GBP/USD bullish reversal aims at 1.25 and 61.8% Fib

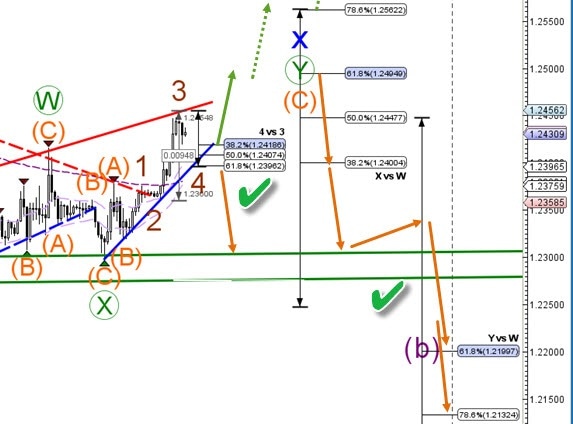

The GBP/USD was unable to break below the support zone (green lines) and made a bullish breakout above the resistance line (red) instead. What’s next for the Cable?

1 hour chart

The GBP/USD made a bearish ABC (orange) pattern within the wave X (green), which indicates a more complex WXY (green) correction. Within the wave Y (green), price seems to be building an ABC (orange) pattern. Currently, price could be in a wave 3-4 (brown) as long as price respects the Fibonacci levels of wave 4 vs 3. The main target is the 61.8% Fib at 1.25.

A break above the 1.25 round level would indicate a turn of events and the bulls would be regaining control. This is especially true if a corrective pattern is visible after strong bullish momentum, which would make a reversal more likely.

The analysis has been done with the CAMMACD.Core System.

For more daily technical and wave analysis and updates, sign-up up to our ecs.LIVE channel.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.