GBP/USD Analysis: bulls disappointed by Brexit developments

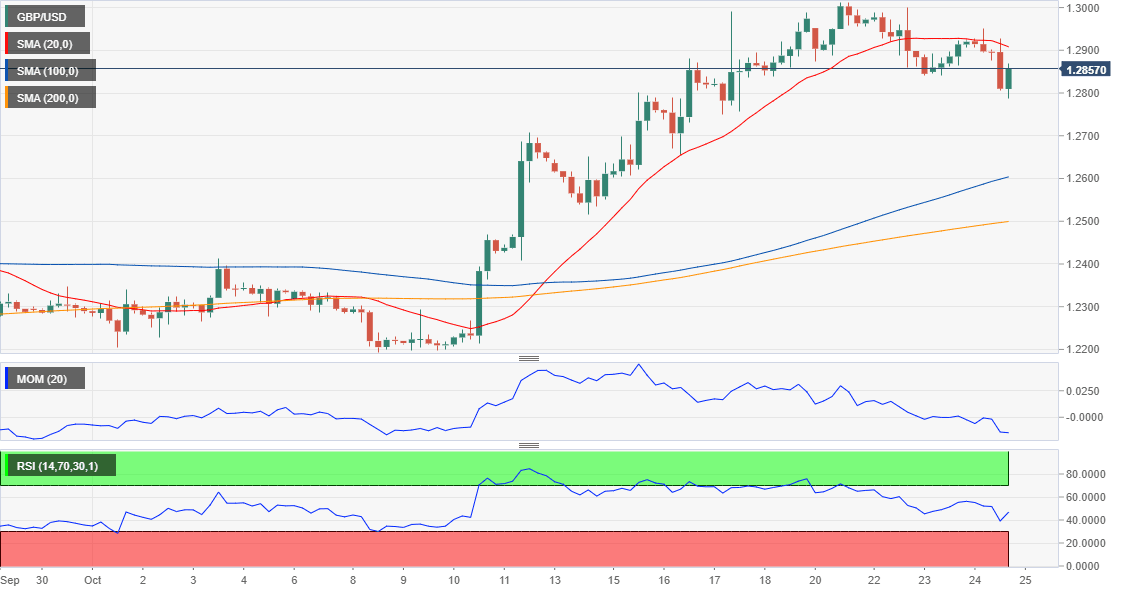

GBP/USD Current Price: 1.2856

- UK PM Johnson called for a snap election on December 12.

- Johnson election’s motion unlikely to be supported by the Parliament.

- GBP/USD poised to extend its slump toward 1.2700 amid persistent Brexit uncertainty.

The GBP/USD pair has fallen to 1.2788, its lowest in a week, amid growing political tension in the UK correlated to Brexit. The pair reached such a low after UK PM Boris Johnson called for a general election on December 12th. Johnson stated that the way to get Brexit done is to Parliament agreeing with the December election and that MPs could study the Brexit Bill before the dissolution, which would take place early November. He now needs to table the proposal and get it approved, something that’s looking less likely as the day goes by, as Labour and other opposition parties are against it, and good prefer to have first a guarantee against a no-deal Brexit. The mess continues fueling uncertainty and weighing on Sterling. In the Meantime, the EU27 is yet to confirm the extension, although it seems that it will be a three-month one.

GBP/USD short-term technical outlook

The GBP/USD pair bounced from the mentioned low to settle around 1.2850, with the 4 hours chart showing that the pair remained capped for a second consecutive day by a now bearish 20 SMA. Technical indicators in the mentioned chart remain within negative levels, lacking directional strength, although adding to the bearish case. A break through the mentioned daily low will open the door for an extension toward the 1.2700 figure.

Support levels: 1.2830 1.2785 1.2740

Resistance levels: 1.2890 1.2930 1.2965

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.