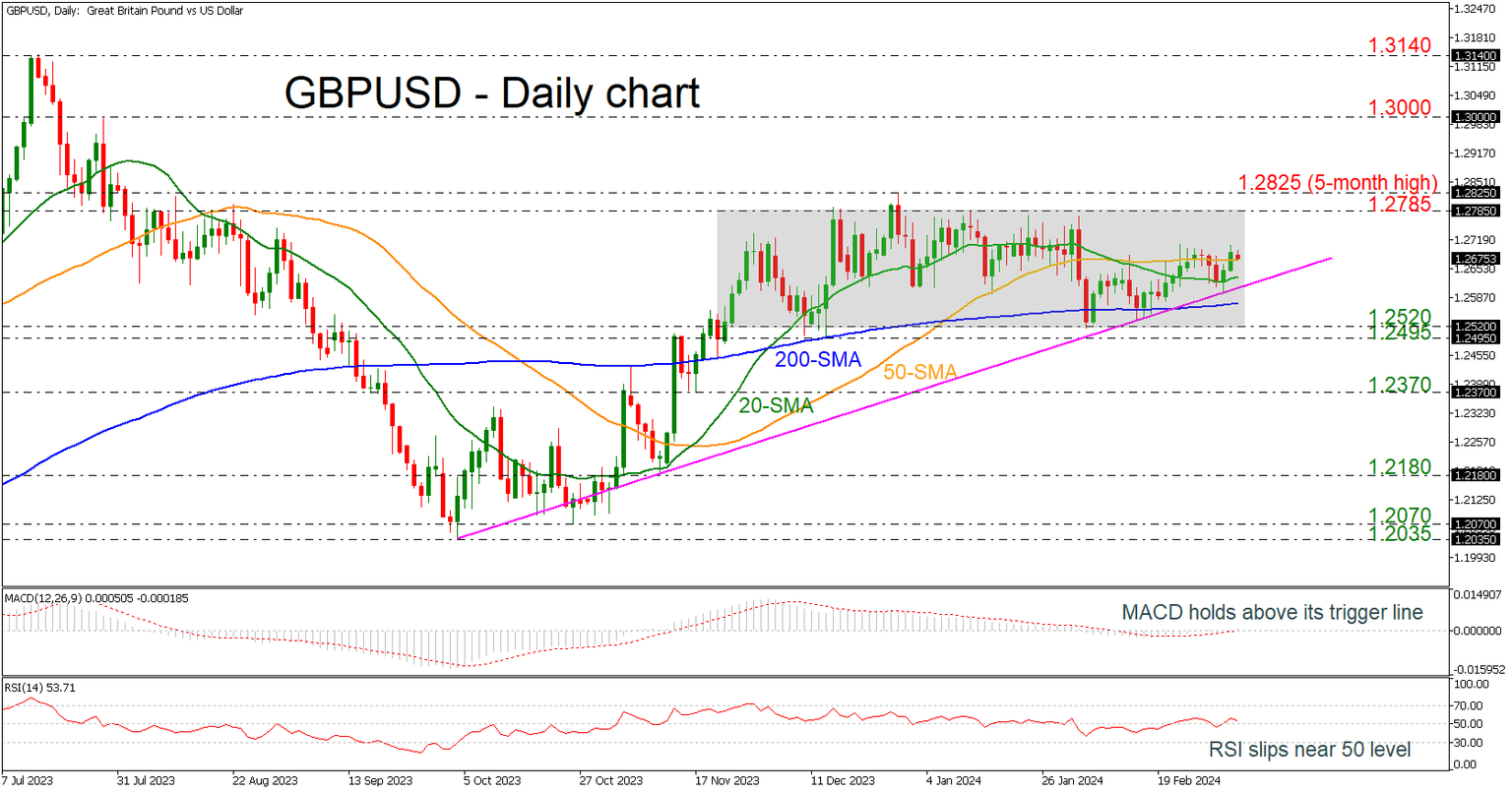

GBP/USD battles with SMAs within sideways channel [Video]

-

GBP/USD continues its consolidating move.

-

Medium-term uptrend line acts as strong support.

![GBP/USD battles with SMAs within sideways channel [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/iStock-472155766_XtraLarge.jpg)

GBP/USD is still holding near the mid-level of the medium-term trading range of 1.2520-1.2785. The pair is battling with the 50-day simple moving average (SMA) at 1.2673 again, with the technical oscillators suggesting weak momentum on price. The MACD is flattening near its trigger and zero lines, while the RSI is pointing slightly down, trying to cross below the 50 level.

In the case of more notable gains, the pair may manage to hit the upper boundary of the consolidation area at 1.2785 ahead of the five-month peak of 1.2825. Steeper increases could drive the market towards the 1.3000 psychological mark.

On the other hand, some critical levels are waiting the price for a turning move from the price such as the 20- and the 200-day SMAs at 1.2630 and 1.2575 around the longer-term uptrend line. Beneath these lines, the 1.2495-1.2520 support region may halt bearish actions before resting near 1.2370 bar.

All in all, GBP/USD has been lacking clear direction over the last three months, but a closing day below the supportive trend line would change the outlook to negative.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.