GBP/USD analysis: Surges as forecast

GBP/USD

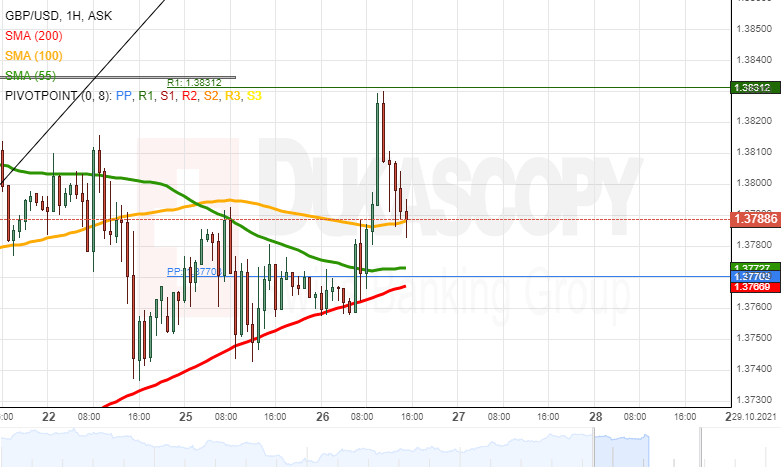

The GBP/USD fulfilled the first scenario described on Monday, as it broke the resistance of the 55 and 100-hour simple moving averages and jumped to the 1.3830 level and the weekly R1 simple pivot point at 1.3831.

By the middle of Tuesday's trading hours, the pair had bounced off the 1.3830 mark and retreated to the 100-hour SMA at 1.3785.

If the pair continues to decline, it would look for support in the mentioned 100-hour SMA near 1.3785. Below the SMA, support could be provided by the 55 and 200-hour simple moving averages and the weekly simple pivot point at the 1.3766/1.3773 range.

On the other hand, a potential surge would once again test the resistance of the 1.3830 mark and the weekly R1 simple pivot point.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.