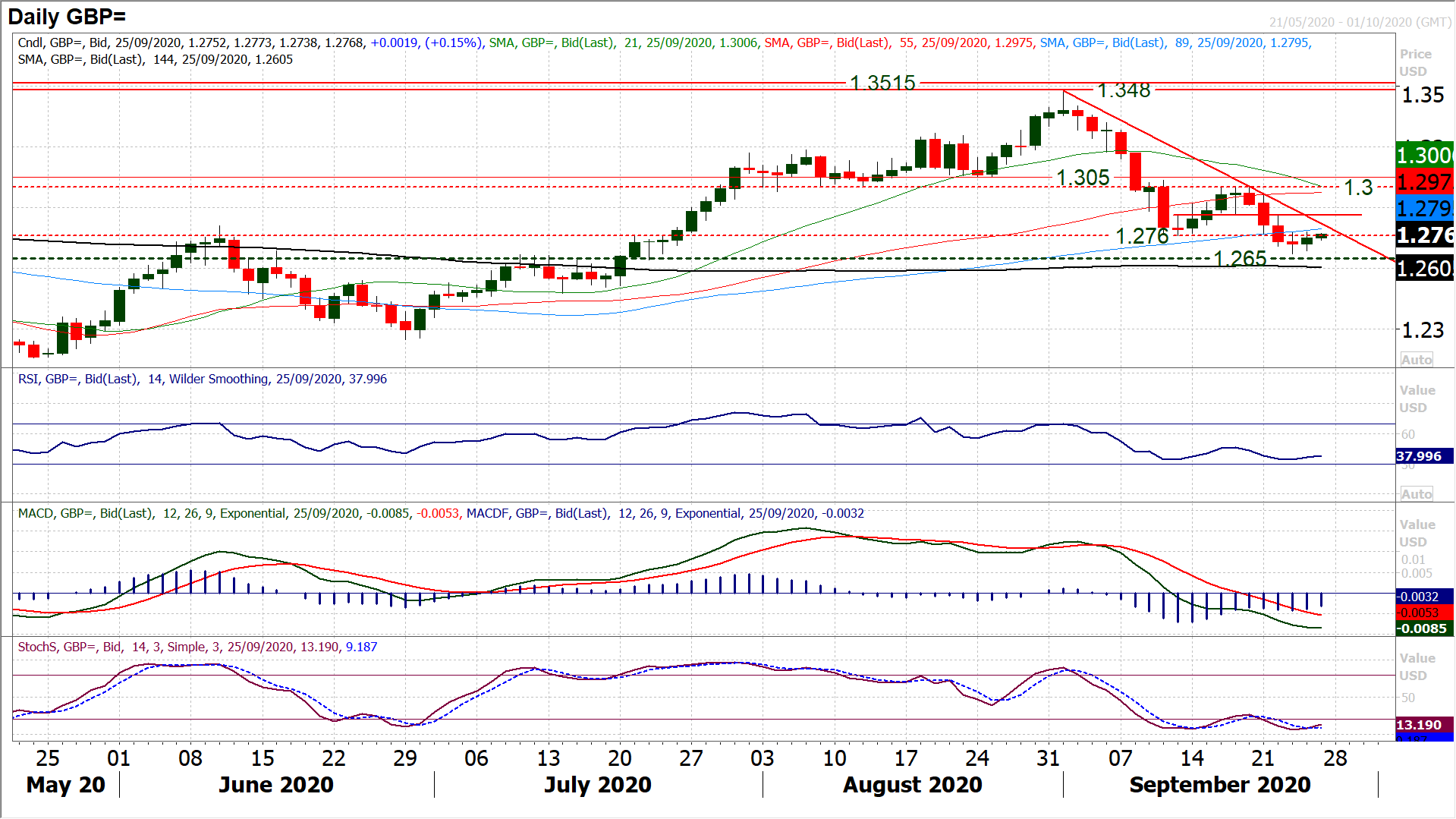

GBP/USD

As with EUR/USD there has been a mild tick higher on Cable as the strength of the dollar rally has just eased in the past 24 hours. However, this is likely to be another chance to sell as the growing medium term pressure on 1.2650 support builds. The trend lower of the past three weeks comes in around 1.2825 today and there is a near term pivot around 1.2860 which we see will likely contain a rally before downside pressure renews. Momentum indicators are far more negatively configured on a medium term outlook now, but are just beginning to tick back higher again. This near term rebound should be seen as a chance to sell. We expect this week’s low of 1.2670 to come under further pressure and how the market reacts around 1.2650 (which is a breakout support band of old highs) will determine whether this move goes much deeper towards 1.2480 and possibly 1.2250 in due course. Above 1.2860 would improve the near term outlook, but the bulls need above 1.3000 to really push ahead once more.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD: Negative bias should persist below the 200-day SMA

EUR/USD lost traction and faded the initial bull run to the area of yearly peaks near 1.0530, all following a late bounce in the US Dollar amid steady risk aversion in the global markets.

GBP/USD alternates gains with losses near 1.2480

After climbing to three-week highs above the 1.2500 mark, GBP/USD has lost some momentum and retreated to the 1.2480 range, driven by a modest recovery in the US dollar on Monday.

Gold extends corrective decline towards $2,730

Spot Gold is under strong selling pressure at the beginning of the week, trading around the $2,730 mark in the American session. The bright metal was unable to advance against a battered US Dollar (USD) despite a dismal market mood.

Crypto Market Crash: How corporate investors $58B move after Trump Inauguration triggered Bitcoin price dip

Bitcoin’s price dipped as low as $98,500 on Monday, its lowest in 12 days since January 15. On-chain data trends show how whale investors’ strategic moves after Donald Trump’s inauguration may have triggered the crypto market crash.

Five fundamentals for the week: Fed, ECB and US GDP try to compete with Trump Premium

The gift that keeps on giving – US President Donald Trump continues to be "generous" with market volatility, but this week, he'll face competition from the Fed. A rate decision in the Eurozone, the first release of US GDP for the entire 2024, and the Fed's favorite inflation gauge will all rock markets. Fasten your seatbelts..

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.