GBP price action setups: GBP/USD, GBP/JPY and GBP/AUD analyzed

-

The British pound is under pressure due to Donald Trump's potential tariff policies, causing volatility in GBP/USD and global markets.

-

GBP/USD is approaching its 2024 yearly low, with potential for further downside if Trump's tariff rhetoric continues and the US dollar strengthens.

-

GBP/JPY's price action is uncertain due to conflicting signals from the Bank of Japan's monetary policy.

-

GBP/AUD is in a defined bearish trend, with key support and resistance levels identified.

The British pound remains under pressure as the dollar continues to advance. This comes after the Bank of England kept rates steady with a cautious approach in December, while the Federal Reserve gave a more aggressive outlook for 2025.

It has been a somewhat topsy-turvy start to 2025 as markets continue to wait with bated breath for the inauguration of incoming US President Doonald Trump. At the moment his comments are stirring up market volatility as rumors continue to swirl around his potential approach toward tariffs.

This morning CNN reported that Trump considered declaring a national emergency to start a new tariff program. This pushed the US Dollar higher, while stocks lost some gains and commodity prices dropped. The sensitivity on display at present is a sign of the growing uncertainty of Trump's proposals and their potential implications.

GBP fundamental overview

The UK economy is expected to remain resilient in 2025 following a surprise performance in 2024. There remain inflation concerns, however the rise of the US dollar has made life difficult for GBP/USD. However, this could leave the GBP poised for gains against emerging market currencies as well as commodity linked currencies such as the Australian Dollar.

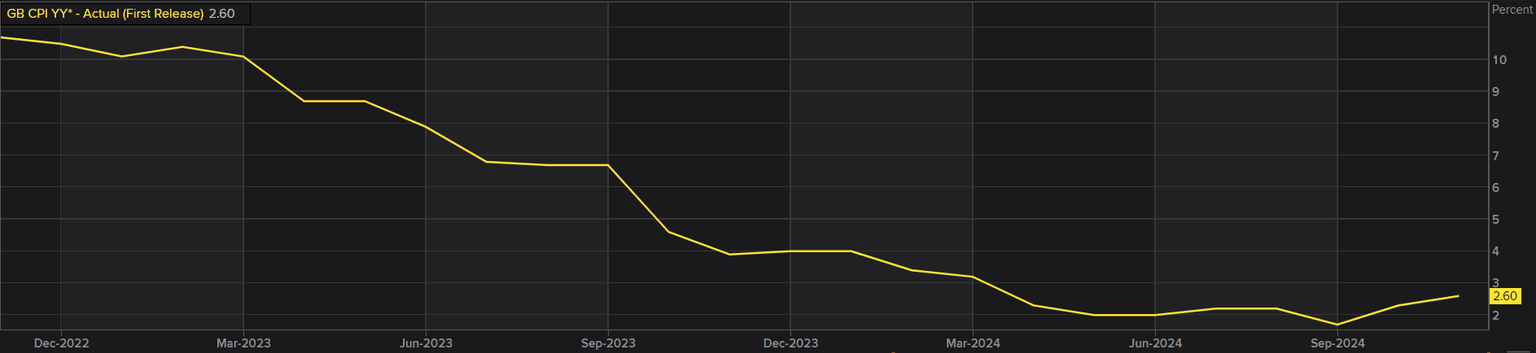

In November, UK inflation was 2.6% compared to the same time last year, increasing for the second month in a row and staying above the Bank of England's 2% target. This is due to stubborn wage growth and rising prices in the service sector.

Source: LSEG (click to enlarge)

The job market is starting to cool down, but unemployment is still low at 4.2%, and wages are growing at 5.2%. Some slowdown in the job market is expected after the Labour government's first Budget.

The GBP seemed poised to benefit from less rate cuts in 2025, but the election of Donald Trump has led to a similar scenario in the US. This has left cable vulnerable to further downside in the weeks ahead.

Technical analysis

GBP/USD

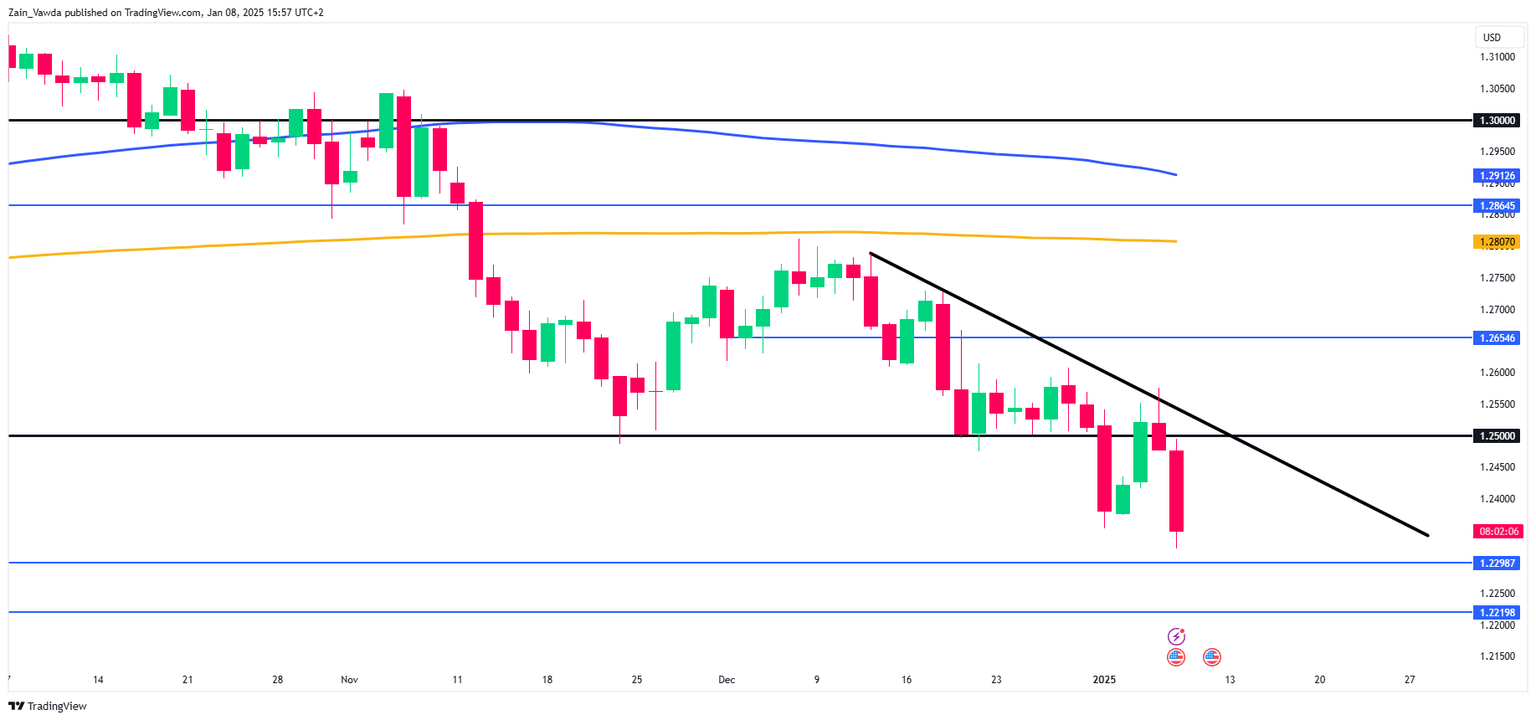

From a technical standpoint, GBP/USD on a daily timeframe has just printed a fresh low and is now within a whisker of the 2024 yearly low at 1.22987.

This comes following a two day selloff largely inspired by comments from incoming US President Donald Trump. The comments were around potential tariffs and reignited US Dollar strength which dragged cable lower.

There were signs from a technical aspect as well, with GBP/USD failing to break above the previous swing high as well as the descending trendline.

The 2024 year low beckons, will GBP/USD find support or will the US dollar continue to advance and drag cable toward support at 1.22198?

A lot will depend on US data in the coming days as well as Donald Trump's rhetoric around tariff plans etc.

If GBP/USD is to find support at 1.22987, the swing low of January 3 around the 1.2375 may be the first hurdle before the 1.2500 handle comes back into focus.

GBP/USD Daily Chart, January 8, 2024

Source: TradingView.com (click to enlarge)

Support

-

1.2298.

-

1.2219.

-

1.2000 .

Resistance

-

1.2375.

-

1.2500.

-

1.2582.

GBP/JPY

GBP/JPY is one pair that looked set to move higher after the BoJ decided not to increase rates in December.

However, where in the past the BoJ used intervention talk as a way to strengthen the Yen, at present it appears the normalization of monetary policy is being used to try and create a similar impact.

The results have led to mixed price action for GBP/JPY making the pairs next move that much harder to predict.

As things stand, GBP/JPY is currently testing the 200-day MA around the 195.33 handle with a break lower facing the 100-day MA at 193.71. Both of these support levels may prove hard to crack.

A move higher from current prices for GBP/JPY needs to break above the 198.00 if the pair is to have any chance at reclaiming the 200.00 level.

For now, keep an eye out for comments regarding BoJ monetary policy. These comments have the potential to drive the narrative in the days to come.

GBP/JPY Daily Chart, January 8, 2024

Source: TradingView.com (click to enlarge)

Support

-

195.33 (200-day MA).

-

193.71.

-

190.00.

Resistance

-

196.57.

-

198.00.

-

200.00.

GBP/AUD

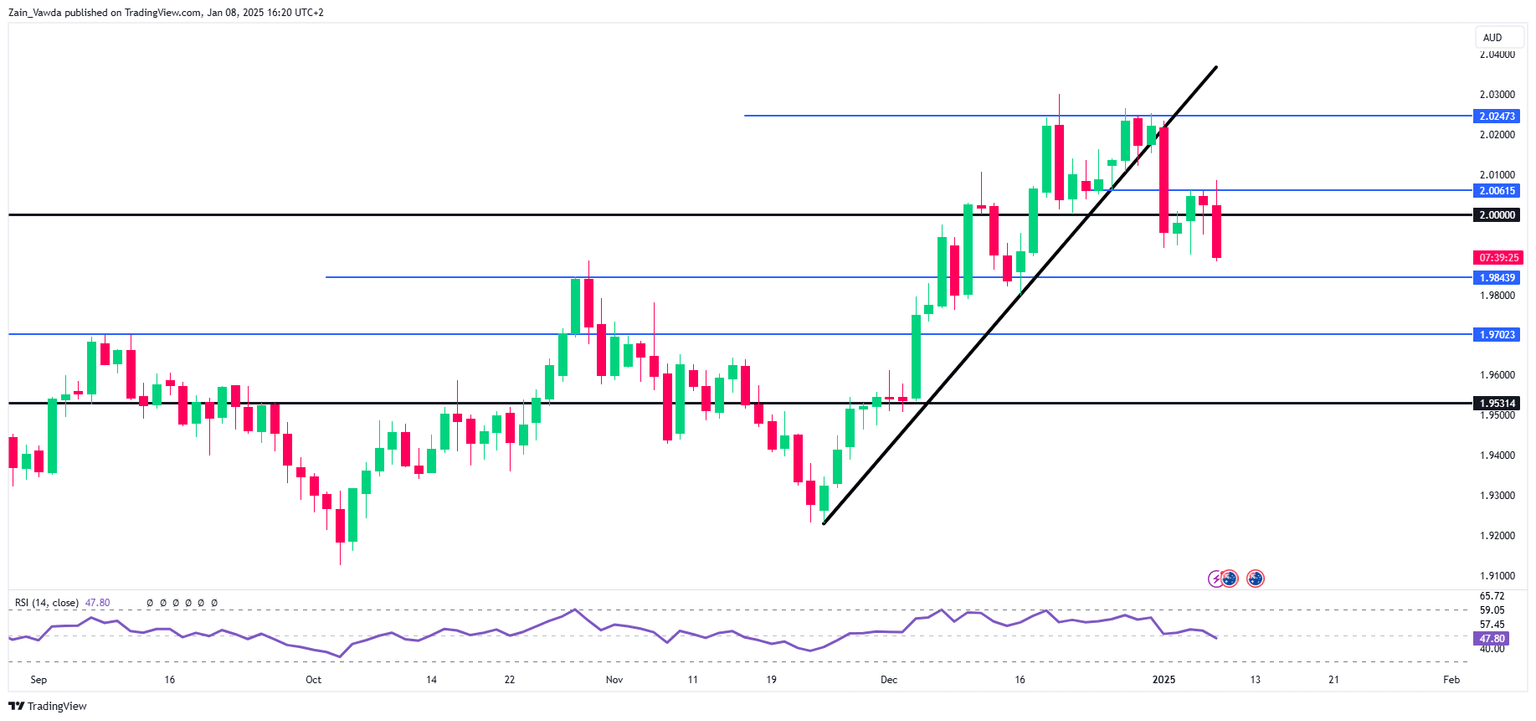

From a technical standpoint, GBP/AUD is now firmly in a bearish trend having topped out on December 19. A retest and lower high on December 27 preceded the selloff we have seen since then.

A brief pullback toward resistance above the 2.000 handle at 2.006 to print a lower high before the selloff continued.

Immediate support now rests at around the 1.9850 handle before the 1.9700 level comes into focus.

If a bounce occurs off support at the 1.9850 area, resistance at 2.000 and 2006 will be key. A break of these levels could open up a push toward the December highs.

GBP/AUD Daily Chart, January 8, 2024

Source: TradingView.com (click to enlarge)

Support

-

1.9850.

-

1.9700.

-

1.9500.

Resistance

-

2.0000.

-

2.0061.

-

2.0247.

Author

Zain Vawda

MarketPulse

Zain is a seasoned financial markets analyst and educator with expertise in retail forex, economics, and market analysis.