GBP/USD analysis: Respects pivot point

GBP/USD

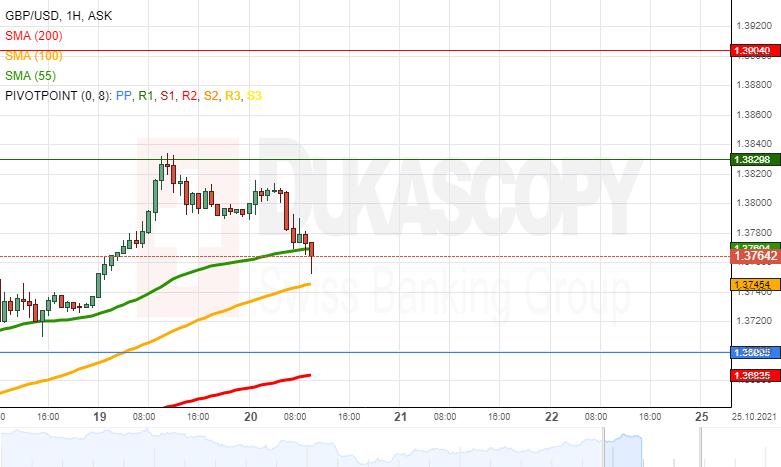

On Tuesday, the GBP/USD surged and reached the resistance of the weekly R1 simple pivot point at the 1.3830 level. The pivot point's resistance held and caused a decline. By the middle of Wednesday's European trading hours, the decline had passed the support of the 55-hour SMA at 1.3769 and was heading to the 1.3750 mark.

In the case that the 1.3750 mark, which could be supported by the 100-hour SMA, holds, the EUR/USD would recover. A potential recovery might find resistance first in the 55-hour SMA at 1.3770. Afterward, the weekly R1 simple pivot point at 1.3830 might serve as resistance.

On the other hand, a decline below the 1.3750 mark would highly likely result in a decline to the weekly simple pivot point at the 1.3700 mark. Note that the round exchange rate of 1.3700 can provide support and resistance on its own.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.