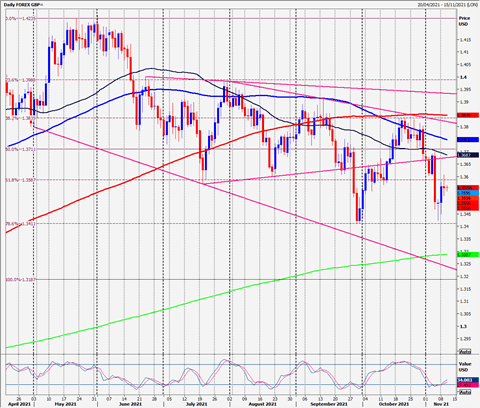

GBP/USD: Shorts worked perfectly with a high for the day at 1.3607

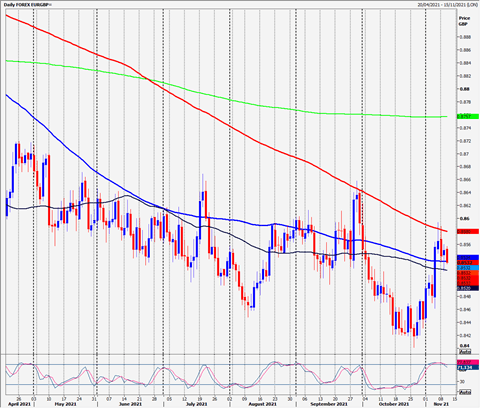

GBP/USD, EUR/GBP, GBP/NZD

GBPUSD beat 1.3510/30 to target 1.3570/80 & my selling opportunity at 1.3600/20. Shorts here worked perfectly with a high for the day at 1.3607 & a collapse to my target of 1.3525/15.

In fact, this was also the low for the day.

EURGBP shorts at the 200-day moving average at 8585 work on the slide to second support at 8520/10 for profit taking on any remaining shorts.

A low for the day exactly here so long also worked on the bounce to 8550.

GBPNZD shot higher to strong resistance at 1.9050/70 but shorts need stops above 1.9090 (which looks likely today's high as I write).

Daily analysis

GBPUSD try shorts again at 1.3600/20 targeting 1.3560, perhaps as far as minor support at 1.3525/15. Below here look for 1.3470/60.

A selling opportunity at 1.3600/20. Try shorts with stops above 1.3635. A break higher targets 1.3570/75.

EURGBP holding below 8550 retests supports at 8520/10. Try longs again with stops below 8500. A break lower targets 8475.

Longs at 520/10 target 8550 before first resistance at the 200 days moving average at 8585/95. A break above 8600 is a buy signal for this week.

GBPNZD shorts at strong resistance at 1.9050/70 target 1.9895, perhaps as far as 1.8950.

A break above 1.9090 targets 1.9170/80.

Author

Jason Sen

DayTradeIdeas.co.uk