GBP/USD Analysis: Stage seems set for additional gains, US GDP eyed for fresh impetus

- A combination of factors assisted GBP/USD to attract some dip-buying on Wednesday.

- A declining trend in Delta variant infections in the UK acted as a tailwind for the sterling.

- The post-FOMC USD selloff also contributed to the ongoing move up to one-month tops.

The GBP/USD pair prolonged its recent strong rebound from the lowest level since early February and climbed back above the 1.3900 mark on Wednesday. The pair did witness some intraday selling and dropped to the 1.3840 region, though a combination of factors helped limit any further losses. The British pound was supported by the declining trend in Delta variant infections and comments by the UK’s top epidemiologist, Neil Ferguson, saying that the end of the pandemic could be just months away. Apart from this, the emergence of some fresh selling around the US dollar assisted the pair to attract some dip-buying.

The greenback struggled to capitalize/preserve its early modest gains, instead met with aggressive supply in reaction to the Fed Chair Jerome Powell's dovish turn at the post-meeting press conference. The US central bank announced its monetary policy decision and sounded optimistic about the economy, acknowledging that the economy has made progress towards the maximum employment and price stability goals. Powell, however, emphasised that they were some ways away from substantial progress on jobs and was also cautious about tapering. He said that policymakers discussed some details but it will take a few more meetings to get into it.

The difference in tone between the policy statement and Powell's remarks, along with a sharp decline in the US Treasury bond yields weighed heavily on the greenback. In fact, the yield on the benchmark 10-year US government bond dropped back closer to five-month lows and kept the USD bulls on the defensive through the Asian session on Thursday. This, in turn, allowed the pair to gain some follow-through traction for the fourth consecutive session – also marking the sixth day of a positive move in the previous seven. The pair was last seen trading near one-month tops as the focus now shifts to the Advance second-quarter US GDP print.

The first estimate is expected to show that growth in the world's largest economy accelerated by a robust 8.6% annualized pace during the April-June quarter. The release will be accompanied by the usual Initial Weekly Jobless Claims and followed by Pending Home Sales data from the US. Apart from this, the US bond yields will play a key role in influencing the USD price dynamic dynamics and produce some meaningful trading opportunities around the major.

Short-term technical outlook

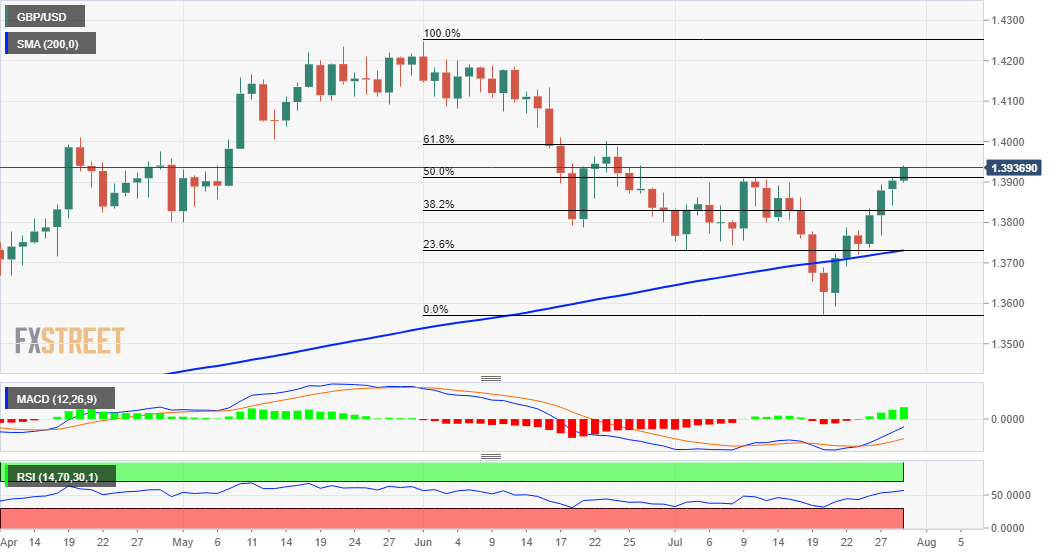

From a technical perspective, the momentum beyond the 1.3900 mark confirmed a near-term bullish breakout through a resistance marked by the 50% Fibonacci level of the 1.4249-1.3572 downfall. Given that technical indicators on the daily chart have been gaining positive traction, the stage seems all set for a move towards reclaiming the key 1.4000 psychological mark. The latter coincides with the 61.8% Fibo. level, which if cleared decisively should pave the way for a further near-term appreciating move. The next relevant hurdle is pegged near mid-1.4000s, above which bulls are likely to aim back to reclaim the 1.4100 round-figure mark.

On the flip side, the 1.3900 mark now seems to protect the immediate downside ahead of the overnight swing lows, around the 1.3840 region, just ahead of the 38.2% Fibo. level. Some follow-through selling has the potential to drag the pair further towards the 1.3800 mark, which if broken might prompt some technical selling. The pair might then accelerate the fall towards the 1.3730 confluence support, comprising 23.6% Fibo. level and the very important 200-day SMA. Sustained weakness below the mentioned confluence support will shift the bias back in favour of bearish traders.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.